Now that the November 2022 midterm elections are behind us, the stock market is now in year 3 of the 4-year pattern of the presidential cycle. Some analysts look at this on a calendar basis, but I prefer to start counting the years from November 1st for this purpose, as the stock market usually reacts to anyone who is elected president as soon as they know the result. Usually that’s instantaneous, although in 2000 it took until mid-December for things to be sorted out.

During a typical 4-year presidential term, the stock market tends to be flat for the first 2 years. Then the third year is almost always a positive year. The election year can be much more dodgy, and there are examples of election years going really badly, as was the case in 2000 and 2008. But the third years have been increasing really consistently, almost always. The notable exceptions were 1931, when the world was in the midst of the Great Depression, and 1939, when the Wehrmacht marched through Poland. Barring such conditions, one can usually assume that the third year is a successful year.

But this time it could be different. The third-year upleg got off to a great start, breaking out of the October 2022 lows on time. But the rally stalled in December in a way that the Presidential Cycle Pattern (PCP) doesn’t reflect on this week’s chart.

The PCP is formulated by dividing all the data into 4-year periods and then averaging them together. Some adjustments are still needed to get consistent data. One such adjustment is to balance all years. Until 1952 the stock exchange traded on Saturdays; then there was a time in the mid 1960’s when trades were closed on Wednesdays to allow “paperwork” to be caught up (there were no computers then). Thus, in order for each 4-year period to be of consistent length, some truncation of Saturdays or duplication of earlier days for uneven holidays is required.

I also recalculate prices for each 4-year period to reflect a starting value of 1.00 from November 1st of the election year. The higher price level of recent years will not throw the calculation of the “average” out of balance.

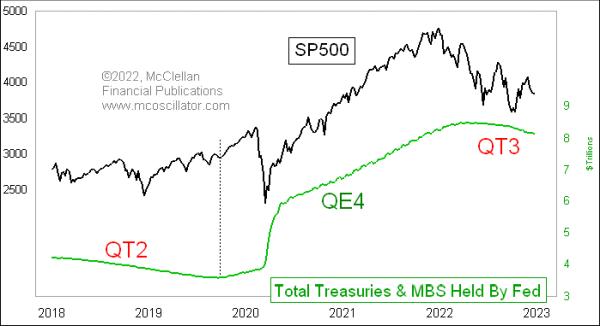

The big drop we saw in December 2022 is definitely atypical for a third year. That doesn’t necessarily mean the stock market can’t get back on track with what the PCP is showing, but it does say we’re not having a typical start. And that makes sense when you consider that not only is the Federal Reserve raising interest rates at an all-time high, but it’s also selling its Treasury and mortgage holdings at an all-time high.

We know that the first round of quantitative tightening (QT1) in the summer of 2008 had a terrible effect on the stock market. QT2 in 2018-19 wasn’t that bad because it was offset by an income tax rate cut enacted in 2017. But QT2 only kept the stock market sideways until the Fed started buying Treasuries and MBS again in late 2019.

From a physical point of view, there is always a “force equation”. The motion of the object or particle in question depends on the sum of all these forces. For 2023 we have the bullish power of the third year of a presidency meeting the bearish forces of Fed rate hikes AND Fed QT. If ever there was a condition when the third year bullish bias couldn’t work, this is the time.