Trend momentum strategies that trade stock-based ETFs should meet two conditions before considering a position. First, overall market conditions should be bullish. That means going long stocks in bull markets and running out of stocks in bear markets. Second, the trend for the ETF should be up. By taking advantage of these basic requirements, performance can be improved. Once these two conditions are met, we can start the ranking process to find the strongest. Let’s look at examples using the Nasdaq 100 ETF (QQQ) and the Dow SPDR (DIA).

First of all, we need to be in a bull market environment. TrendInvestorPro uses the Composite Breadth model to determine market conditions and has been positive since late March. This means that the environment for equity-based ETFs is favorable. Second, the trend composite must be positive, meaning the ETF is in an uptrend. Only ETFs in uptrends can be included in a trend momentum portfolio and considered for positions. For ETFs, the rank indicator of choice is the normalized ROC. The chart below shows QQQ with a positive trend composite since February 2nd and a normalized ROC of 5.44.

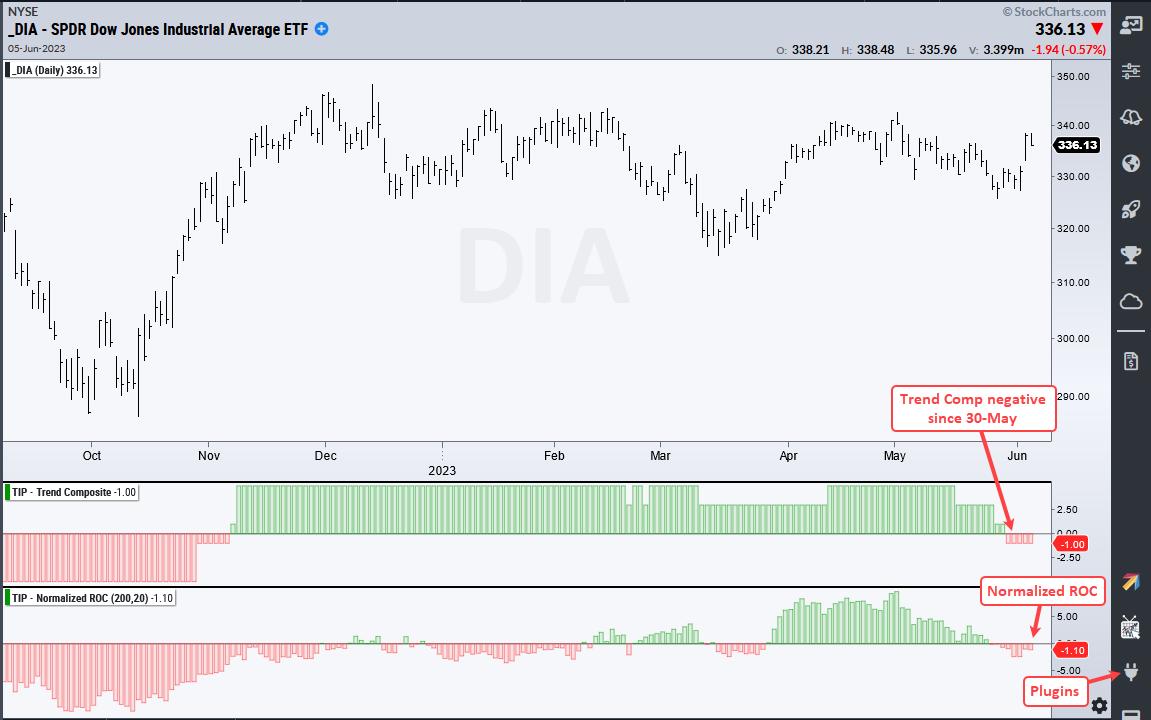

The normalized ROC(200.20) gives us the 200 day dollar profit or loss in ATR(20) terms. QQQ is up $26.41 over the past 200 days, ATR(20) is at 4.858 and normalized ROC is at 5.44 (26.41/4.858 = 5.44). Unlike QQQ, the next chart shows DIA with a negative normalized ROC (-1,1). Obviously, QQQ is leading and DIA is lagging behind. Also note that the trend composite turned negative for DIA in late May. QQQ is eligible but DIA is not.

TrendInvestorPro recently launched a normalized ROC strategy for trading the leading ETFs. This strategy also uses the composite width model and trend composite and exponential slope to establish a momentum minimum. Subscribers get access to a seven-part article detailing the strategy and showing key performance indicators. Click here for instant access.

Normalized-ROC, the Trend Composite, ATR Trailing Stop and nine other indicators are part of the TrendInvestorPro Indicator Edge Plugin for StockCharts ACP. Click here to take your analytics process to the next level.

————————————————– ——–

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. With his primary focus on US stocks and ETFs, his systematic approach to identifying trends, finding signals within trends, and setting key price levels has made him a valued market technician. Arthur has written articles for numerous financial publications including Barrons And Stock and commodity magazine. In addition to his Chartered Market Technician (CMT) distinction, he holds an MBA from Cass Business School, City University, London.