There’s no debate that 2022 was a choppy year for global stocks. The markets had to deal with all sorts of things; rising inflation, recession fears, geopolitical tensions and a series of record-breaking interest rate hikes by central banks around the world. However, these situations have presented us with the need to almost always remain invested in a sector that is resilient and offers stability for at least part of each investor’s portfolio. The NIFTY PSE Sector, represented by the NIFTY PSE Index ($CNXPSE), is one such sector.

The NIFTY PSE Index includes companies in which 51% of the outstanding share capital is owned directly or indirectly by the central and/or state governments.

A look at the weekly charts paints an interesting picture; A look at the long-term monthly charts reveals an even more interesting picture that is causing the real excitement. Let’s start with the weekly chart first.

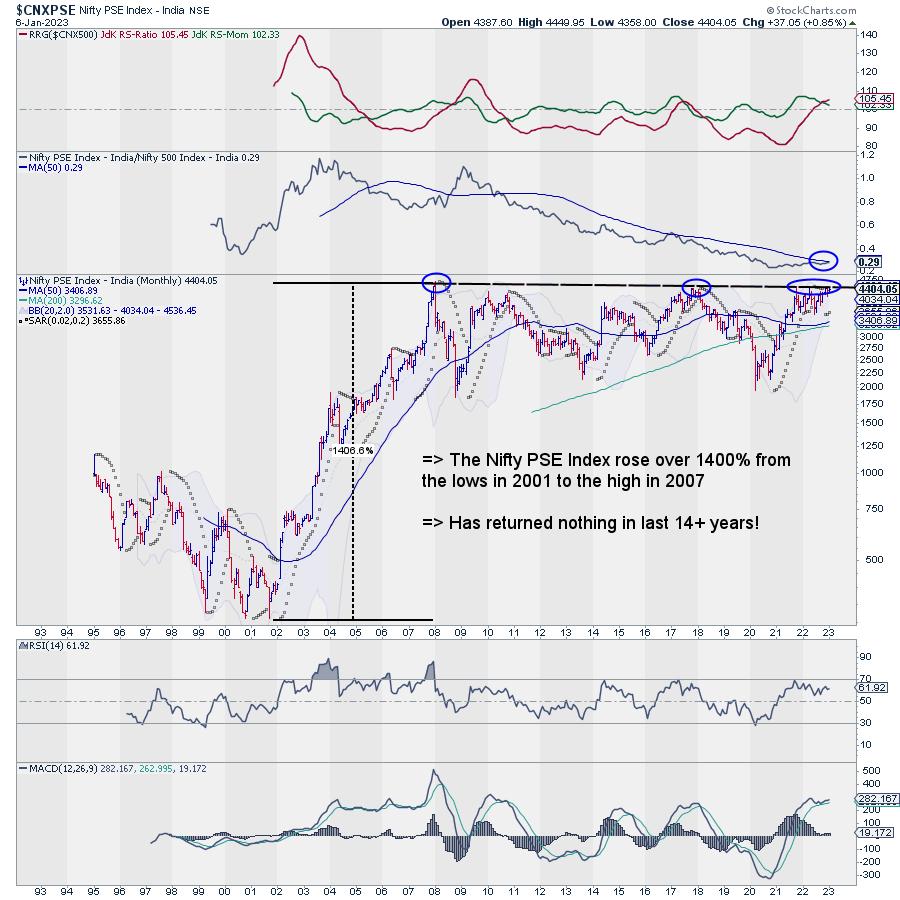

After forming the pandemic lows in March 2020, $CNXPSE is up 130% to date. It rose from the lows formed near the 1960-1990 zones and peaked above 4400 in October 2021. Despite often robust relative performance over the past year, this sector has rallied virtually nothing over the past 14 months, since he stays there the same level as in October 2021.

From a short to medium term perspective, it is oscillating in a trading range of 3650-4450. The 4400 level has been tested at least three times since October 21; It appears to be forming higher bottoms within this range pattern and could stage a breakout if it moves well above the 4500 level.

That’s not all. If we zoom out and take a long-term view, this is where the real excitement comes in. Let’s take a look at the long-term monthly chart of $CNXPSE.

After its inception in January 1995, the NIFTY PSE index bottomed out near 325-330 in September 2001. From that point until it peaked near 4400 in January 2008, this index ended up posting impressive returns of over 1400% over 6 years. However, from January 2008 to present, the index has not returned anything for 14 years as it remains at the same level today as it was in January 2008.

Barring temporary outperformance, the index tested the 4400-4500 levels in January 2008, a few times between September and December 2017, and a few times over the last 14 months.

This means you’ve received well over 130% returns unless you invested in the PSE pocket during the pandemic lows. However, if you’ve been invested since 2008, you haven’t received anything in the past 15 years.

How would investors track this bag and stay invested in it?

The answer to that might be twofold.

