At the end of the week, let’s use the GoNoGo charts to get a feel for the market movements.

The chart below shows the $SPY with daily prices and the full suite of single security GoNoGo indicators. As we can see, the price has recovered this week, prompting GoNoGo Trend to paint a series of amber Go Fish bars. At the bottom, we see that the GoNoGo oscillator broke above the zero line, suggesting that momentum has shifted away from NoGo, causing the price to change color. We will see if GoNoGo Trend can enter “Go” bars when the price rises.

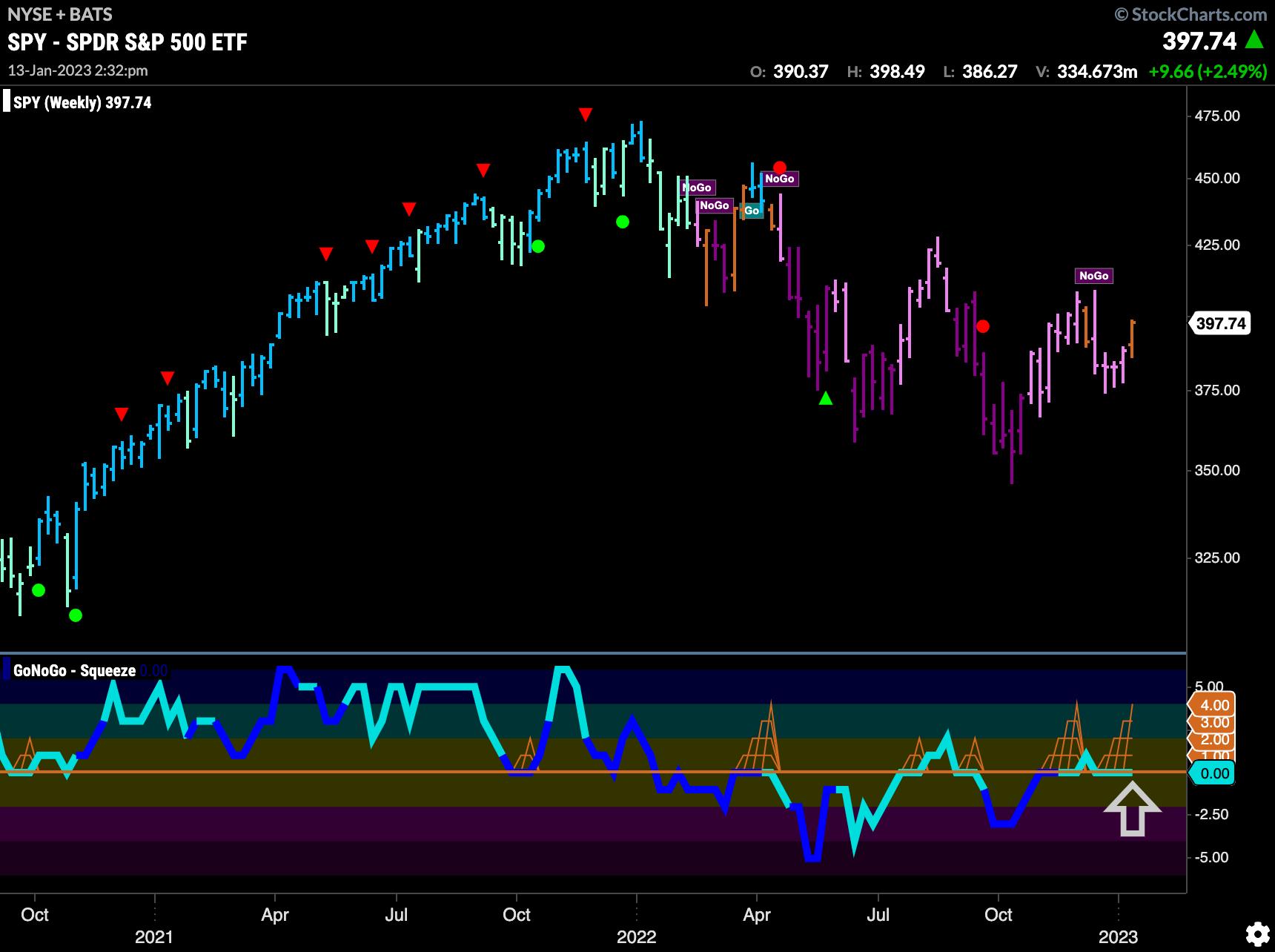

If we zoom out and look at the weekly chart below, we see that there is the same uncertainty on the longer timeframe chart. This week’s price action causes the GoNoGo trend to paint an amber “Go Fish” bar here and the “NoGo” trend is losing momentum. Of course, the price could move lower and the indicator could draw “NoGo” bars again, but we see a turning point as the market tries to make a higher low. The GoNoGo oscillator shows that there is little directional momentum as the tug of war between buyers and sellers continues. As the oscillator is stuck at the zero line, it is important to note if this level becomes support, in which case we could see the price go even higher.

Let’s turn to some GoNoGo RelMaps to understand where the performance is coming from as we see the signs that the market is moving towards a riskier environment. Below we have a GoNoGo RelMap showing the Morningstar 9 style boxes. These tickers can be easily found on stock charts. What is clear is that the outperformance of late has come from value stocks, mostly large and mid-caps. The top three panels here are large, mid, and small cap value. The bottom three boxes here are the three growth styles, again large, mid and small cap. We can see that these growth styles have generally underperformed.

Finally, the GoNoGo Sector RelMap confirms the above by providing us with a defensive picture regarding the sectors within the S&P 500 that are outperforming. The growth sectors $XLK, $XLY and $XLC are the top three panels in that order and you can see that the “NoGo” colors are the most prevalent. The middle of the chart shows the more defensive, value and industrial sectors like $XLI, $XLB, $XLE and $XLF all painting blue “go” bars, as well as $XLU and $XLRE. Let’s see what next week brings!

Alex Kohl

Alex Kohl, CEO and Chief Market Strategist at GoNoGo Charts, is a market analyst and software developer. For the past 15 years, Alex has led technical analysis and data visualization teams, leading both business strategy and product development of analytical tools for investment professionals. Alex has created and implemented training programs for large companies and private clients. His classes cover a wide range of technical analysis topics, from introductory to advanced trading strategies.

learn more