KEY

TAKEAWAYS

- PayPal broke out from its two-year consolidation and triggered a new bullish signal

- The next upside target for the bullish trend in PYPL is around the $90 level

- The call vertical options strategy can be used to capitalize on the upside breakout in PYPL

Earlier this year, in April and June, I laid out a bullish thesis for PayPal Holdings, Inc. (PYPL)—the stock price was bottoming and had the potential to break out. Since then, PYPL has improved. Earlier this week, it finally broke out from its two-year consolidation, triggering a new bullish signal for investors to seek further exposure in PYPL.

On the weekly chart below, you can see PayPal’s stock price has decisively broken through a major resistance at $68, a level it struggled with during its two-year consolidation phase. This breakout, coupled with improving momentum and outperformance relative to the market (see Relative Strength Index in the lower panel) suggests that PYPL is poised for a continuation higher. The next upside target for this bullish trend is around the $90 level.

5-YEAR WEEKLY CHART OF PYPL. The resistance level is displayed as a horizontal line drawn @ $68. The lower panel displays the Relative Strength Index (RSI), which is rising.Chart source: StockCharts.com. For educational purposes.

Despite past challenges, PYPL remains fundamentally undervalued. PYPL trades at only 15X forward earnings, which is attractive given its future EPS growth rate, 14% revenue growth rate of 8%, and competitive net margins of 14%. These metrics indicate that PYPL is not only undervalued relative to its growth potential, but well on its way for its turnaround.

The Call Vertical Strategy for PYPL

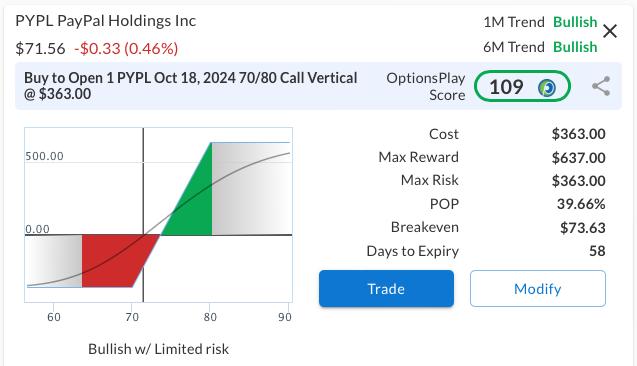

To capitalize on the breakout higher, I suggest buying the October 18, 2024, $70/$80 Call Vertical for a $3.63 debit. This entails the following:

- Buying the Oct 18 $70 calls

- Selling the Oct 18 $80 calls

PYPL CALL VERTICAL STRATEGY RISK GRAPH. You’re risking $363 for a maximum reward of $637 for this position.Image source: OptionsPlay.

This call vertical spread allows you to benefit from the bullish trend while limiting risk. The total potential profit on this trade is $637 per contract if PYPL is above $80 at expiration, with a maximum risk of $363 per contract if PYPL is below $70 at expiration.

The strategy aligns with our bullish technical and fundamental thesis for PYPL. Explore the options chain for PYPL to view real-time prices.

Tony Zhang is the Chief Strategist at OptionsPlay.com, where he has assembled an agile team of developers, designers, and quants to create the OptionsPlay product suite for trading and analysis. He has also developed and managed many of the firm’s partnerships extending from the Options Industry Council, Nasdaq, Montreal Exchange, Merrill, Fidelity, Schwab, and Raymond James. As a proven thought leader and contributor on CNBC’s Options Action show, Tony shares ideas on using options to leverage gain while reducing risk.

Learn More