If you’ve been focusing too much on how much the high-flying tech stocks have depreciated the value of your portfolio, you may not have noticed that the marginalized value stocks are showing signs of a turnaround. That’s not unusual; In an economically uncertain environment, value stocks tend to outperform their growth peers. Not a guarantee, but something to keep in mind throughout 2023.

What is a value stock?

Some people believe that a value stock is one that has fallen in value and is being priced at a discount. In other words, if a growth stock’s price has fallen significantly and you buy it at a bargain price, it’s considered a value investment. That’s an extreme view. Another, more realistic perspective is to think of a value stock as one trading at a low price relative to its fundamentals. In short, a value stock’s price may be lower than its book value, or its price-to-earnings ratio may be lower than that of its peers.

Value stocks also have dividend and yield potential. And in uncertain times, the yield and dividends could add some cushion to your portfolio. Buff Dormeier, CMT, Chief Technical Analyst at Kingsview Partners, has found that this is having an impact on his company’s portfolio performance. “Over the past year, the value style has outperformed the capital-weighted indices by 32%, while the growth style has underperformed by -17% in 2022,” said Dormeier.

The benefits of investing in value stocks

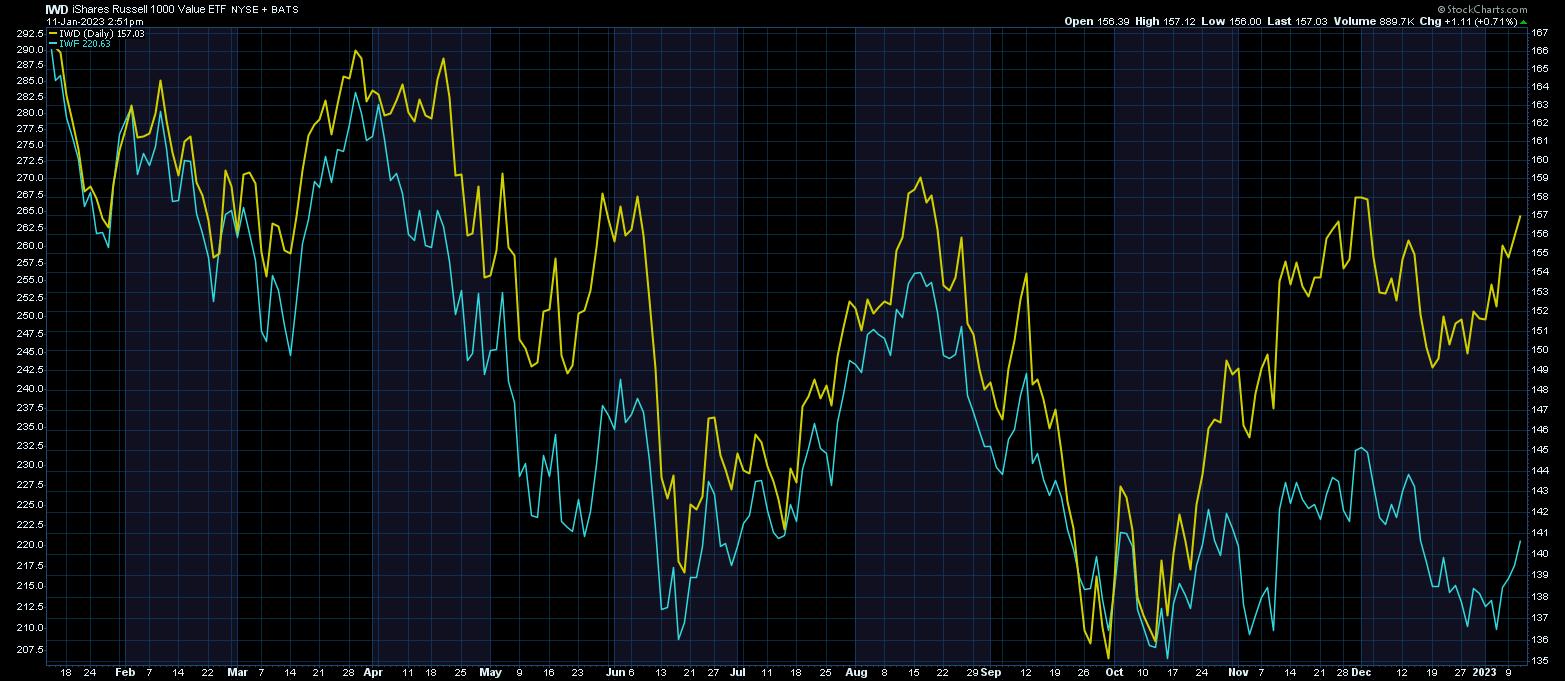

