Shutterstock (SSTK), the American creative content solutions company, has experienced an insane downtrend from October 2021 to the end of 2022. Bearish aside, SSTK’s fundamentals haven’t been entirely disappointing. There were two positive (but fading) earnings and revenue “beats”, a mixed earnings report, and finally a completely negative miss on both counts in the second quarter before signs of a mixed recovery in the third quarter punctuated by an earnings Beat and a loss of sales.

Still, the latest report did very little to ignite ‘green shoots’ in market sentiment. The company even received a sharp downgrade from investment bank JMP Securities in November over increasing competition from generative AI. According to the bank, Shutterstock’s stock photos could lose value because AI can generate images from simple text prompts.

But that narrative changed in January 2023. A flurry of announcements indicated Shutterstock wasn’t about to be swamped by the AI trend. The company made strides to claim a sizable stake in the upcoming “Singularity” engine.

SSTK claims a share of the “Singularity” space

Perhaps it was a matter of seizing the opportunity to hedge against short-term disruptions or gain early favor with the future “masters” of singularized humanity. In any case, SSTK announced its strategic partnerships with major AI players Meta, OpenAI and LG AI Research to advance generative AI research (exactly what analysts claimed would disrupt SSTK’s future prospects). SSTK also launched its own generative AI-based creative platform that builds visuals based on (you guessed it) text prompts.

To sweeten the deal for its shareholders, SSTK also increased its dividend payout (up $0.27 per share) by 13% sequentially. The dividend based on the current price level is 1.41% yield.

SSTK’s share price rose 50% following the announcements and is now up 41% year-to-date just as Q4 22 results are due to be announced on Thursday 9th February 2023, ahead of the open.

