- This will serve as the title and main focus of the article. The goal is to review the Seeking Alpha Quant Rating system from a data-driven perspective, highlighting its accuracy, key metrics, and comparison to other rating systems

- End the introduction like: Whether you’re looking to improve your stock-picking strategy or make more informed financial decisions, this guide will help you understand whether the Seeking Alpha Quant Rating is right for you.

Keyword to be used: Seeking Alpha Quant Rating Review

Suggested Word Count: 150-200 words

CTA Button Text: Explore Seeking Alpha Quant Ratings Today!

Overview of Seeking Alpha Quant Ratings

Of all the tools available on Seeking Alpha, I rely on their Quant Rating this most. In this overview of Seeking Alpha Quant Ratings I will a answer these important questions first:

- What it is?

- How does it work?

- How investors can use?

- What makes it different from traditional rating systems?

From Seeking Alpha’s own web page, they describe their “Quant Rating” as:

- Seeking Alpha’s ‘Strong Buy’ quant ratings are the result of powerful computer processing and our special ‘Quantamental’ analysis.

- From nearly all U.S. securities, our quant algorithm picks stocks with the strongest collective value, growth, profitability, EPS Revisions, and price momentum metrics vs. the peer sector.

- These attributes are assigned grades that are then weighted to maximize the predictive value. The best stocks are awarded a ‘Strong Buy’ rating.

- Over the last 13 years, the backtested strategy has delivered very impressive returns, beating the S&P 500 12 out of 13 years.

- What’s more, if we look at the performance since inception (December 2009 onwards), our ‘Strong Buy’ stock picks have delivered a staggering return, as you can see above.

To use the Quant Rating is quite simple. They have backtested their Quant Rating and shown that stocks with a Strong Buy rating outperform the market and stocks with a Strong Sell underperform the market. What that means is that I only want to buy stocks that are rated Strong Buy and when my stocks start to slip into their SELL Rating, then know when to sell.

