Budget challenge games for students are a powerful tool in teaching financial literacy. These games offer engaging ways to learn money management, helping students make smart financial decisions and set realistic savings goals. By simulating real-life scenarios, these games prepare students for future financial stability.

Key Takeaways

- Budget challenge games engage high school students in learning essential financial literacy skills, covering budgeting, credit scores, and decision-making.

- These games simulate real-life scenarios, helping students prepare for unexpected financial events and long-term savings goals.

- Customizable options in budget games allow educators to tailor the experience, ensuring effective and relatable financial education for diverse classrooms.

Engaging Budget Challenge Games for High School Students

High school is a critical time for developing financial literacy skills, and budget challenge games offer an engaging learning experience that makes this process enjoyable. These financial literacy games cover a range of topics, from creating personal budgets to navigating unexpected life events and understanding credit scores.

These games integrate real-life scenarios into gameplay to teach students how to manage money wisely, make smart financial decisions, and set realistic savings goals. The interactive nature of these games ensures that students remain engaged, making it easier for them to grasp complex financial concepts and apply them in their daily lives.

Creating a Personal Budget

One of the core aspects of financial literacy games is teaching students how to create and manage a personal budget. Through these budget games, students learn to review their fixed and variable expenses, projected income, and set savings goals regularly. They understand the importance of prioritizing needs over wants, which is crucial for maintaining financial stability.

The lesson ‘Pay Yourself First’ emphasizes the significance of saving, helping students realize the importance of preparing for unexpected expenses. Managing realistic monthly expenses and bills helps students acquire budgeting skills that will benefit them throughout their lives.

Navigating Unexpected Life Events

Life is full of surprises, and budget challenge games prepare students to handle unexpected events with resilience and adaptability. Through simulations of unplanned life circumstances, students experience the challenges of financial decision-making during these times. Understanding the importance of an emergency fund is critical, as it can significantly reduce the stress of unforeseen financial difficulties.

These real-life scenarios help students develop the skills needed to manage unplanned expenses and maintain financial stability.

Understanding Credit Scores

Credit scores play a vital role in financial health, and budgeting games introduce students to the concepts of responsible credit use and the balance between needs and wants. Embedded lessons within these games cover topics like comparison shopping, mortgages, and opportunity costs, helping students grasp the complexities of credit scores and their impact on financial decisions.

Understanding these concepts enables students to make informed choices that positively affect their credit scores and overall financial well-being.

What is a Budget Challenge?

A budget challenge is more than just a game—it’s a comprehensive financial literacy program designed to teach students essential money management skills through practical, hands-on experience. Typically spanning a 10-week online experience, participants manage the finances of an independent young adult, covering tasks such as paying bills, receiving paychecks, and managing savings and credit accounts. This immersive approach helps students understand the intricacies of personal finance, from selecting vendors for housing and insurance to establishing an emergency fund and managing credit effectively.

Budget challenges can be seamlessly integrated into various educational subjects such as math, economics, and life skills, making them a versatile tool for educators. By simulating real-life financial situations, these programs provide students with a safe environment to learn and make mistakes, ultimately preparing them for the financial responsibilities they’ll face in adulthood.

Best Budget Challenge Games for High School Students

When it comes to teaching high school students about financial literacy, certain budget games stand out for their effectiveness and engagement. Many educators are familiar with The Budget Challenge, a popular simulation known for its realism. If you’re searching for alternatives or comparing options, you’ve come to the right place. We’ll look at The Budget Challenge, PersonalFinanceLab’s Budget Game, and Everfi, to see how they stack up, especially for the high school market.

These platforms provide a variety of scenarios and tasks that teach budgeting skills, responsible spending, and the importance of financial planning. Participating in these fun games allows students to learn valuable financial concepts while enjoying the process, making financial education both enjoyable and impactful.

