What investment belief do you have that the vast majority of your peers (over 75%) do not share?

In 2019, I decided to answer the above question publicly and add to it over time. You can view the entire thread herebut my last Podcast with Michael Batnick and Ben Carlson touching on the same topic, so with your “nudge” I’m also sharing the entire list below.

Sorry for offending anyone in advance!

2019

1. Investing solely on dividend yield is a tax-inefficient and nonsensical investment strategy.

For more information, see our old book Shareholder Yield: A Better Approach to Dividend Investing, free download here.

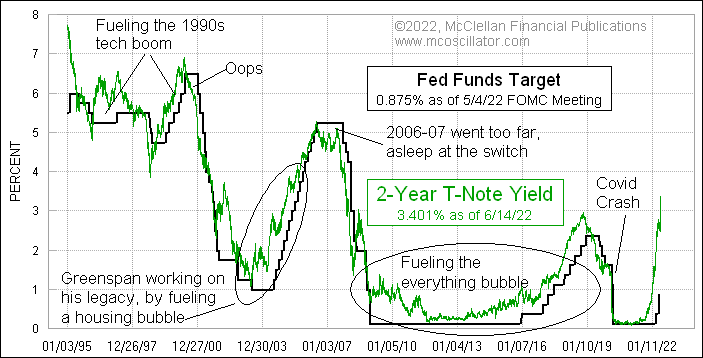

2. The Federal Reserve has done a good job.

I say publicly all the time that they should just peg the fed fund rate to the 2 year paper, and my friend Tom McClellan has a good chart illustrating this view…

3. Trend-following strategies deserve a sensible allocation in most portfolios.

With our Trinity models we have probably the highest trend allocation of any RIA I know, the default allocation is half!

4. A simple, low-cost global market portfolio of ETFs will outperform the vast majority of institutions over time.

For more information see our old GAA book, free download here.

5. US investors should allocate at least 50% of their equity allocation to non-US countries.

Check out our post “The case for global investing” For more information.

6. 13F replication is a better approach to investing in most long-term hedge funds than investing in the hedge funds themselves.

Invest with the house free book download here.

7. As long as you have some of the major constituents (global stocks, bonds, real assets), your asset allocation doesn’t matter. Fees and taxes are crucial.

For more information see our old GAA book, free download here. Also, here’s an old one Twitter thread on the subject.

8. A simple quantitative screen for public stocks will outperform most private equity funds.

Learn more by listening to my past podcast episodes Dan Rasmussen & Jeff Hook.

9. A reasonable timeframe for evaluating a manager or strategy is 10, maybe 20 years.

We have written a paper on this topic that you can read here.

10. I don’t feel like I need to have an opinion on Telsa stock.

Although I have shared my opinions with Elon on other topics before (read here)

11. A passive index is not (anymore) the same as a market capitalization index.

2020

12. Financial advisors and money managers are four times leveraged by the stock market and could/should hedge this risk…or even not own US stocks!

Read our longer post on the topic here.

13. Most foundations and pension funds would be better off laying off their employees and switching to a systematic portfolio of ETFs.

You had to know that I wrote a blog post Office about it, right? CalPERS finally told me they won’t hire me for it. I tried…

2021

14. Everyone likes to complain about manipulation, THE FED, r/wsb, yadda yadda… Markets work as usual. which is usually. Short press? Yawn, it’s been going on forever.

Jamie Catherwood had a great time post Office On the history of the short squeeze.

15. High stock market valuations are not justified by low interest rates.

Read my article from January 2021 here.

16. A globally diversified portfolio of assets is *less risky* than investing your safe money in short-term bonds or bills.

This is one of the topics covered in The Stay Rich Portfolio post Office.

2022

17. The CAPE ratio is a useful indicator and factor.

Here’s mine FAQ with everything you need to know about the CAPE ratio.

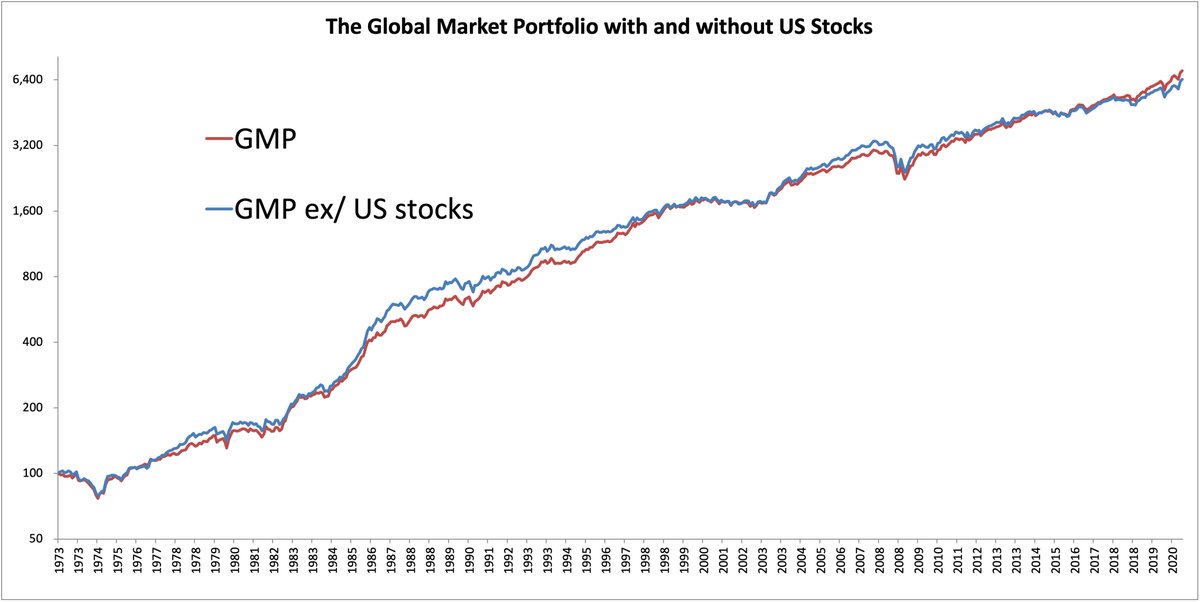

18. Owning US stocks will not affect your investment performance. You could own 0% and do well.

Here’s mine tweet with the following table.

19. A portfolio of government bonds weighted by yield will outperform a portfolio weighted by market cap and total debt issuance.

Read our whitepaper on this here.

… Sequel follows …

Am I overestimating how much I disagree with others? What beliefs do you disagree with your peers on? Feel free to reply to the original thread here.