After the markets ended in gains for three consecutive weeks, this time the markets took a breather by ending slightly in the red. In the previous technical note, it was mentioned that the Nifty is not only overextended on the shorter time frame charts; The VIX is also hovering around one of its lowest levels in recent history. It was also mentioned that at any point the indices could look like a correction; if not sharp, then at least modest. The trading range remained in line with expectations; The index fluctuated within a 309-point range for the week. After consolidating for most of the week and saying goodbye to its peak, the reference index NIifty ended the week with a net loss of 203.95 points (-1.14%).

In the coming week it is important to keep a very careful and close eye on a few things from a technical point of view. The India VIX. This volatility gauge closed at a new low of 11.63 after falling 2.33% on a weekly basis. This has fallen to a new low, breaching the 11.70 2021 low. As this has persisted at precariously low levels, this has made the markets vulnerable to sharp profit taking from current and higher levels. The monthly derivatives series also expires this week; the 17700 strike has the highest buildup from Call OI and this will act as a strong resistance point for the index.

Next, the 17700 and 17865 levels will act as strong resistance points. Supports come at 17500 and 17380.

The weekly RSI is 50.15; it remains neutral and shows no deviation from the price. The weekly MACD remains bearish and below the signal line.

Pattern analysis shows that last week’s high, ie 17863, has become almost an immediate high in the short term; no significant move higher is likely unless this level is taken out. Also, a key support zone for the NIFTY falls at 17367 and 17187; the 50-week and 100-week MA from NIFTY. However, the possibility of testing these levels would only increase if the index eventually breached 17500 levels.

As we approach the markets in the coming days, we must tread very carefully. The long-only market participants must focus on finding opportunities from the broad market universe; It would be unwise to chase the upside of the indices and their constituents from this point forward. Some relative outperformance is expected from defensive sectors such as FMCG, consumer goods, pharma, PSE etc. A very selective approach is recommended for the coming week.

