After the 1/19/23 crash, someone asked me if I was still optimistic. And my response was, “As long as the NYAD’s advance decline line stays above its 200-day moving average, the bulls will benefit when in doubt.” back to what he had lost in the previous two days.

Do not get me wrong. Neither I nor anyone else knows what’s going to happen in the stock market at any given moment. Still, there are reliable indicators that smooth out daily price fluctuations. One of them is the breadth of the market. And mine favorite indicator to smooth things out with is the New York Stock Exchange’s Advance Decline line.

That’s because the market’s internals (the term used by technicians to refer to the breadth of the market as measured by NYAD and similar indicators) now lead the indices more often than in the past, where indices were the primary Indicators of the market trend were.

The reason for this is twofold. First, indices are weighted by capitalization. This means that mega-cap stocks can make an index’s price fluctuate wildly, distorting the price trend. For example, a poor earnings report for a major stock can cause the S&P 500 (SPX) to decline while the NYAD is either moving higher or consolidating.

In this case, where a heavily weighted stock is taking the index down while the rest of the market continues to move up, you would see a positive deviation, which means the breadth of the market is better than what the cap-weighted skewed price indicates. The current market is showing positive divergence, which is bullish by definition.

The second reason is the fact that algorithmic trading (bots) can further distort market action on an intraday basis. This often happens when meme stocks attract money and the algos amplify the current trend while piling up to make quick profits.

In both cases, the NYAD filters price distortion as each individual stock only gets one vote in this indicator. So when the NYAD goes up or down, it’s because the majority of stocks are going up or down, respectively. In other words, a rising NYAD is a more telling indicator of an uptrend than a rising S&P 500, where a handful of stocks can skew the index.

The opposite is also true. When NYAD falls and SPX rises, this is referred to as a negative deviation. Negative divergences often precede bear markets or significant declines.

Until something changes, this market is under the influence of positive divergence, which is why I am still biased towards the bullish case. If the situation reverses, I will change my mind.

I have more details on NYAD and SPX below.

Bull Vs Bear Market Checklist Review

As I noted here last week, I’ve noted in my weekly subscriber portfolio update for the past few months that I would become bullish when the following conditions are met. Here they are, with updates:

- The NYAD is moving well above its 200-day moving average;

- A rally in XED, which would mean liquidity has improved;

- The VIX has been trading near its lows for a long time, which would mean that put buyers have largely walked away, leaving market makers with no choice but to buy calls and index futures to hedge their bets;

- A clear sign from the Fed that the rate hike cycle is not just slowing down but is coming to an end.

So here we are at the moment. NYAD and VIX are still bullish. XED is still moving sideways, which is essentially neutral. Meanwhile, the Fed is speaking from both sides of the mouth, recently leaking that it would raise rates by just 25 basis points, while more recent Fed spokesmen are still talking of raising rates to over 5%.

All in all we have two positives and one neutral. This means the environment for stocks is better than it was at the end of 2022 because the breadth of the market is better and bears are less willing to buy put options, eventually driving stock prices lower. As long as liquidity remains stable, even if the Fed remains focused on raising rates, the market is more likely to grind higher than fall. If any of these parameters deteriorate, the downtrend will resume.

Check out what works with a free trial of my service. click here for more.

Buy Homebuilders Dip as mortgage rates fall

Investors who focus on the latest real estate data, which use rising inventories, falling home prices, dismal existing home sales and reports of homebuilders using gimmicks to sell their burgeoning inventory, are not observing the bullish effects of falling mortgage rates on homebuilders and related stocks .

Last week we saw the average 30-year mortgage fall to 6.15%. That’s nearly a point below the peak seen in late 2022. Meanwhile, the reported data is from December. Activity increases on the ground. For the first time in several weeks I am seeing new housing being framed into new developments, along with the sale of land for future construction. In addition, I’m starting to see a trickle of traffic in some existing homes, which I’m keeping an eye on as indicators. This suggests that the dire real estate data is set to improve somewhat over the next few months.

That means the recent slight pullback in homebuilders (SPHB) is likely a buying opportunity for those who missed the rally from the October low.

If you are looking for ideas on which builders to buy, take a free trial of my service here.

Bullish development: NYAD breaks the 200-day moving average and sets a new high

The New York Stock Exchange’s Advance Decline Line (NYAD) settled above its 50-day and 200-day moving averages on 1/6/23. The stock market is in an upward trend.

For its part, the CBOE Volatility Index (VIX) failed to make any notable gains, signaling a significant change in market sentiment. That too is bullish. When the VIX rises, stocks tend to fall as rising put volume is a sign that market makers are selling stock index futures to hedge their put sales to the public. A drop in the VIX is bullish as it means fewer put option purchases and eventually leads to call purchases, prompting market makers to hedge by buying stock index futures, increasing the chances of higher stock prices.

