“As the S&P 500 goes in January, so goes the year.” if you a The Stock Trader’s Almanac Reader, you will be familiar with this saying. According to almanac, this seasonal indicator has registered 12 major errors since 1950. That’s an accuracy ratio of 83.3%. Given that 2023 is a year before the election, another point to note is that in 15 of the last 18 years before the election, the entire year followed the direction of January.

It looks like that almanacExpectations are on track for January, which could portend positive stock market performance in 2023. After a dismal 2022, January’s performance has injected a dose of optimism into the markets. The S&P 500 Index ($SPX) is up 6.17% in January and S&P 500 stocks have performed strongly – Tesla (TSLA), Amazon (AMZN), Apple (AAPL) and Nvidia (NVDA), to name just a few.

The January indicator Trifecta

Even if nothing is certain on the stock exchange when All three January indicators are checked, it adds some comfort to investor sentiment. We had a Santa Claus rally for the last five trading days of December and the first two trading days of January. It was a mild rally, but a rally nonetheless. The first five days of January were over and the January barometer was positive.

Jeffrey Hirsch, editor of the The Stock Trader’s Almanac, noting in a tweet that if all three January indicators rise, the next 11 months are up 87.1%. That’s a significant probability. Does that mean you can sit back, relax and use a buy and hold strategy and watch your returns grow? If you’ve been trading for a while, you know that’s never the case. There’s always a chance that we could see a sell-off in the next 11 months. Any unforeseen event could lead to increased volatility in the markets, which you must always be prepared for.

sector plays

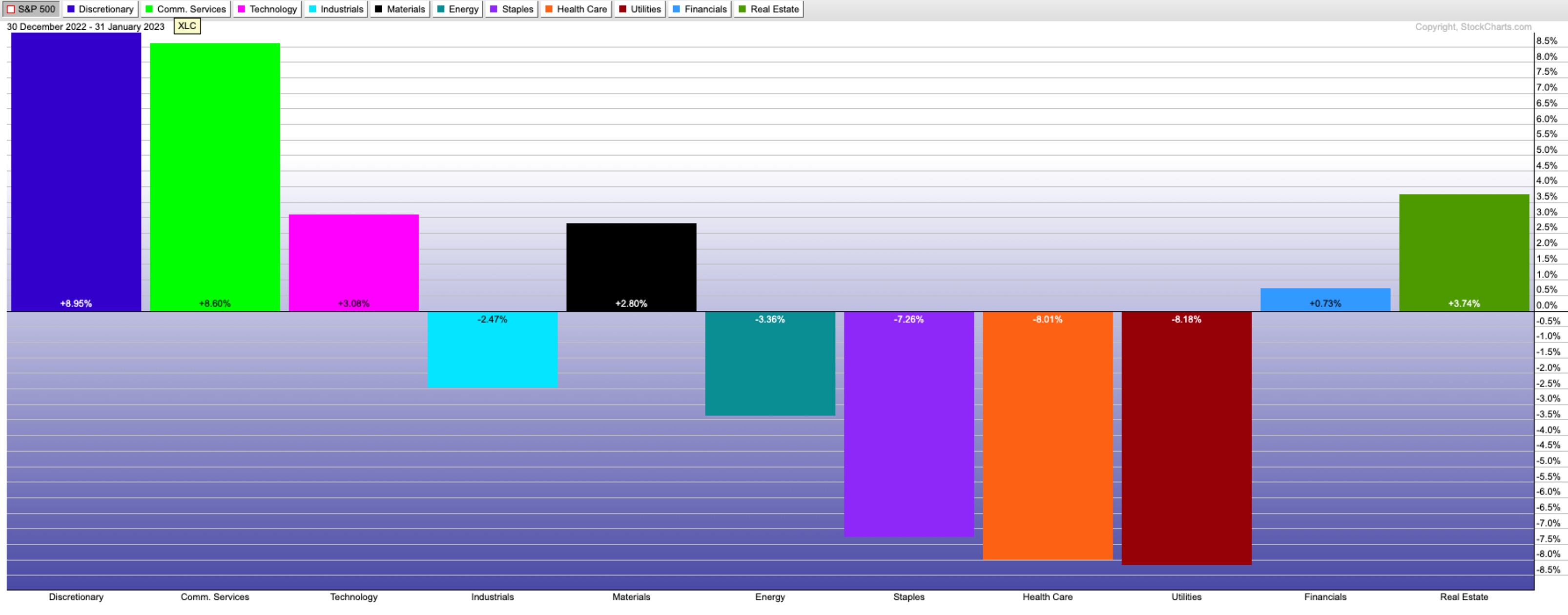

Looking at sector performance in January, the list tops the list with Consumer Discretionary up 8.76%, followed by Communication Services up 8.60%. Looks like Risk-on trading could come back To table.

CHART 1: S&P SECTOR PERFORMANCE IN JANUARY. Consumer discretionary tops the list, followed by communications services. Chart source: StockCharts.com. For illustration only.