Industry analysis for the coming week

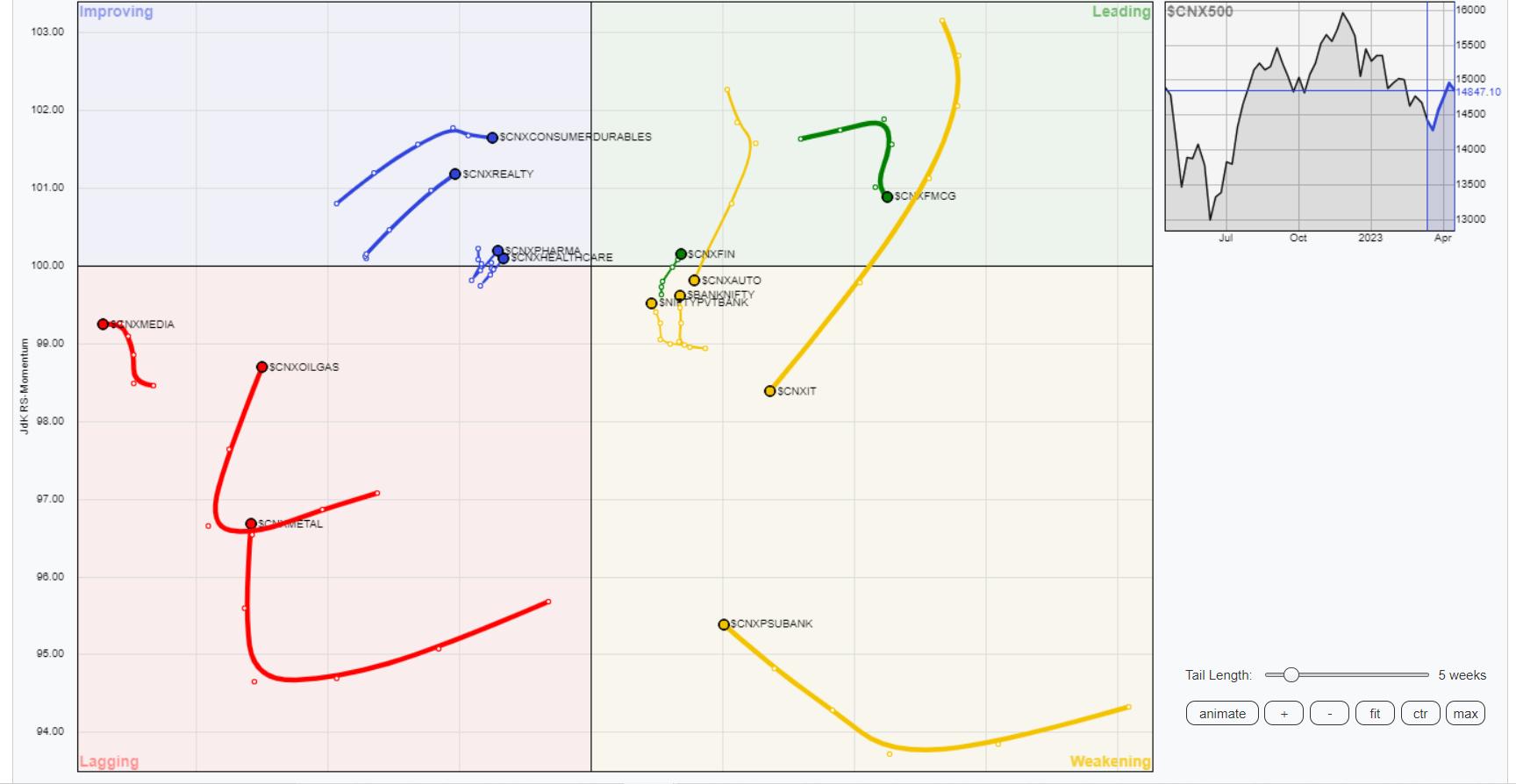

In our look at Relative Rotation Graphs®, we compared various sectors to the CNX500 (NIFTY 500 Index), which represents over 95% of the free float market capitalization of all listed stocks

Analysis of the Relative Rotation Graphs (RRG) shows no major changes in the sectoral lineup from the previous week. We have placed NIFTY Infrastructure, Midcap 100 and the PSE Index in the leading quadrant and are expected to outperform the broader markets relatively. The Financial Services Index has rolled into the leading quadrant.

The IT and Auto indices rolled into the weaker quadrants. This could end their period of relative outperformance and we could see these pockets taking a breather. The Banknifty and PSU Bank indices are also in the weaker quadrant. However, they are expected to improve their relative momentum versus the broader markets.

Media and metal indices are seen in the lagging quadrant; They all appear to be trying to consolidate and create a potential base by showing improvement in their relative momentum versus the broader markets. The NIFTY Services industry index is also in the lagging quadrant. All of these groups are likely to lag the broader NIFTY500 index relatively.

The energy, pharmaceutical and commodity indices rolled into the improving quadrants. The consumption index and housing index are also rolling firmly in the improving quadrant. These groups should see robust performance over the coming week.

Important NOTE: RRG™ charts show the relative strength and momentum of a group of stocks. In the chart above they show relative performance against the NIFTY500 Index (broader markets) and should not be used directly as buy or sell signals.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Milan Vaishnav, CMT, MSTA is a capital markets professional with nearly two decades of experience. His area of expertise includes consulting in portfolio/fund management and advisory services. Milan is the founder of ChartWizard FZE (UAE) and Gemstone Equity Research & Advisory Services. As a Consulting Technical Research Analyst and with over 15 years experience in the Indian capital markets, he has provided clients with top quality independent technical research focused on India. He is currently a daily contributor to ET Markets and The Economic Times of India. He is also the author of one of India’s most accurate Daily/Weekly Market Outlooks – a Daily/Weekly Newsletter currently in its 18th year of publication.