Liquidity is flat despite the Fed’s QT maneuvers as the Eurodollar Index (XED) has been trending sideways to slightly higher in recent weeks. Note that the market’s recent rally off the October bottom corresponded to this flattening out in liquidity.

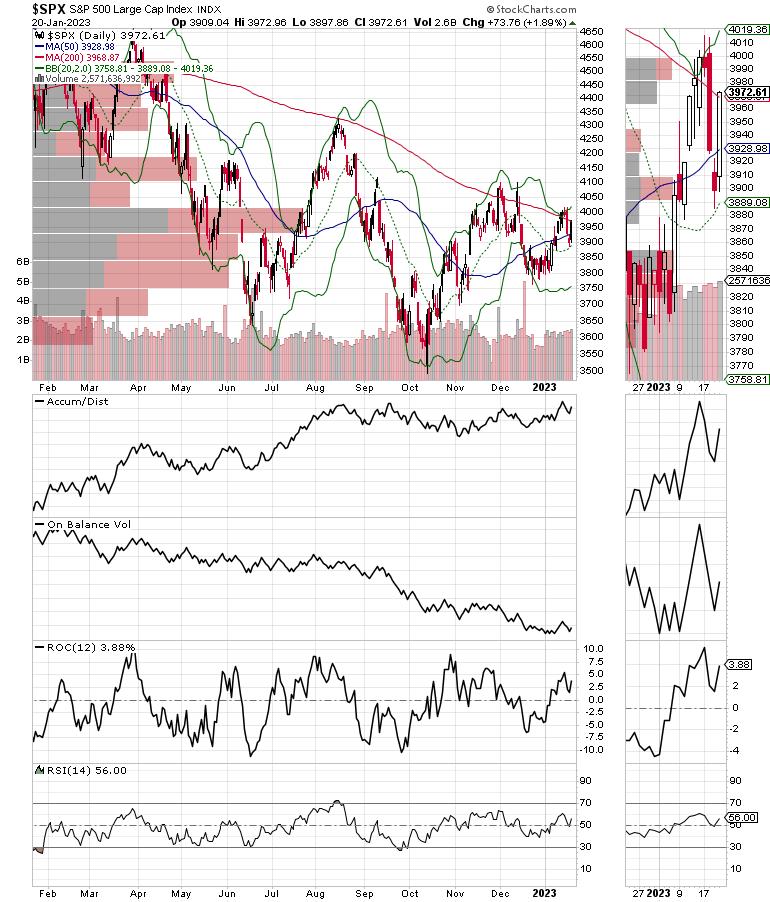

The S&P 500 (SPX) has found support at 3800-3900 three times in the past few days and is now back above its 20-, 50- and 200-day moving averages but closed just below the 4000 area. At the same time, Accumulation/ Distribution (ADI) stable and On Balance Volume (OBV) has bottomed while attempting to turn up. That means stocks are now being bought net, albeit in spurts.

The Nasdaq 100 Index (NDX) has made a pretty concrete triple bottom, although it continues to lag SPX. It’s still possible that it hit a triple bottom with the 10,500-10,700 price range, which has resulted in some short-covering. The index is now above 11,000 while the real test is what will happen around 12,000 and the 200-day moving average.

For the most up-to-date information on options trading, visit here Options trading for dummies, now in its 4th edition – Get your copy now! Now also available as an Audible audiobook!

#1 New Release in Options Trading!

#1 New Release in Options Trading!

Good news! I created my NYAD complexity chaos diagram (on my YD5 Videos) and a few other favorites public. You can find them here.

Joe Duarte

In the money options

Joe Duarte is a former money manager, an active trader and a widely recognized independent stock market analyst since 1987. He is the author of eight investment books, including the bestseller Trading options for dummiesrated a TOP option book for 2018 from Benzinga.com and now in its third edition, plus The book “Invest everything in the 20s and 30s”. and six other trading books.

The book “Invest everything in the 20s and 30s”. is available at Amazon and Barnes and Noble. It was also recommended as Washington Post Color of Money Book of the Month.

For Joe’s exclusive stock, option and ETF recommendations, visit your mailbox each week https://joeduarteinthemoneyoptions.com/secure/order_email.asp.

Joe Duarte is a former money manager, active trader and widely respected independent stock market analyst dating back to 1987. His books include Best Selling Trading Options for Dummies, A TOP Options Book for 2018, 2019 and 2020 from Benzinga.com, Trading Review.Net 2020 and Market Timing for Dummies. His latest bestseller, The Everything Investing Guide in your 20s & 30s, was named Color of Money Book of the Month by The Washington Post. To have Joe’s exclusive stock, options and ETF recommendations delivered to your inbox each week, visit the Joe Duarte In The Money Options website.

learn more