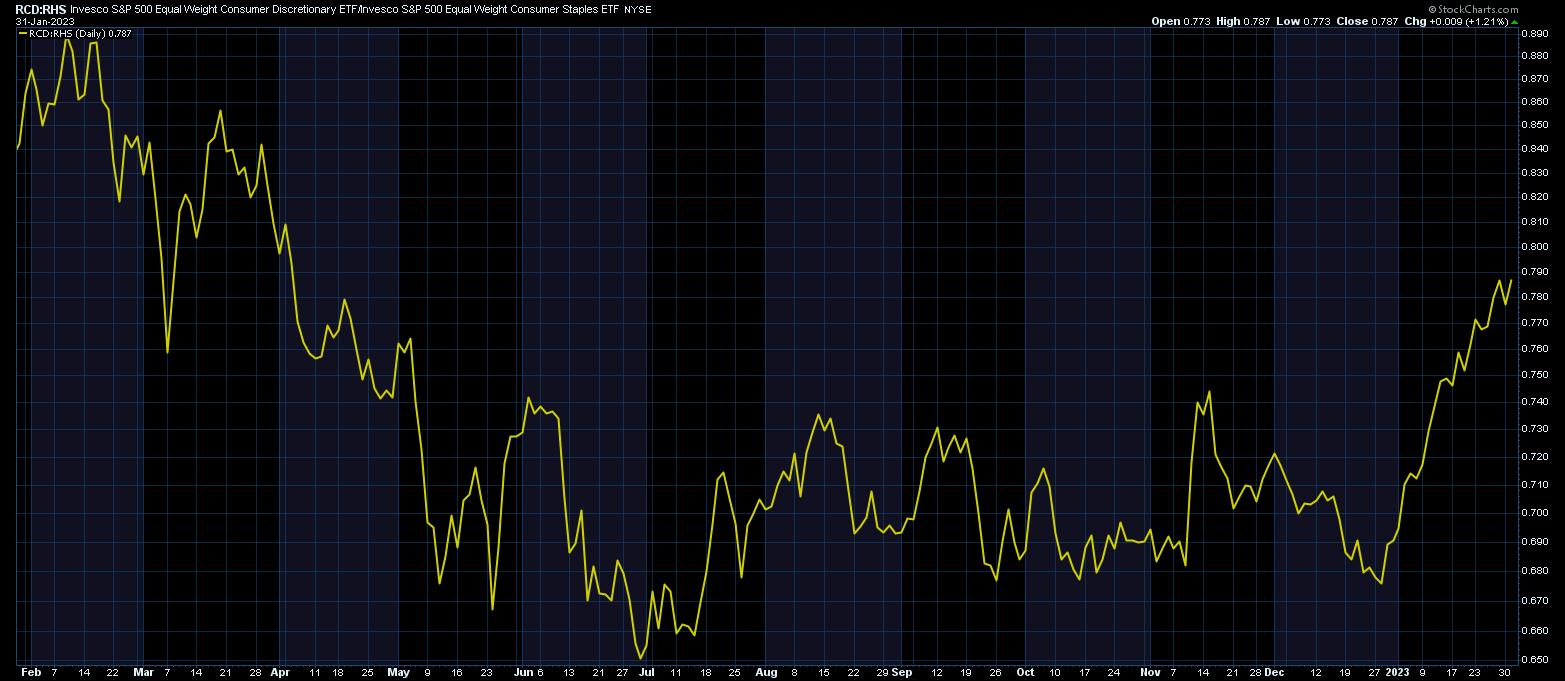

The consumer discretionary/consumer staples ratio (see chart below) shows that consumer discretionary is outperforming underlyings, suggesting that investors are leaning towards more aggressive strategies for now. Why? Much of this could have to do with investor expectations. Earnings season is underway and expectations are low. So even though profits have been tepid, investors are in no rush to sell their holdings. There is also a Fed meeting and investors are comfortable with the idea of a soft landing. The CBOE Volatility Index ($VIX) traded below 20, supporting investor complacency.

CHART 2: HIGH-PERFORMANCE CONSUMERS VS. CONSUMER COLLECTIONS. When consumer discretionary outperforms consumer staples, it is an indication that investors are biased towards a more risk-on trade.Chart source: StockCharts.com. For illustration only.

CHART 2: HIGH-PERFORMANCE CONSUMERS VS. CONSUMER COLLECTIONS. When consumer discretionary outperforms consumer staples, it is an indication that investors are biased towards a more risk-on trade.Chart source: StockCharts.com. For illustration only.

Tech stocks have rallied after being smashed in 2022. The Nasdaq Composite ($COMPQ) is up over 10% in January. Interestingly, small-cap stocks are also on the rise, as evidenced by the S&P 600 Small Cap Index ($SML).

What should you see in the future?

According to Hirsch, February tends to be stronger than average years in the years leading up to the election, and the Nasdaq tends to be the best-performing index, with the Russell 2000 being the second best. Given that technology stocks and small-cap stocks ended January strong, there’s a chance the trend will continue into February.

Regularly check the market overview on the StockCharts platform. In February, pay close attention to the Nasdaq Composite and the S&P 600 Small Cap Index. Stocks in these indices could do well if things play out as described in the almanac. Remember that markets are seasonal. Any sign of a reversal in a particular area of the market could mean that another area is preparing to take over. Identifying trend changes and capitalizing on them is what technical analysis is all about.

Regularly monitoring sector and industry performance via the sector summary and market summary tools can greatly assist you in your investment decisions. Set up your dashboard to give you an overall view of the market so you can easily see when changes are happening in the market. add the Stock Trader’s Almanac 2023 to mixand you are armed to plan your trades for the rest of the year.

Jayanthi Gopalakrishnan is Director of Site Content at StockCharts.com. She spends her time creating content strategies, providing content to educate traders and investors, and finding ways to make technical analysis fun. Jayanthi was the Managing Editor at T3 Custom, a content marketing agency for financial brands. Prior to that, she was senior editor of Technical Analysis of Stocks & Commodities magazine for over 15 years.

learn more