It has been an immensely volatile and eventful week for markets as they head towards the final weekly close before the Union budget. The last three sessions, particularly the last two sessions, have been overshadowed by sharply bearish reactions to Hindenburg Research’s report on Adani Group shares. Hindenburg Research is a “financial forensic research” that specializes in uncovering companies around the world involved in wrongdoing and fraud, and they have accused the Agani Group of brazen stock manipulation and decades of accounting fraud.

The NIFTY, which received support from the 20-week MA for five straight weeks, suffered a sharp move lower; it breached key support levels and pulled down resistance levels. The index recorded a wide trading range of 707.70 points in the previous week. It ended up with a net loss of 423.30 points (-2.35%). The NIFTY is down about 600 points from the intraweek peak. volatility increased; INDIAVIX surged 25.65% to 17.32.

The damage that past sessions have done to the markets has been significant from a technical point of view, all the more so as we turn our attention to the Union budget next week. The NIFTY breached the weekly chart’s 20-week MA which stands at 17896 and also the 100-DMA which currently stands at 17950. The index pulled its resistance points down. The coming week has strong resistance at the 17750 and 17860 levels. Supports come in at the 17400 and 17250 levels.

The weekly RSI stands at 47.95; it has made a new 14-period low, which is bearish. It remains natural and shows no deviation to the price. The weekly MACD is bearish and trading below the signal line. A great engulfing candle has emerged; its emergence while important support is injured makes it even more effective in nature.

Pattern analysis shows that the NIFTY breached two key support levels on different chart timeframes. It broke the 20-week MA at 17896 and eventually breached the 100-DMA at 17950 as well. This price action has pulled the resistance points for NIFTY quite a bit lower. It also means that any technical pullbacks will meet strong resistance at this point and potentially face selling pressure if the 17900-17950 zone is not convincingly highlighted.

We’re going into the Union budget this week; it is scheduled for submission on Thursday, February 2nd. This will cause a lot of volatility in the coming days. On the one hand, the markets have yet to finalize their reaction to the Hindenburg report, which made allegations of an absolutely serious nature; on the other hand, it should also react to budget proposals that are presented.

As markets face the double-edged sword of volatility, the best way to navigate such an uncertain environment is to keep leveraged exposure at modest levels. Having said that, it would be best to remain invested in sectors such as PSE, IT, FMCG, Pharma, etc. which are showing good improvement in relative strength versus the broader markets, or remain invested in low beta sectors that remain less volatile than the markets in general. From a technical point of view, NIFTY will not show any meaningful and sustained upward movement while staying below 17950. Overall, a very cautious approach is advised for the coming week.