Check out the comparison table below for more details.

| Feature | PersonalFinanceLab (Budget Game) |

The Budget Challenge | Everfi |

| Primary Focus | Comprehensive Personal Finance (Budgeting, Investing, Career, etc.) | Realistic Budgeting & Cash Flow Simulation | Broad Financial Literacy Topics (Modular) |

| Cost Per Student | $10 | $30 | Typically Free (Sponsor-Funded) |

| Simulation Realism | High (Realistic bills, income, unexpected events) | Very High (Focus on vendor payments, bill cycles, consequences) | Moderate (Scenario-based learning within modules) |

| Integrated Curriculum | Extensive Library (300+ lessons), Customizable Assignments, Auto-Grading | Supporting materials available, focused on the simulation’s mechanics | Integrated lessons within modules, often standardized |

| Teacher Tools | Admin Dashboard with Robust Reporting on Student Activity & Actions on Site | Teacher dashboard for monitoring progress and scores | Class management, progress tracking |

| Customization | High (Rules, Scenarios, Income, Expenses, Assignments, Features On/Off) | Moderate (Game length, some scenario elements) | Low (Primarily module selection) |

| Time Commitment | Highly Flexible (Weeks to Full Semester, Teacher Controlled) | Typically Fixed Duration (e.g., 10 weeks), requires regular check-ins | Variable (Based on number of modules assigned) |

