BUTTON

souvenirs

- After three quiet decades, Japanese stocks are making a comeback

- The rise can be attributed to factors such as improved corporate governance, cheaper stock prices compared to the US, a weaker yen and the fact that companies are returning more money to their shareholders

- The $64 price level is crucial for the MSCI Japan Index ETF (EWJ)

After a three-decade lull in which international investors showed little interest, Japanese equities seem to be back in the limelight. As investors around the world wonder if now is the right time to invest in Japan, the iShares MSCI Japan ETF (EWJ) has seen an overwhelming run, gaining almost 18% year-to-date – its highest level in 33 years.

Notably, at its peak in June, EWJ outperformed the S&P 500 Index ($SPX), as shown by StockCharts’ perfcharts below.

CHART 1: EWJ AND S&P 500 PERFCHARTS: The iShares MSCI Japan ETF outperformed the S&P 500 Index from April to June 2023. Chart source: StockCharts.com. For illustration only.

What triggers the trend reversal?

Investors like Warren Buffett are spending capital to get back into the Japanese market. Why? There are a number of factors: improved governance standards, cheap stocks relative to the US market, a depreciated yen, and share buybacks and record dividends have helped Japanese stocks strengthen.

More notably, several major semiconductor manufacturers are also reportedly expanding production in Japan and strengthening technology partnerships, seen as a safer way to capitalize on China’s growth amid U.S.-China tensions.

In general, there are enough reasons to be bullish on Japanese stocks, especially semiconductors, which are seeing a huge surge in interest right now. So what does the technical picture look like?

A weekly technical picture from EWJ

EWJ tracks approximately 237 Japanese large and mid caps (with minimal small cap exposure) listed on the Tokyo Stock Exchange. The Index aims to provide investors with a comprehensive and representative view of the Japanese stock market.

A head and shoulders bottom

CHART 2: WEEKLY CHART OF EWJ. The price is trending up after a 7-month head and shoulders low. Chart Source: StockCharts.com (Click on the chart to view the live version). For illustration only.

If you zoom out for an overall view of EWJ’s price action on a weekly chart, you’ll notice the following: head and shoulders down For seven months, from June 2022 to January 2023. Extending the neckline a couple of months, you can see it offered ample support twice, with the market responding with a strong rejection to the upside in March.

What about buying pressure and momentum?

This is an important question as a breakout can only go as far as the momentum and (in this case) cash flow will allow.

The Chaikin cash flow (CMF) shows a clear increase in buying pressure starting from the right shoulder (RS) before the breakout. But let’s double check that value by calling this accumulation distribution line for a second opinion. Looking at both indicators (one panel above the other) one sees a similar value (side note: the breakout of the line coincides with the breakout of EWJ from the formation). As for the dynamics Relative Strength Index (RSI) gives an encouraging reading as it crossed the 50 mark (midline) well before the CMF and accumulation distribution turned positive.

Overall, the weekly chart paints a bullish picture. But on a smaller and more tactical scale, where could one find a good entry point? And is EWJ facing a retreat? If so, how deep could it go?

Keep looking back

The ironic thing is that to get a sense of what’s ahead, you have to look back. To make sure you see where this uptrend is going, let’s zoom out even further to see the price action over three years.

CHART 3: A THREE-YEAR REVIEW OF THE WEEKLY CHART OF EWJ. Note the importance of the $64 price level. Chart Source: StockCharts.com (Click on the chart to view the live version). For illustration only.

Notice how EWJ hit resistance at $64.11 on June 14th? Well now you can see why. The $64 level was a critical support level for 2021. It was eventually broken and bears might view this level as support turned resistance.

This means that $64 represents a critical resistance level that EWJ must break and hold if the Japanese market resurgence holds. If you are optimistic about this prospect, you might consider a few entry points. Let’s look at the daily chart of EWJ.

