Some of you may have heard us talk about monthly moving averages or read our commentary on what they mean.

On Monday we asked, “What if the 4200 range top that we’ve been calling for in the S&P 500 turns out to be… the top?” Then move on fox business’ Make money with Charles PayneI discussed the 2-year business cycle.

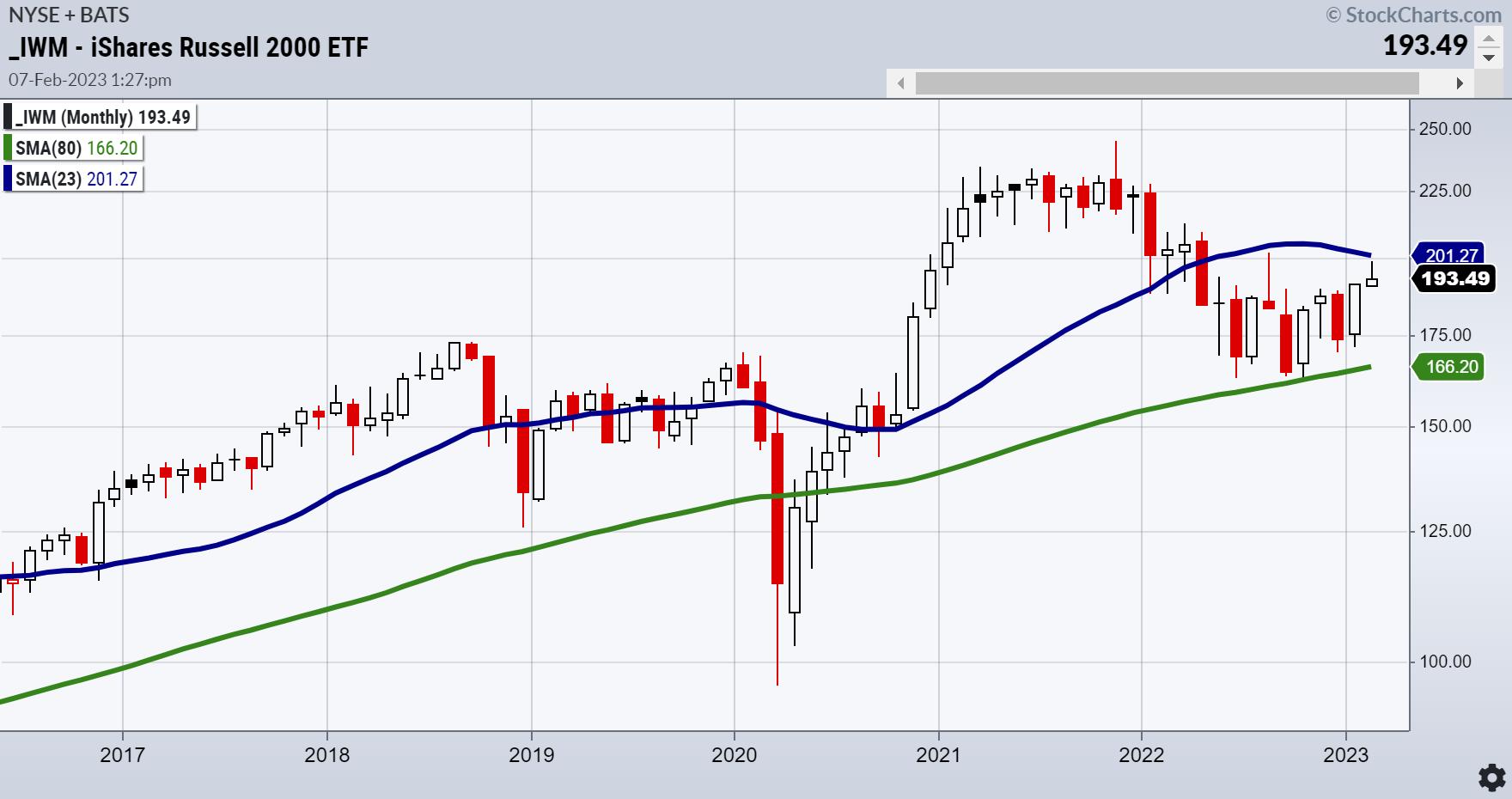

Today we are going to show you the charts of what this business cycle looks like. A 2 year or 23 month moving average in blue is at least interesting.