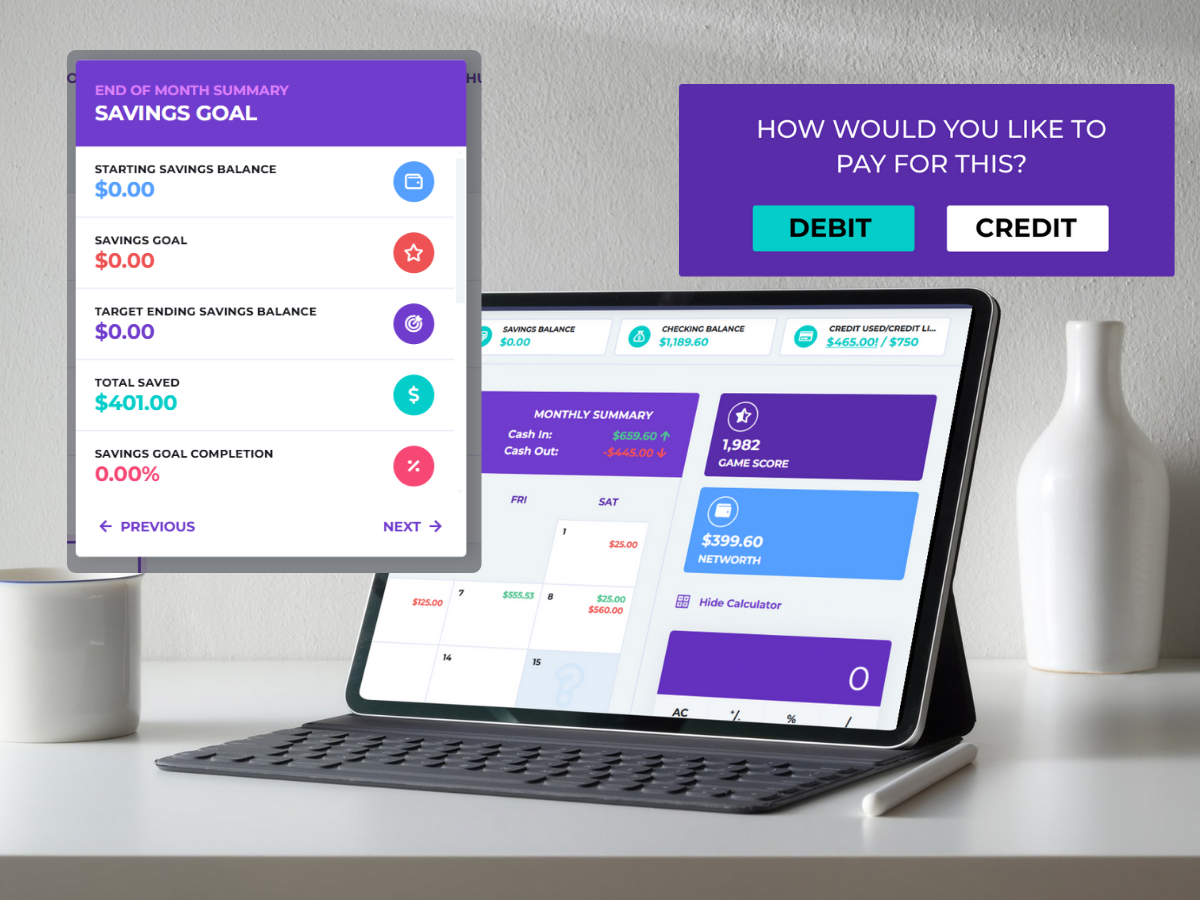

| User Interface (UI) & Engagement | Very High (Colorful, Gamified, Modern, Integrated Activities, Leaderboards) | Moderate (Functional, Realistic, Mimics Online Banking) | Moderate (Interactive Lessons, Clean Design, Less “Game” Feel) |

| Key Strength | Cost-Effective, Comprehensive, Customizable & Engaging Platform | Hyper-realistic budgeting simulation mechanics | Free accessibility, introduces basic concepts |

| Potential Drawback | Scope might feel broad if only budgeting is needed | Highest Cost, Narrower Focus, Less Flexible Duration | Can lack depth/engagement of a dedicated simulation, limited customization |

| Learn more about PersonalFinanceLab | Learn more about the Budget Challenge | Learn more about Everfi |

(Note: Pricing and specific features are subject to change. Please verify with each provider.)

If you’re looking for an affordable, adaptable, comprehensive, and genuinely engaging platform to teach budgeting and beyond, PersonalFinanceLab offers unmatched value for the high school market.

While The Budget Challenge simulates the mechanics of paying bills realistically, its high cost, narrower focus, fixed duration, and less gamified interface make PersonalFinanceLab a more compelling overall package for high school financial literacy. PFL offers a robust Budget Game within a broader, highly customizable, and engaging learning ecosystem – all at the significantly lower price of $10 per student. Compared to free options like Everfi, which serve as introductions but lack simulation depth and integrated gameplay, PersonalFinanceLab provides a superior, flexible, and cost-effective educational experience designed to truly captivate and empower students with lasting financial skills.

Best Budget Challenge Games for College Students

College students face unique financial challenges, and budget games like those found on Stocktrak.com and Budgetchallenge.com are designed to address these needs. These platforms offer simulations that cover a wide range of financial topics, from managing student loans to investing in the stock market.

Engaging in these financial literacy games helps college students develop the budgeting skills necessary to navigate their financial futures. The interactive and practical nature of these games ensures that students remain engaged and motivated to learn, making financial literacy an integral part of their college experience.

| Feature | StockTrak (Personal Finance Simulation) |

The Budget Challenge (Plus Investing) |

MyEducator (Personal Finance and Economic Decision-Making) |

| Primary Focus | Integrated Personal Finance & Stock Market Simulation | Realistic Budgeting + Retirement Investing Behaviors (401k Focus) | Integrated Courseware + Applied Personal Finance Simulation |

| Cost Per Student | $19.99 | $30+ | $89.99 |

| Simulation Scope | Budget Game + Active Trading (Stocks, Bonds, & Mutual Funds) | Budgeting + Simulated 401k Contributions (Mutual Funds/ETFs) | Budgeting, Saving, Debt Mgmt, Insurance, Basic Investing Concepts (Often scenario/goal-based) |

| Budgeting Component | Yes (Detailed: Income, Bills, Savings Goals, Credit Score, Financial Literacy Embedded Lessons, Mini-Games) | Yes (Highly Detailed Bill Payments & Consequences) | Yes (Integrated within Practice Problems) |

| Investing Component | Yes (Sophisticated: Real-Time Data, Global Exchanges, Advanced Orders, Research Tools, Charting) | Yes (Simulated 401k: Historical Data, Fund Selection, Employer Match, Focus on Fees/Diversification) | No (Illustrates principles, less active trading focus) |

| Integration: Budget-Invest | High (Budget savings can directly fund investment portfolio) |