Industry analysis for the coming week

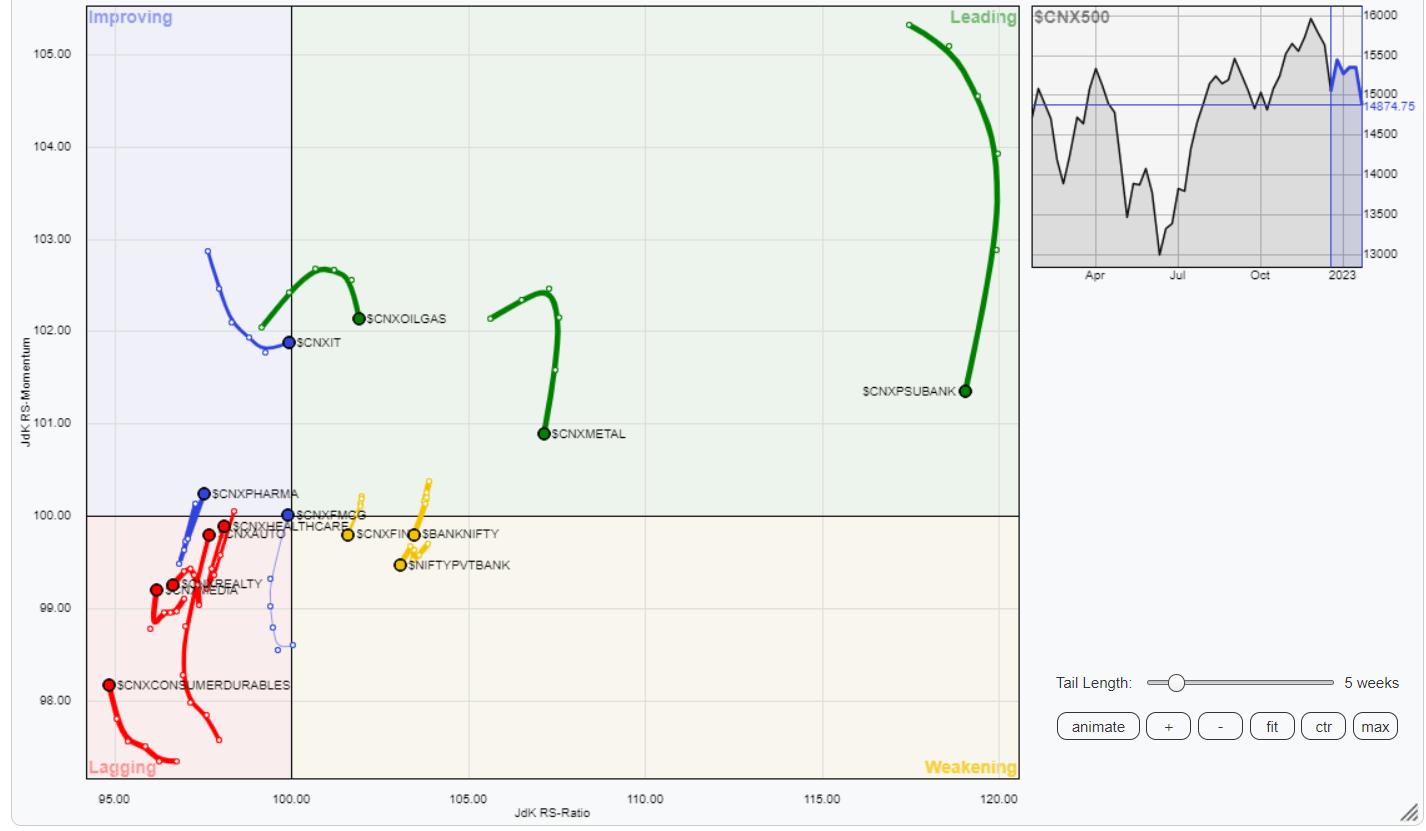

In our look at Relative Rotation Graphs®, we compared various sectors to the CNX500 (NIFTY 500 Index), which represents over 95% of the free float market capitalization of all listed stocks.

Analysis of the Relative Rotation Graphs (RRG) shows some visible changes in the overall sectoral structure compared to the previous week. NIFTY PSE, Metals, Infrastructure, PSU Bank and Commodities are placed in the leading quadrant. Other than that, PSE is the only sector that rotates tightly within this quadrant. The others show a moderation in relative momentum versus the broader markets.

BankNifty, Nifty Services Sector and Financial Services Sector Index rolled into the weaker quadrant. They can still perform well individually, but may not perform well relatively.

The NIFTY Realty and Media Sector indices languish in the lagging quadrant. That being said, the Auto, Consumer, Midcap 100 and FMCG indices are within the lagging quadrant but will significantly improve their relative momentum.

The Pharma Index has rolled into the improving quadrant and is firmly placed along with the IT Index. The energy sector index is also in the improving quadrant but is giving up its relative momentum slightly.

Important NOTE: RRG™ charts show relative strength and momentum for a group of stocks. In the chart above they show relative performance against the NIFTY500 Index (broader markets) and should not be used directly as buy or sell signals.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Milan Vaishnav, CMT, MSTA is a capital markets professional with nearly two decades of experience. His area of expertise includes consulting in portfolio/fund management and advisory services. Milan is the founder of ChartWizard FZE (UAE) and Gemstone Equity Research & Advisory Services. As a Consulting Technical Research Analyst and with over 15 years experience in the Indian capital markets, he has provided clients with top quality independent technical research focused on India. He is currently a daily contributor to ET Markets and The Economic Times of India. He is also the author of one of India’s most accurate Daily/Weekly Market Outlooks – a Daily/Weekly Newsletter currently in its 18th year of publication.