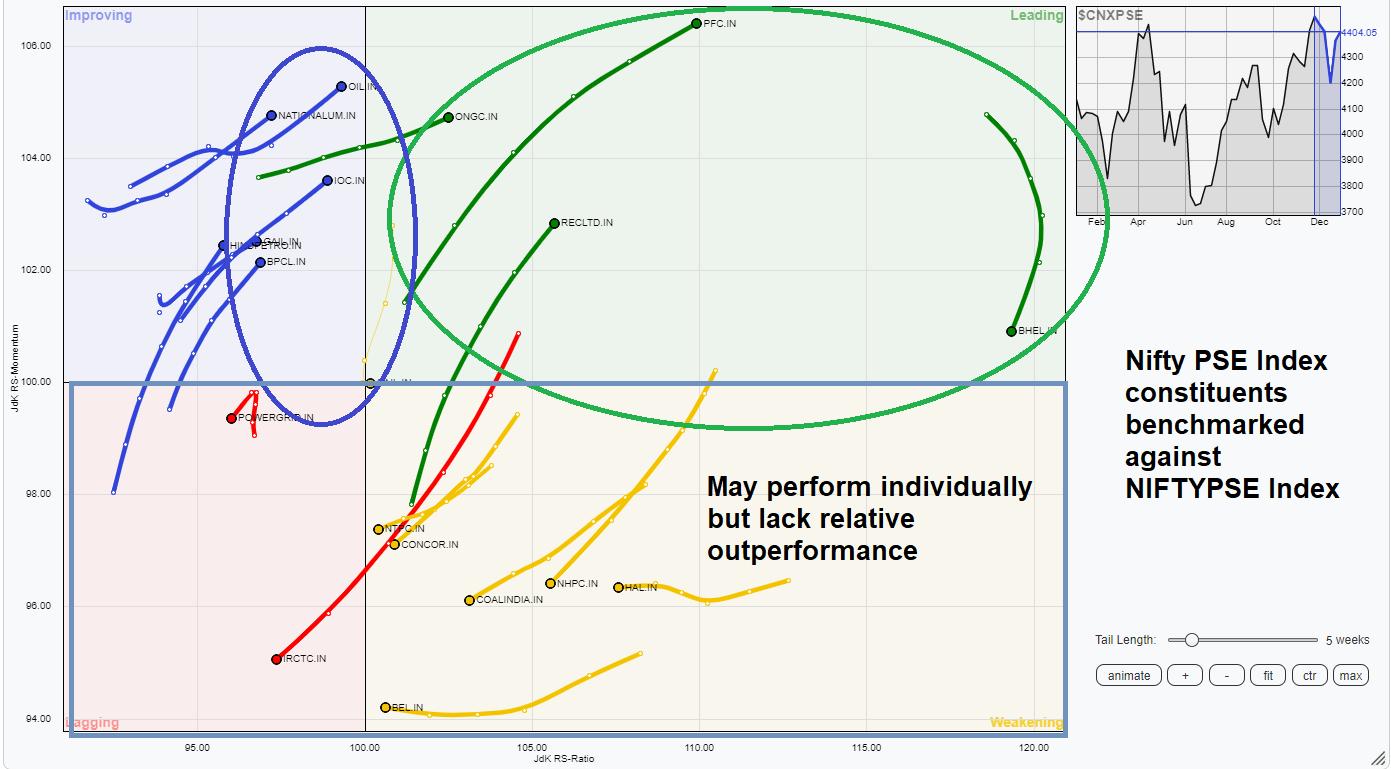

For active investors, it would mean active track the rotations and stay invested in the stocks with strong relative momentum within the Nifty PSE Index. As of now, the picture is as follows:

The RRG above shows NIFTY PSE constituents compared to the NIFTY PSE Index. Those circled in blue and green are those that relatively outperform the benchmark.

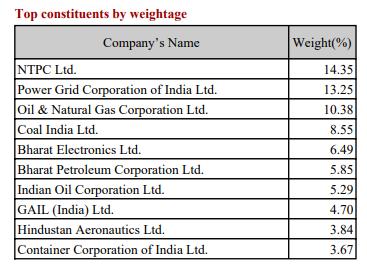

For passive investors, The approach may be slightly different. They may only remain invested in the Index Constituents in proportion to their weighting in the Index.

Interestingly, the NIFTY PSE Index consists of 20 stocks. However, the top 10 stocks make up 76.37% of the index. Following these stocks and staying invested in them should do the trick!

What makes this bag durable and safe?

This group has a positive to strong positive correlation with the Frontline NIFTY 50 Index. Over the past year it has seen a 0.63 correlation, but over 5 years and since its inception it has seen a 0.70 correlation and 0.74 with the Nifty.

The security and resilience come with the beta this sector has against the NIFTY. It has a beta below 1. In the last year it has seen a beta of 0.71. Over the past 5 years and since its inception, it has a 0.83 beta against the NIFTY. This has ensured that this group of stocks has fallen less than the Frontline Index during turbulent times.

Conclusion?

Pretty straightforward and easy. Watch for a significant move above 4450-4500 in this index and we could be in for a multi-year breakout in this index!

Milan Vaishnav, CMT, MSTA | Founder and Technical Analyst | www.equityresearch.asia |www.chartwizard.ae

Milan Vaishnav, CMT, MSTA is a capital markets professional with nearly two decades of experience. His area of expertise includes consulting in portfolio/fund management and advisory services. Milan is the founder of ChartWizard FZE (UAE) and Gemstone Equity Research & Advisory Services. As a Consulting Technical Research Analyst and with over 15 years experience in the Indian capital markets, he has provided clients with top quality independent technical research focused on India. He is currently a daily contributor to ET Markets and The Economic Times of India. He is also the author of one of India’s most accurate Daily/Weekly Market Outlooks – a Daily/Weekly Newsletter currently in its 18th year of publication.