Moderate (401k contributions deducted from simulated paycheck) |

Low (No practical integration for students to practice concepts) |

| Curriculum/Resources | Extensive Library, Customizable Assignments, Videos, Calculators, Auto-Grading | Focused materials, Mutual Fund Fact Sheets, Future Value Visualizer | Integrated e-textbook, chapter quizzes, learning modules |

| Professor Tools | Very High (Extensive Customization & Reporting) | Moderate-High (Simulation setup, scoring based on specific metrics) | Moderate (Course setup, assignment management, grading, LMS integration) |

| Key Strength | Integrated Budgeting & Investing Simulations, Flexibility, Customization, Research Tools | Hyper-realistic Budgeting + Behavioral Retirement Investing Focus | Seamless Textbook/Courseware Integration, Structured Learning Path |

| Potential Drawback | Comprehensive features require orientation | Narrower Investment Scope (401k focus), Less Active Trading, Higher Cost | Cost (often bundled), Less Investment Sophistication/Flexibility |

| Learn more about StockTrak’s Personal Finance Service Level | Learn more about the Budget Challenge Plus Investing | Learn more about MyEducation Personal Finance and Economic Decision-Making |

While The Budget Challenge Plus Investing provides valuable lessons in retirement saving discipline and MyEducator excels in structured course integration, StockTrak offers the most versatile, comprehensive, and powerful platform for teaching both practical budgeting and dynamic investing in a college setting.

StockTrak uniquely allows professors to enable students to transfer savings directly from their budget simulation into their active trading portfolio. This tangible link reinforces the core personal finance principle of saving in order to invest. Professors can even start students with minimal cash, forcing them to build their portfolio through diligent budgeting – a powerful lesson TBC’s 401k model (focused on paycheck deductions) and MyEducator’s more conceptual approach don’t replicate in the same active way.

Beyond the core simulations, StockTrak includes tutorial videos, interactive calculators, and engaging mini-games within the budget simulation (e.g., time management, shopping prioritization) that add layers of practical skill-building.

For college educators seeking to provide a truly comprehensive financial education, StockTrak is the leading choice. It masterfully integrates practical budgeting with sophisticated, active investment management, offering unparalleled flexibility and depth. While The Budget Challenge Plus Investing excels in teaching disciplined retirement saving habits and MyEducator provides strong courseware integration, StockTrak uniquely empowers students to manage their cash flow, build capital through savings, research diverse investments, and execute trades in a dynamic, real-time environment – all within one platform.

Best Budgeting Activities for Students

ADD TEXT INTRO

CashCrunchGames.com

CashCrunchGames.com focuses on making financial literacy accessible and engaging for students through money games and interactive resources. While they offer various tools like conversation starters and mini-lessons, their approach incorporates budgeting activities in several ways:

- Direct Gameplay: Their (currently revamped) flagship board game, CashCrunch Junior, is designed to explicitly teach concepts like budgeting, cash flow, needs vs. wants, and making money decisions through gameplay, encouraging players to track and manage virtual money.

- Mini-Lessons & Activities: The “Mini Money Lessons” (available for different age groups) include budgeting topics within their short, activity-based format, providing practical exercises within the 15-30 minute lesson structure.

- Scenario-Based Learning: The “Personal Finance Connectors” card game allows students to apply financial knowledge to scenarios, which often inherently involve budgeting decisions and trade-offs.

- Guided Discussion: The “Daily Conversation Starters” provide prompts that encourage discussions around spending choices, saving, and money management, fostering the critical thinking needed for effective budgeting.

WeAreTeachers.com

WeAreTeachers offers a curated list of free interactive budgeting activities specifically designed for high school students. The resource aims to equip teens with practical financial skills through a variety of engaging formats:

- Printable Game: Features a prominent “Free Printable Bean Budget Game Bundle” where students make budgeting decisions using beans as currency, simulating choices and dealing with unexpected financial changes.