Industry and Industry Rankings by SSTK

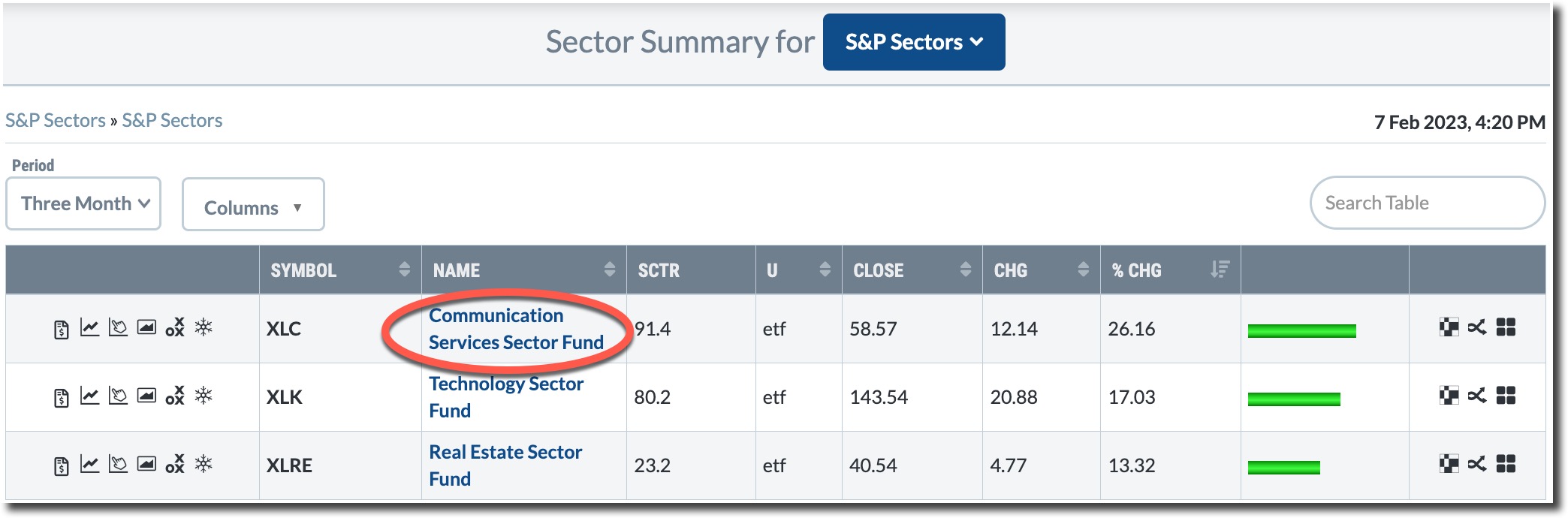

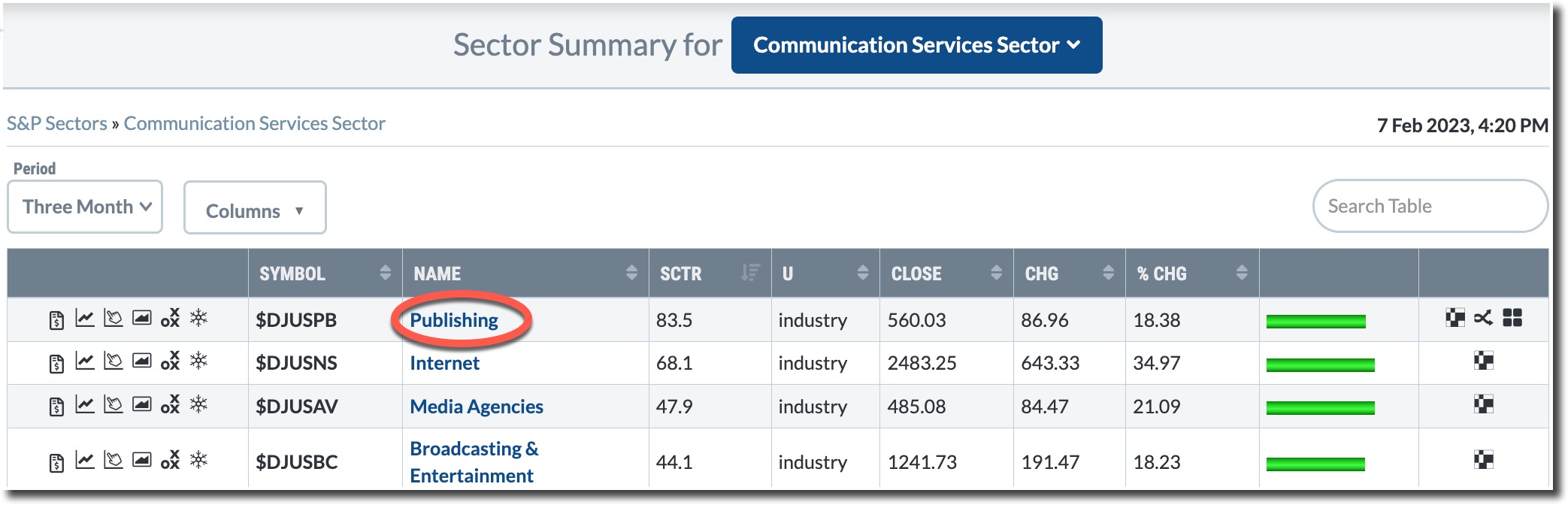

Let’s step back and take a look at SSTK’s place within its larger accomplishment in the communications services sector. Looking back three months…

- The Communications Services Sector Fund (XLC) sector outperforms all 11 S&P sectors with a strong return of 26.16% and a StockCharts Technical Ranking (SCTR) rating of 91.4. Now let’s zoom in to see the industry performance.

- Among the six industries within the sector, publishing holds the highest SCTR score (83.5) based on a three-month retrospective.

- And within that industry group, SSTK holds the highest SCTR score of 91.8, which places its tech preference in the top tier of potential achievers.

Technical image of SSTK on the eve of earnings

CHART 1: SHUTTERSTOCK’S DAILY PRICE CHART PRE-EARNINGS. SSTK has quite a bit to offer: a Golden Cross, it’s due to its 38.2% Fib retracement level and a fundamental pivot point. But a divergence between the price and the stochastic oscillator could mean that a reversal is underway. Chart source: StockCharts.com. For illustration only.

CHART 1: SHUTTERSTOCK’S DAILY PRICE CHART PRE-EARNINGS. SSTK has quite a bit to offer: a Golden Cross, it’s due to its 38.2% Fib retracement level and a fundamental pivot point. But a divergence between the price and the stochastic oscillator could mean that a reversal is underway. Chart source: StockCharts.com. For illustration only.

In the chart above, you can see the impact the announcements had on SSTK’s stock price.

- Use of Fibonacci retracement Levels from the October 2021 high of 126.12 and the November 2022 low of 44.40, SSTK broke its 38.2% retracement levels but stalled and retreated.

- The swing that led to SSTK’s 8-month high at 81.23 correlates with a divergence on the Stochastic Oscillatorsuggesting a near-term reversal is underway.

- SSTK’s strong momentum was enough to generate a Golden Cross result. The 50 days moving average (yellow line) is now above the 200-day moving average (blue line).

Will SSTK Bring Shock or Shutter Earnings?

Much depends on SSTK’s earnings report on Thursday (February 9) as traders weigh the prospect of earnings strikes, misses or mixes and forecasts against the longer-term prospects that will see the stock surge in January.

A dismal earnings report could send SSTK below $60, threatening SSTK’s technical (along with its fundamental) outlook. Be sure to add this stock to one of your chart lists. When publishing the earnings report, consider any developments in company policies and other partnership announcements.

If the earnings report surprises and the stock surges higher, there’s plenty of room to the upside. If you open a long position, the 38.2% Fib level would be a potential stop level. SSTK may play for the long term, but developments in the AI field are also progressing at an accelerated pace.

Karl Montevirgen is a professional freelance writer specializing in finance, crypto markets, content strategy and art. Karl works with several organizations in the fields of equities, futures, physical metals and blockchain. He holds FINRA Series 3 and 34 licenses and a dual MFA in critical studies/writing and music composition from the California Institute of the Arts.

Learn more