Value stocks tend to have smaller drawdowns during market declines. The chart below shows an overlay of the iShares Russell Value ETF (IWD) and the iShares Russell Growth ETF (IWF). IWD (yellow line) has moved up and down in line with IMF (blue line). Since October 2022, however, the gap between the two has widened, with value stocks significantly outperforming growth stocks. Does that mean it’s a good time to add value stocks to your portfolio?

CHART 1: GROWTH PERFORMANCE VS. WORTH. On this one-year daily chart, you can see that the iShares Russell 1000 Value Exchange Traded Fund (IWD) has been moving in line with and outperforming the iShares Russell 1000 Growth ETF (IWF) for most of 2022. Since October, the outperformance of the IWD began to gain importance.Chart source: StockCharts.com. For illustration only.

Given that value stocks are relatively stronger than growth stocks, it’s only natural to think that the movement could be on the verge of exhaustion. “I think we’re still at the beginning of this movement,” added Dormeier. “This makes a lot of sense in an inflationary environment because when inflation is high, profits are worth less going forward based on discounted cash flow. So, owning cash cow companies pays off immediately, especially when profits are returned to shareholders via dividend payments.”

The present value of a growth stock is based on future cash flows. And when interest rates are high, future cash flows are discounted at that higher rate. This makes growth stocks less valuable and value stocks a more attractive investment.

How long should you hold a value stock?

Value stocks tend to be cyclical. So when investing in them, it is important to study the market and be ready to swap them out when the time is right. You shouldn’t hold onto them because it can take a long time for them to go back up.