- Hands-On Activities & Worksheets: Provides links to and descriptions of practical tools, many from the Consumer Financial Protection Bureau (CFPB). These include activities like using income/spending trackers, bill calendars, creating buying plans, building savings “first-aid kits,” reflecting on needs vs. wants, and researching real-world costs (groceries, job salaries, living expenses).

- Interactive Online Games: Compiles a wide array of free online games and simulations that place students in various financial scenarios. Examples include managing money (“How Not To Suck at Money,” “Misadventures in Money Management”), simulating specific jobs/situations (“The Uber Game,” “Spent,” “Influenc’d”), planning trips (“Hit the Road”), understanding college costs (“Payback”), managing movie budgets (“Lights, Camera, Budget!”), and making choices based on potential careers (“Claim Your Future”).

TeachersPayTeachers.com

Teachers Pay Teachers (TpT) offers a wide variety of free budgeting activities by serving as a marketplace where educators share resources they’ve created. Unlike a single platform or game, TpT provides budgeting activities through a diverse collection of downloadable materials from numerous teacher-authors.

- Scenario-Based Projects: Many activities place students in relatable situations requiring budget management, like planning holiday gift lists, birthday parties, BBQs, class parties, dinner parties, or even dream vacations.

- Real-World Activities: Resources guide students through budgeting for more complex real-life expenses, such as finding an apartment, financing a car, grocery shopping (often using real store flyers or websites), or dining out.

- Worksheets and Calculation Practice: Various printables focus on the mechanics of budgeting, including calculating percentages for savings/needs/wants, adding/subtracting decimals (money), and tracking expenses.

- Lesson Plan Components: Educators offer free warm-ups, complete lesson plans, center activities, or worksheets designed to integrate budgeting into existing curricula (Math, Economics, Family Consumer Sciences, Life Skills, Special Education).

- Integrated Activities: Some resources are designed to add a budgeting element to other subjects (like STEM challenges) or to facilitate reflection after using external online budgeting games (like Playspent).

Fun and Interactive Ways to Teach Budgeting Skills

Gamification has revolutionized financial education by making learning about personal finance fun and interactive. Budget games effectively teach students financial literacy skills through their own decision-making, enhancing problem-solving abilities and increasing motivation. These games provide an engaging learning experience that helps students understand complex financial concepts and apply them in real-life scenarios.

Teachers can personalize these games to match their teaching styles and student needs, ensuring that financial education is both effective and enjoyable.

Monthly Budget Planning

Monthly budget planning is a crucial skill taught through budget games, where students learn to balance immediate desires with long-term financial goals. By distinguishing between essential and non-essential expenses, students can create effective monthly budgets that prioritize savings and responsible spending.

Understanding their financial choices enables students to make informed decisions that contribute to their overall financial stability.

Managing Cash Flow Shortfalls

Budget games teach students to anticipate and manage cash flow shortfalls by simulating realistic financial scenarios. Creating a cash flow management plan helps students prepare for potential shortfalls and maintain financial stability.

Learning to quickly assess their financial situation during cash flow shortages helps students avoid financial stress and make smart financial decisions.

Responsible Spending and Debt Management

Responsible spending and debt management are essential components of financial literacy games. These games illustrate the impact of high-interest loans and the dangers of predatory lending practices, helping students understand the importance of reading and understanding loan agreements.

Highlighting these potential pitfalls in budgeting games teaches students to make informed financial decisions that avoid unnecessary debt and prioritize financial health.

Real-Life Scenarios in Budget Challenge Games

Budget challenge games excel at simulating real-life financial scenarios, providing students with a hands-on experience that enhances their ability to make sound financial decisions. These simulations cover a wide range of financial situations, from managing part-time job income to saving for long-term goals, preparing students for the financial realities they’ll face in adulthood.

The interactive nature of these games develops critical thinking skills and reinforces the importance of financial planning and risk management.

Part-Time Jobs and the Gig Economy

Budget challenge games often include scenarios involving part-time jobs or gig work, teaching students to navigate income fluctuations and budget management. These games simulate the unpredictability of earnings common in the gig economy, helping students learn to handle variable income and make informed financial decisions.

