I’m a believer and believer in history when it comes to the stock market. After years of research, I understand that some aspects of US stock performance are fairly transparent and the resulting technical signals can generally be relied upon. There were many red flags coming into 2022 that indicated we were in trouble in the short to medium term, and I wrote and spoke about them throughout the first six months of 2022. But many of my signals changed in mid-June, prompting me to call a June 2022 bottom. The risks of staying short were too great, while the rewards of risk on the long side had improved significantly. Those who got back into the stock market last summer were handsomely rewarded with the S&P 500 rising 13% from that low.

I was criticized for calling for a bear market before it started and was later criticized for saying the bear market was over – long before anyone suggested it. It takes a thick skin to stand up to the crowd, but I’ll just say what I see. It helps that I’m not brainwashed by all the negativity in the media. The lesson here is to keep StockCharts.com ON and TURN OFF all outside noise!

The Fed and Inflation

On Wednesday, the Fed admitted it was winning the battle against inflation. We’ll likely see another 25 basis point hike in interest rates, but beyond that I see a much more dovish Fed. I believe rates will come down later in 2023 and if the January jobs report was any indication, a very soft landing is quite possible. Growth with falling interest rates is NIRVANA for stock prices. In 2022 we had two quarters of negative GDP and rising rates. That’s what the S&P 500 priced in during its 27% cyclical bear market decline. The NASDAQ fell closer to 40%. Everything was burned.

Bear Market: Cyclical vs. Secular

Many demanded, and some still do worldly Bear market, which is a long-term bear market. The problem is that you can’t call a long-term bear market until it’s confirmed. We’ve had 3 secular bear markets since 1950. 3!!!! If you count them on your hand, you still have two fingers left. In other words, they don’t happen very often, but the Peter Schiffs of the world are given far too much airtime on CNBC to spit out their nonsense. Think about it. Why would CNBC continue to cater to someone who has repeatedly missed the biggest bull markets in history and mislabeled the market year after year? It’s the trainwreck approach to increasing viewership, an embarrassment if you ask me.

The big picture

Anyone who has attended any of my Market Outlook webinars knows that I start each one with a BIG PICTURE 100 year chart of the S&P 500. This is how it currently looks:

Honestly, how can you look at this chart and be consistently bearish in US stocks? We are in another secular phase (secular BULL market) favoring US equities. Especially after big rallies like the ones we had in 2020 and 2021, there will be short-term phases of weakness from time to time. These are cyclical bear markets that require patience. You need to recognize these phases BEFORE they occur as swing trading strategies are no longer rewarding and you can lose a lot of money quickly. This is why I told EarningsBeats.com members in early 2022 that we needed to recognize that conditions were about to change and swing trading wasn’t going to work. They either need to switch to cash or become more aggressive on the short side. In early February, I hosted a webinar called “Anatomy of a Cyclical Bear Market” to help our members understand what’s to come. If you just stuck with what worked, you’d be no better off than Cathie Wood, who has dumped her ARK funds in recent years. It has never adjusted to the cyclical bear market and its investors have paid a ridiculously high price. It should have been avoided.

But let’s return to the diagram above. I use it for perspective. And “perspective” is my word for 2023, replacing “patience” in 2022. This big picture helps me get through markets like 2022 because I believe we will come out of it stronger than ever and return to all-time highs. But you have to be patient in the turbulence. During secular bear markets, the monthly PPO turns decidedly negative. That has yet to happen as the monthly PPO remains positive and looks set to rise again. Also, the monthly RSI falls well below 40 during secular bear markets. The monthly RSI has already bottomed above 40 and has bounced back into the 50 level. They need technical confirmation of a secular bear market and we don’t see any.

The future path

We saw a very nice rally. January was one of the strongest on record, the ninth best January on the S&P 500 since 1950. Strong Januarys almost always lead to very strong years. It’s not a perfect science and certainly not a guarantee, but there’s a lot of history to suggest that the odds of a strong year are increasing significantly. The biggest issue we faced in 2022 was mood. He was far too optimistic in late 2021 after the S&P 500 posted its biggest 22-month rise since the 1930s. We badly needed the sentiment to turn bearish and that only goes one way – a protracted bear market where everyone’s psyche turns from ecstasy to despair. We needed all YouTube experts (sarcasm) who unanimously believed that seeing a market bottom was impossible and that our only way was lower. That’s the kind of mentality that marks low points.

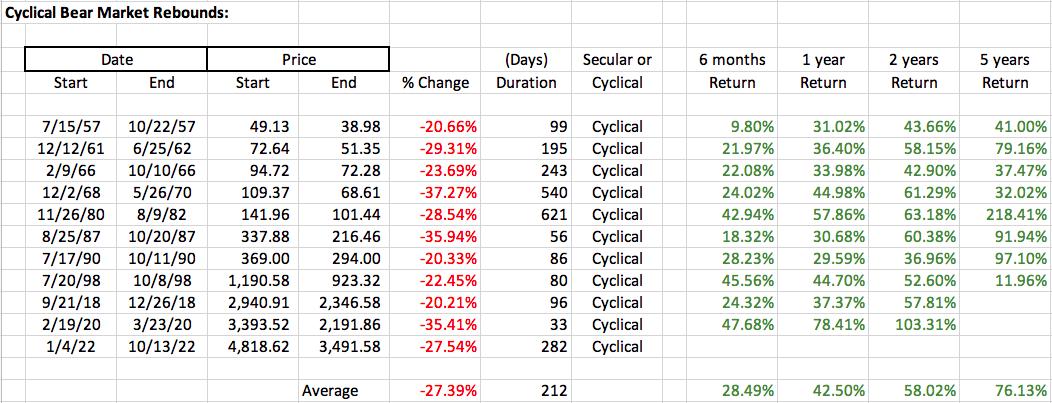

Luckily, after months of pain, we got where we needed to be and the bottom formed. The October 2022 low marks the seventh time in the last 14 bear markets (6 out of 11 if we only look at cyclical bear markets) that the October bear market bottom has been reached. Because many investors fail to see the end of bear markets, they also miss out on the huge market gains that follow. Below is a table of the 11 cyclical bear markets since 1950, showing the gains made in the following 6-month, 1-year, 2-year, and 5-year periods:

Look at these 1-year returns after the end of the cyclical bear market. The worst 1-year return was 29.59%. Applying this WORST return to the October 2022 low, we should expect the S&P 500 to stand at 4525 by October 2023. If we apply the AVERAGE 1-year yield of 42.50%, we see the S&P 500 at 4975. All-time highs suddenly don’t seem that far away.

Unfortunately, this is the kind of research on EarningsBeats.com that CNBC and other outlets could produce if they were genuinely interested in providing valuable educational content to their viewers. But it’s all about the mighty dollar. Education takes a back seat to profit. Their interests lie in raising ad dollars and scaring viewers into watching with ridiculously bearish headlines, and the quicker everyone realizes that, the quicker they can walk away and focus on what really matters.

Please subscribe to my FREE EB Digest newsletter if you haven’t already. CLICK HERE Enter your name and email address. No credit card is required and you can unsubscribe at any time.

Happy trading!

Tom

Tom Bowley is the Chief Market Strategist of EarningsBeats.com, a company that provides a research and education platform for both investment professionals and individual investors. Tom writes a comprehensive Daily Market Report (DMR) that provides guidance to EB.com members every day the exchange is open. Tom has brought technical expertise here at StockCharts.com since 2006 and also has a fundamental public accounting background which brings him unique skills to approach the US stock market.