Entering a long position in EWJ

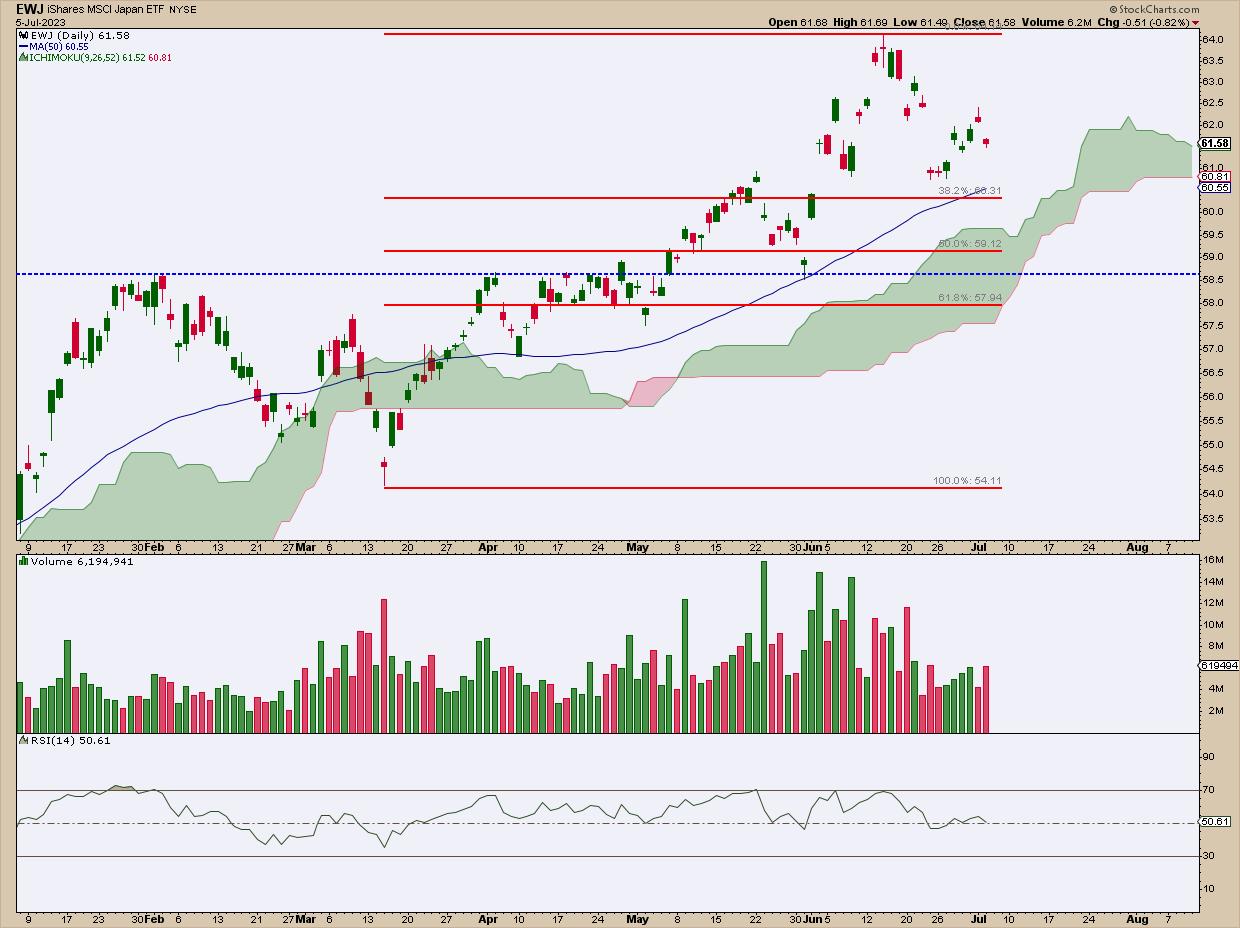

TABLE 4: DAILY TABLE OF EWJ. Note several potential support levels, all of which can be viewed as potential buy targets. Watch for the price to break below the 61.8% Fibonacci retracement line. Chart Source: StockCharts.com (Click on the chart to view the live version). For illustration only.

BIG CAUTION: If you look at any of the weekly charts, you’ll see that “buying the pullback” now means making an entry relatively high in the price action. If you’re ok with that, there are a few things to consider.

- The RSI still remains above the center line (50) which is a bullish sign that momentum is holding for now despite the EWJ pullback. Also, EWJ had not yet reached overbought levels when it touched its high of $64.00.

- The price seems to be sliding steadily over the 50-day period simple moving average (and note the Ichimoku cloud slightly below the moving average). Both appear to support the short-term trend, but also detract from the likelihood that EWJ could see a deeper decline in the coming weeks.

- And if that deeper pullback occurs, the $58.50 support (resistance becomes support) and the general range between the 50% and 61.8% Fibonacci levels should act as a buffer for a bounce (Fibonacci retracement from the second leg of the EWY uptrend). .

If the price drops below these levels, EWJ undergoes an even deeper correction. In this case you might want to check the fundamental picture. If it still warrants a bullish outlook, you need to readjust your technical setup for a more appropriate entry point.

Other Japanese ETFs to Check Out

EWJ is the largest ETF in the US market that gives you exposure to Japanese equities. But there are a few smaller ETFs that are worth mentioning.

- JPMorgan BetaBuilders Japan ETF (BBJP) follows the Morningstar Japan Target Market Exposure Index with 273 stocks in the basket. The main sectors are industrials and consumer discretionary.

- WisdomTree Japan Hedged Equity Fund (DXJ) Provides access to the Japanese stock market while hedging fluctuations between the US dollar and the yen.

- Xtrackers MSCI Japan Hedged Equity ETF (DBJP) tracks the MSCI Japan US Dollar Hedged Index, reducing exposure to dollar/yen fluctuations.

Remember to choose your ETFs carefully.

You can research the individual ETFs using the icon summary Tool on StockCharts.com. Here you will find technical data, fundamental data and other fund details. You will also find predefined Scans, Alerts and ChartLists for a specific symbol.

What if Japan’s economy didn’t have staying power?

Don’t ignore the risks. Some experts say there must be a clear sign that Japan has regained the economic momentum it had in the 1970s and 1980s.

Think of the bursting of Japan’s stock and real estate bubbles in the early 1990s, policy mistakes, demographic challenges, and China’s emergence as an economic and political superpower. They have all hampered Japan’s economic recovery.

There are also reasons to be skeptical of the rally: deflationary pressures, complex corporate governance practices and an aging population with a rapidly declining workforce – not the most promising harbingers of renewed global competition. Still, Buffett praised Japan’s economic potential and resilience, and plans to hold those investments for about 10 to 20 years. Perhaps the Oracle of Omaha is seeing something that most of us can’t see (yet).

The conclusion

After three decades in the shadows, Japanese stocks appear poised for a significant comeback. Factors such as improved governance standards, cheap stocks relative to the US market, a depreciated yen and record dividends have all contributed to this rebound. Also, Japan’s booming chip manufacturing industry could be a good opportunity to invest in semiconductor and AI (artificial intelligence) developments, especially amid US-China tensions.

The article presents a technical scenario and possible entry points if you want to invest in Japanese stocks at this stage of the game. Just consider the technical and fundamental risks associated with such an entry. While some experts say Japan’s resurgence has staying power, the decision is broadly undecided.