Experiencing these scenarios helps students develop the skills needed to manage their finances effectively, even in uncertain economic conditions.

Saving for Long-Term Goals

Setting and pursuing long-term savings goals is a key lesson in budget challenge games. These games reinforce the significance of realistic savings objectives, teaching students to prioritize long-term financial stability. Learning to set and achieve savings targets enhances students’ ability to plan for future financial needs and secure their financial well-being.

Customizable Budget Games for Classroom Use

Customizable budget games offer teachers the flexibility to tailor financial education to their classroom dynamics. These games can be personalized to match specific student needs and teaching styles, making financial literacy education more effective and engaging.

With enriching resources like lesson plans and group projects, teachers can create a comprehensive learning experience that covers all aspects of money management.

Adjustable Game Settings

Adjustable game settings in budget games allow teachers to modify key components such as starting bank balance, fixed expenses, and hourly wage to better match student levels. Students can begin the game as part-time workers or full-time professionals, catering to different learning experiences.

Teachers can also adjust the duration of gameplay by selecting when students play, enhancing the flexibility and pacing of the game.

Embedded Lessons and Mini-Games

Embedded lessons and mini-games within budget games provide interactive ways to teach important financial concepts. These fun mini-games help solidify financial concepts and keep students engaged in the learning process.

Incorporating these elements into budget games creates an engaging learning experience that helps students retain and apply financial knowledge effectively.

Integration with Classroom Tools

Integrating budget games with classroom tools like Google Classroom enhances the overall instructional experience by making it easier for teachers to manage and track student progress. This seamless integration allows for a streamlined usage of budget games, ensuring that students remain engaged and motivated to learn.

Incorporating these tools allows teachers to provide a more comprehensive and effective financial education.

Benefits of Budget Challenge Games for Students

Budget challenge games offer numerous benefits for students, from improving financial decision-making to enhancing engagement and learning. These interactive activities help students realize the importance of financial literacy and prepare them for real-world financial challenges. By incorporating fun and engaging elements, these games make learning about personal finance enjoyable and memorable.

The following subsections will delve into specific benefits in more detail.

Improved Financial Decision Making

Budget challenge games are instrumental in fostering improved financial decision-making among students. Encouraging students to track their spending habits helps reduce unnecessary debt and promotes responsible spending in a budget game.

Students learn to create strategies that prioritize paying off debts effectively, understand the implications of debt, and make informed financial decisions that positively impact their financial health. This practical approach to personal finance education equips students with the skills needed to manage their money wisely.

Enhanced Engagement and Learning

Gamification plays a significant role in making financial education more engaging and effective. Budget challenge games incorporate embedded lessons and mini-games that reinforce key financial concepts, maintaining student interest and participation.

These interactive elements not only make learning fun but also enhance retention of financial concepts, preparing students for real-world financial challenges they may face in their lives. Making financial literacy an engaging learning experience helps students realize the importance of managing their money wisely.

Preparation for Real-World Financial Challenges

Budget challenge games are designed to simulate real-life financial situations, providing students with a hands-on experience that prepares them for the complexities of managing finances in the real world. Games like ‘Payback’ teach students the importance of balancing academics, work, and social activities while managing debt.

Exposing students to realistic financial scenarios equips them with the knowledge and skills needed to navigate financial challenges independently and successfully and teaches financial literacy skills.

Summary

Budget challenge games provide a dynamic and engaging way for students to learn essential financial literacy skills. From creating personal budgets and handling unexpected life events to understanding credit scores and managing debt, these games cover a wide range of financial topics. By simulating real-life scenarios and incorporating gamification strategies, they make learning about personal finance enjoyable and effective. These games not only enhance student engagement and retention of financial concepts but also prepare them for real-world financial challenges, equipping them with the skills needed to achieve financial independence and success. Incorporating budget challenge games into educational curricula can significantly enhance students’ financial literacy and overall preparedness for adulthood.