What happened in the last 2 years? An uptrend in 2021 based on quick money. Inflation is running hotter than most expected. The banks were caught off guard… and by 2022… the party is over.

So this really begs the question of why this year’s 23-month moving average is one of the most important indicators for stocks.

Here is the Russell 2000 (IWM). Maybe even cleaner. As the grandfather of the Economic Modern Family, a break and close above the 23-month MA would be enough evidence to believe in a soft landing and good news for the economy and the market. Failure to pierce this MA is hacking. A break of the also very important 80-month MA (green), which represents a 6-7 year business cycle – bad… very bad.

In October, IWM held the 80-month rate, leading us to believe that a recession would be averted. Now the market is literally caught in the balance between a longer-term and a shorter-term economic cycle.

Trust the charts and know your time frame.

For more detailed trading information on our blended models, tools and trader education courses, please contact us Rob Quinnour Chief Strategy Consultant to learn more.

IT IS NOT TOO LATE! Click Here if you would like a free copy Mish’s 2023 Market Outlook as an e-book in your inbox.

“I grew my money tree and you can too!” – Misch Schneider

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth and a special bonus here.

Follow Mish on Twitter @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To view updated media clips, Click here.

Read more about Mish’s interview with Neils Christensen in this article from Kitco!

In this appearance Make money with Charles PayneCharles and Mish discuss whether Powell can say mission accomplished.

Mish shares her views on how to approach earnings news from Apple, Amazon and Alphabet, and provides a technical outlook on how earnings results could impact the S&P 500 and Nasdaq 100 in this appearance on CMC Markets.

Listen to Mish on Chuck Jaffe’s money life, starting around the 27 minute mark.

Kristin and Mish discuss whether or not the market has run out of good news in this appearance on Cheddar TV.

Harry Melandri and Mish discuss inflation, the Federal Reserve and any spark plugs that might ignite on Real Seeing.

Jon and Mish discuss how the market (still range bound) is betting on a dovish Fed in this appearance on BNN Bloomberg.

Mish discusses the price and what indices need to do now in this gig Make money with Charles Payne.

In this appearance on TheStreet.comMish and JD Durkin discuss the latest market earnings, data, inflation, the Fed and where to put your money.

In this appearance on CMC Markets, Mish delves into her favorite commodities trades for the week and gives her technical take on trading opportunities for gold, oil, copper, silver and sugar.

- S&P 500 (SPY): 420 resistance with 390-400 support.

- Russell 2000 (IWM): 190 now support and 202 main resistance.

- Dow (DIA): 343.50 resistance and the high of the 6-month calendar range.

- Nasdaq (QQQ): 300 is now the crucial range.

- Regional Banks (KRE): 65.00 resistance.

- Semiconductor (SMH): 248 is the 23-month moving average – key.

- Transport (IYT): The 23-month MA stands at 244 – now resistance.

- Biotechnology (IBB): lateral action.

- Retail (XRT): 78.00 the 23-month ma, resistance and next support 68.00.

Misch Schneider

MarketGauge.com

Director of Trade Research and Education

Misch Schneider serves as director of trading education at MarketGauge.com. For nearly 20 years, MarketGauge.com has provided financial information and training to thousands of individuals, major financial institutions and publications such as Barron’s, Fidelity, ILX Systems, Thomson Reuters and Bank of America. In 2017, MarketWatch, owned by Dow Jones, named Mish one of the top 50 financial professionals to follow on Twitter. In 2018, Mish was the winner of Top Stock Pick of the year for RealVision.