I’ve watched critical sectors like semiconductors ($DJUSSC), software ($DJUSSW), and internet ($DJUSNS) underperform relative to the S&P 500 in 2022. But the good news is that money has been pouring out of the index since June. Three of the aggressive sectors mentioned above are finding homes in other industry groups. This allows the S&P 500 to stay afloat and significantly outperform the more aggressive and growth-oriented NASDAQ 100. Three industry groups benefit particularly strongly from this rotation. In no particular order, here they are:

Aerospace

I don’t know if you were watching Boeing Co. (BA) but after a very difficult period from April to June, BA is up more than 50% sending aerospace stocks ($DJUSAS) much higher. Look at this chart:

This relative breakout of the DJUSAS over the past two months corresponds inversely to the weakness we have seen in leading companies such as Apple, Inc. (AAPL), Tesla, Inc. (TSLA) and Alphabet, Inc. (GOOGL). If you’re wondering why the S&P 500 is still well above its June and October lows, then the chart above is one reason why. The money doesn’t leave the shares. It is turning, keeping hopes of a shorter-term cyclical bear market intact.

Commercial Vehicles & Trucks

Commercial Vehicles & Trucks ($DJUSHR) is another industry within the Industrials (XLI) sector that is flying high — so much so that it recently hit an all-time high. Yes, that’s right. all time high!

You can see the clear breakouts in both absolute and relative prices. Currently, the RSI is down at 53, so the DJUSHR is far from overbought and most likely has to run further.

Medical Equipment

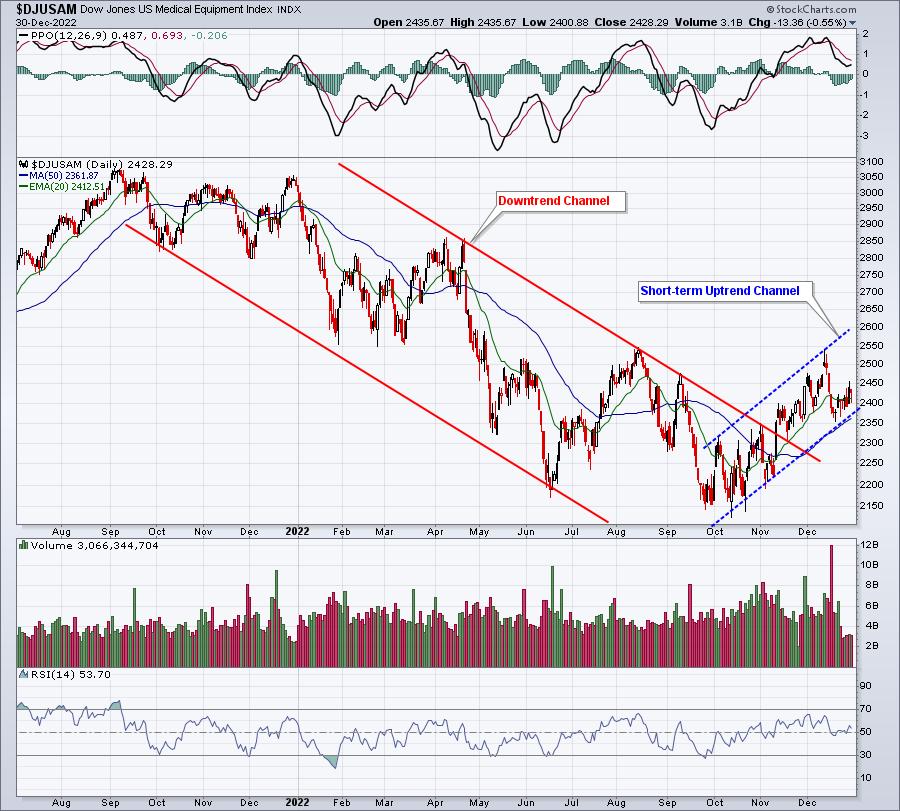

Many other verticals, particularly in financials, industrials, and energy, have outperformed the medical device group ($DJUSAM) over the long term, but I don’t know if anyone is seeing the DJUSAM’s bullishness. The first chart below is the absolute price chart showing that the 2022 downtrend has now been broken:

Since this uptrend isn’t nearly as established as the other two I’ve shown above, it probably makes sense to keep a close eye on the rising 50-day SMA and the short-term uptrend channel. If both are lost, it would be necessary to re-evaluate the group.

Next is the relative price chart, showing that relative PPO has sailed through centerline resistance and continues to gain momentum:

This is just the tip of the iceberg in terms of sector and industry rotation. Keeping an eye on pro-groups is extremely important, especially if you want to trade short-term. A lot of people are writing off this market and anticipating big pullbacks in 2023. I’m not so sure and will be analyzing a set of market signals at our fourth annual Market Vision event next Saturday. This will be a FREE virtual event and you are invited. However, places are limited, so register NOW!

For more information on MarketVision 2023 and to secure your spot, CLICK HERE. David Keller, Julius de Kempenaer and Grayson Roze – all from StockCharts.com – will join me to provide updates as we look towards a brand new year. I hope you join us! And of course…..

Happy New Year and happy trading!

Tom

Tom Bowley is the Chief Market Strategist of EarningsBeats.com, a company that provides a research and education platform for both investment professionals and individual investors. Tom writes a comprehensive Daily Market Report (DMR) that provides guidance to EB.com members every day the exchange is open. Tom has brought technical expertise here at StockCharts.com since 2006 and also has a fundamental public accounting background which brings him unique skills to approach the US stock market.