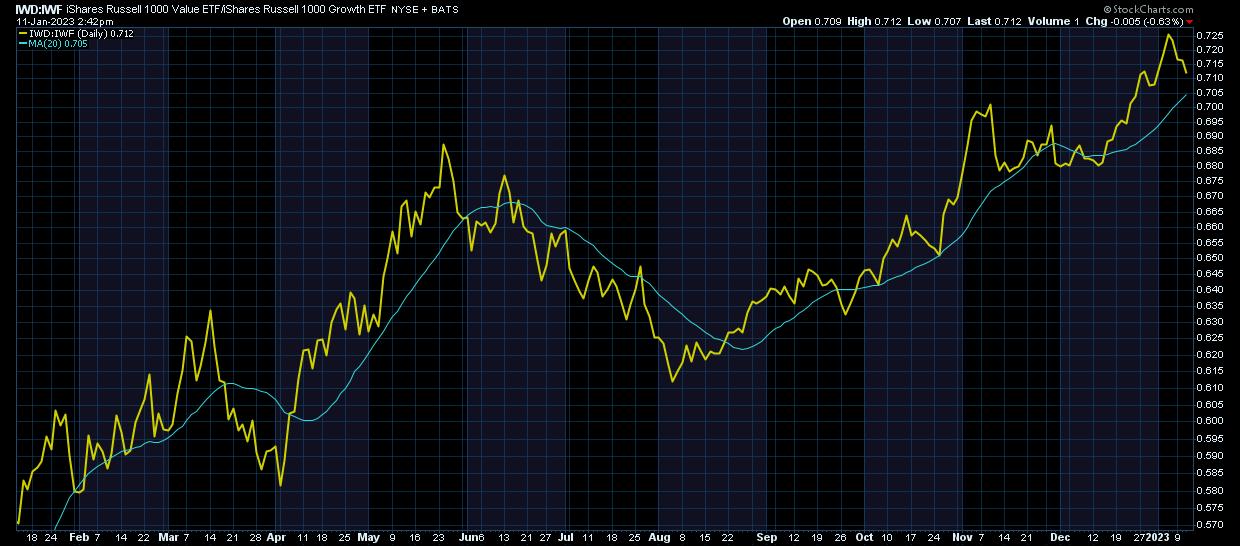

One way to find out how long you should hold a value stock is to look at a chart of the relative performance of the IWD and IMF (see Chart 2). The 20-day moving average (blue line) shows that the trend is still in favor of value stocks, although they are pulling back somewhat. It will be interesting to see if it bounces back after hitting the moving average.

Note: To add the charts to your ChartLists, simply click on the chart. This will take you to the StockCharts platform where you will have the option to add them to your chart lists.

CHART 2: VALUE STOCKS ARE STILL CHEAP. Keep an eye on this chart to see if there is a rebound from the 20-day moving average. This can be a good indication of how long to hold a value stock.Chart source: StockCharts.com. For illustration only.

Which stocks are “value” stocks?

It’s best to conduct your due diligence on basic data, but here’s a cheat sheet.

- Bank stocks tend to top the list of value stocks. They start earnings season on January 13th, so add a few of them to your chart lists – Bank of America (BAC), Citigroup (C), JP Morgan Chase (JPM), Wells Fargo (WFC) and Goldman Sachs (GS ). .

- Builder stocks are also worth considering. Some of the stocks in this category are Pulte Group (PHM), Lennar Corp. (LEN), DR Horton (DHI) and KB Home (KBH). It may also be worth adding the S&P 500 Homebuilding Subindustry Index ($SPHB) to your chart lists.

- Communications network stocks are another favorite among value investors. They are known for their dividends. Stocks that fall into this subsector include Verizon Communications (VZ), AT&T (T) and Comcast Corp. (CMCSA).

- Semiconductor stocks are also gaining some traction recently. Micron Technology (MU), Broadcom Inc. (AVGO) and Qualcomm, Inc. (QCOM) are just a few to consider.

One of the biggest drivers of macroeconomic uncertainty is inflation. Recent comments from Fed Chair Jerome Powell appear to have reassured investors by suggesting that while inflation is cooling, one data item shows no trend. So keep an eye on the Fed’s rate decisions; While it sounds like inflation will take a while to hit the 2% target, value stocks could enjoy their ride.

How to find stocks with dividends and yields

- Scroll down to icon summary under Member Tools in your Dashboard or from Charts & Tools.

- Enter the symbol in the symbol field.

- Under Summary you can see the annual dividend and yield.

The final result

Even though value stocks outperform growth stocks, that doesn’t necessarily mean they’re generating positive returns. But because value stocks tend to have smaller drawdowns during downturns, your losses are likely to be smaller than when investing in growth stocks. And the dividends help. So keep an eye on the macroeconomic indicators, technical indicators, and charts of Value vs. Growth stocks. If you notice a shift in sentiment, it may be time to change your strategy.

“In the long term, growth still drives value, but in inflationary times when interest rates are high and money is tight, value investing is relatively more attractive,” concluded Dormeier.

Take away: Losing a little is better than losing a lot.

Jayanthi Gopalakrishnan

Director, Website Content

StockCharts.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation or without consulting a financial professional.

Happy charting!

Jayanthi Gopalakrishnan is Director of Site Content at StockCharts.com. She spends her time creating content strategies, providing content to educate traders and investors, and finding ways to make technical analysis fun. Jayanthi was Managing Editor at T3 Custom, a content marketing agency for financial brands. Prior to that, she was Managing Editor of the journal Technical Analysis of Stocks & Commodities for over 15 years.

learn more