If you’re looking for stocks that are gaining momentum, the best place to start is to find the leading industry groups. Which sectors were strong in 2022?

The first step is to identify the strong and/or enabling industry groups. I maintain an Industry Group Relative Strength ChartList in my StockCharts.com account, which we make available to our annual members on EarningsBeats.com. The Summary feature allows me to quickly identify the best relative performers across different time periods. At the end of 2022, these were the top 10 industry groups in Q4:

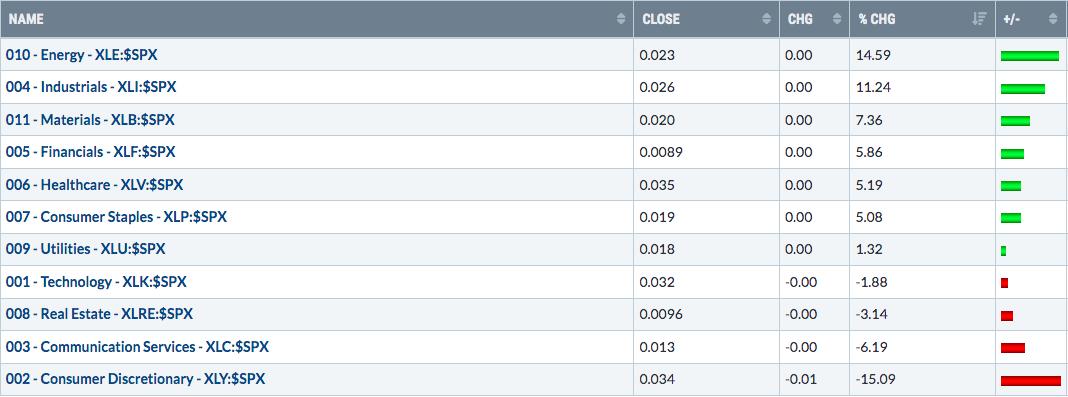

Looking at this list of Q4 executives, I can’t help but notice that Materials (XLB) has three industry groups in the top 10 – Nonferrous Metals ($DJUSNF), Aluminum ($DJUSAL), and Steel ($DJUSST). . Materials clearly had a strong Q4, but there were two sectors that did even better. Check out this Q4 sector leaderboard:

Energy (XLE) and Industrials (XLI) turned significant money away from Consumer Discretionary (XLY) and Communication Services (XLC). I’m not a fan of weak relative strength among the three aggressive sectors – XLY, XLC and Technology (XLK).

However, there is definitely a silver lining. The money that turns away from these aggressive groups does not leave the market. Instead, it simply sends other areas of the market up. That’s why the S&P 500 index was higher in the fourth quarter. That’s good, not bad. But until you start seeing relative strength in XLK, XLY, and XLC, the NASDAQ Composite and other growth-oriented stocks are likely to underperform.

Aerospace started in 2022

One group on this top 10 list is Aerospace ($DJUSAS). Try this Diagram of Boeing (BA).

Another group that I personally found shocking was footwear ($DJUSFT), especially considering how poorly most consumer discretionary stocks fared in the 4th quarter. But here was a former leader who joined forces on the road to 2023 (see chart below).

When you see a big breakout confirming volume, there is usually a follow through and the start of a nice uptrend. But we have yet to see that. In addition, there is a negative divergence that is a signal that the bullish momentum is slowing down. While what’s happening with footwear right now is encouraging, don’t be surprised by near-term disappointments and perhaps a slight pullback to the 20-day mark exponential moving average. We’ll find out soon.

If you would like to hear my thoughts on the coming year and the thoughts of my StockCharts.com colleagues and good friends, David Keller, CMT; Julius de Kempenaer; and Grayson Roze, be safe CLICK HERE and register for the 4th annual MarketVision event this Saturday, The Road Ahead: Navigating an Uncertain Market. It’s a FREE virtual event, NO credit card required. Simply click on the link above, enter your name and email address and view the details of the event. Even if you can’t be there live on Saturday, we’ll make sure you get a copy of the recording!

Happy New Year and happy trading!

Tom

Tom Bowley is the Chief Market Strategist of EarningsBeats.com, a company that provides a research and education platform for both investment professionals and individual investors. Tom writes a comprehensive Daily Market Report (DMR) that provides guidance to EB.com members every day the exchange is open. Tom has brought technical expertise here at StockCharts.com since 2006 and also has a fundamental public accounting background which brings him unique skills to approach the US stock market.