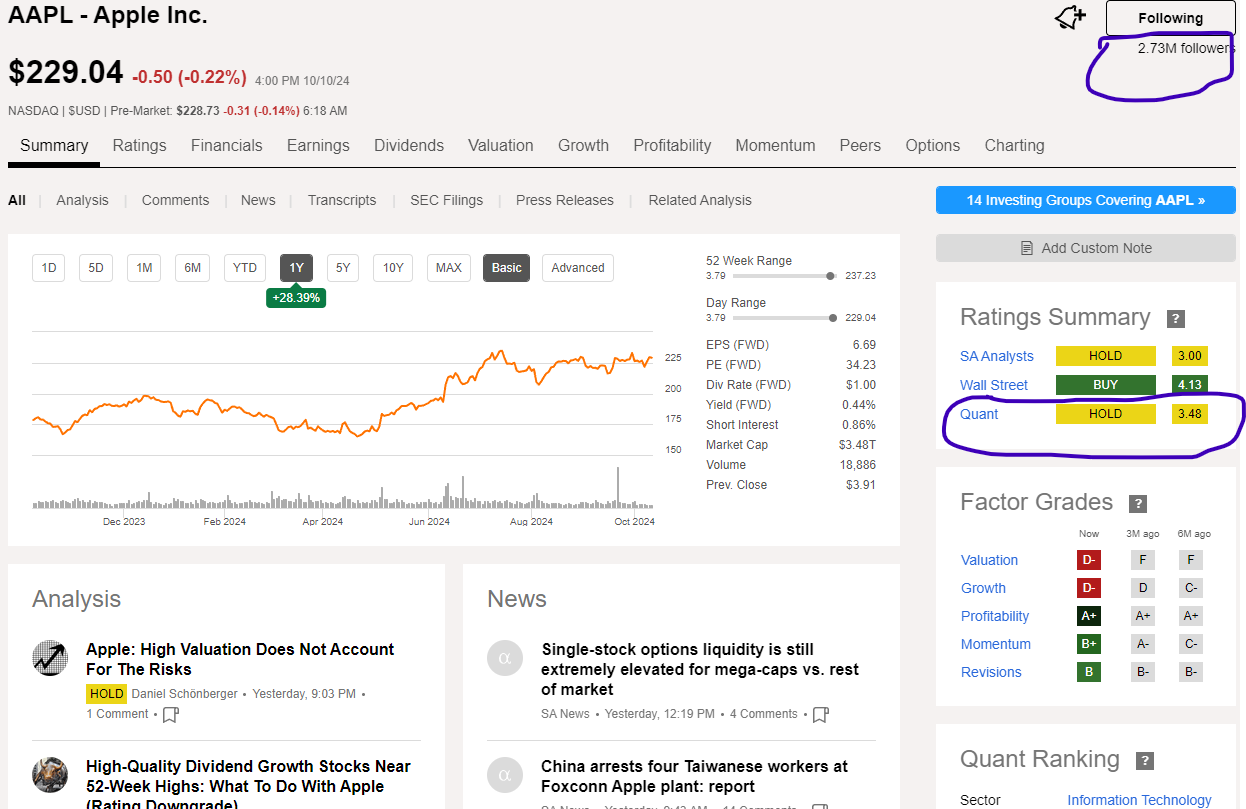

Their site is extremely simple to use. When i login to Seeking Alpha with my Premium subscription and pull up a quote on Apple, I see the following as of October 11, 2024:

In this image above I circled 2 important items. First in the middle right you see Apple as of October 11, 2024 had a Quant Rating of HOLD. If you are just a free member you don’t see this.

Also, in the very upper right, you see that 2.73 million people are following Apple on the Seeking Alpha platform. That gives you an idea of how many people are Seeking Alpha users.

You can also link your brokerage account to Seeking Alpha which makes it really easy to monitor their ratings on your stocks, and you can get alerts when your ratings change. These factors make it very easy to use, very unique, and very helpful in managing my portfolio and confirming what stocks I am considering buying and letting me know when to sell.

Performance of Quant Rating

The performance of Quant Rating can be summed up by this chart:

- Discuss how Quant Ratings perform across various stock categories (e.g., large-cap, mid-cap, small-cap). This should focus on measurable outcomes.

Keyword to be used: Performance of Quant Rating

Suggested Word Count: 300-400 words

- H3: Backtesting Performance and Historical Accuracy

- This section should present the historical backtesting data of Quant Ratings to validate their reliability.

Keyword to be used: Quant Ratings Backtesting Performance

Suggested Word Count: 200-300 words

Key Metrics of Quant Rating Performance

- Explain the critical metrics that show the performance of Seeking Alpha’s Quant Ratings, such as accuracy rates, stock prediction success, and volatility.

Keyword to be used: Key Metrics of Quant Rating Performance

Suggested Word Count: 300-400 words

CTA Button Text: Explore Seeking Alpha Quant Ratings Today!

Reasons for Quant Rating Success

- Outline the factors that make the Quant Ratings successful, such as data-driven algorithms, specific stock metrics used, or other advantages.

Keyword to be used: Reasons for Quant Rating Success

Suggested Word Count: 200-300 words

Quant Rating vs. Analyst Ratings

- Compare and contrast Quant Ratings with traditional human analyst ratings. Highlight strengths and weaknesses of both.

- Compare the Quant Ratings with other common valuation metrics (e.g., P/E ratio, DCF models) to give readers a well-rounded evaluation.

Keyword to be used: Quant Rating vs. Analyst Ratings

Suggested Word Count: 300-400 words

How Will Seeking Alpha Quant Rating Improve Your Investment Strategy?

- Explain the practical ways in which Seeking Alpha’s Quant Rating can enhance your investment approach.

- Highlight key points, avoid unnecessary details, and use simple language.

- Keep sentences short and edit out redundant words. This ensures your responses are clear and impactful.

Suggested Word Count: 100-150 words

Is the Seeking Alpha Quant Rating Worth It?

- Explanation for writer: Discuss whether upgrading to the premium Quant Rating system provides significant benefits compared to the free version.

Keyword to be used: Is Quant Rating Premium Worth It?

Suggested Word Count: 200-300 words

CTA Button Text: Try Seeking Alpha Quant Ratings Today!

FAQs

What is the benefit of a seeking alpha quant rating?

dgfgdfg

What is the difference between Quant Ratings and Factor Grades?

dfghdh

Are Quant Ratings only suitable for short-term investors?

hgdhh

How frequently are the Quant Ratings and trading performance updated?

hdfgh

Internal Link Suggestions

Competitor Summary

- Highlight weaknesses of traditional analyst ratings compared to Quant Ratings, such as:

- Accuracy rates

- Stock predictions

- Volatility.