KEY

TAKEAWAYS

- The broader stock market indexes break their two day winning streak.

- Gold prices hit a new all-time high.

- European stocks are in a solid uptrend.

Tuesday’s stock market action marked a reversal in investor sentiment, with the broader indexes closing lower. The S&P 500 ($SPX), Nasdaq Composite ($COMPQ), and Dow Jones Industrial Average ($INDU) are still below their 200-day simple moving average (SMA). Investor anxiety is elevated ahead of the Fed’s culmination of its two-day policy meeting. The risk-off sentiment is back, with gold and silver prices rallying. But it may not all be due to the risk-off mode, as lower US Treasury yields and the lower US dollar may have also played a role in the precious metal rally. The SPDR Gold Shares (GLD) hit a new all-time high and silver prices are on the rise.

Technology and consumer discretionary were Tuesday’s worst-performing sectors, while Energy and Health Care took the lead but rose modestly. Overall, it was a pretty red day for U.S. equities (see the StockCharts MarketCarpet below).

FIGURE 1. A SEA OF RED. Tuesday’s StockCharts MarketCarpet was a sea of red with specks of green in the Energy and Health Care, Real Estate, Materials, and Industrials sectors.Image source: StockCharts.com. For educational purposes.

The Mag 7 Unwind

The mega-cap, Mag 7 stocks stand out strongly in Tuesday’s MarketCarpet. The daily chart of the Roundhill Big Tech ETF (MAGS) below shows how these stocks are in a steep fall. The ETF fell below its 50-day SMA and struggled to retain its position above it. The fall from the 50-day to the 200-day SMA was like an elevator ride down. MAGS managed to find a little resistance at its 200-day SMA, but that was short-lived.

FIGURE 2. ROUNDHILL BIG TECH ETF (MAGS) SLIDES BELOW 200-DAY MOVING AVERAGE. After sliding below its 50-day SMA, MAGS fell hard and continued sliding as it broke below the 200-day SMA.Chart source: StockCharts.com. For educational purposes.

The rise in volume after MAGS fell below its 200-day SMA suggests there’s a lot more selling than buying. The relative strength index (RSI) is hovering above 30, which implies it isn’t oversold yet. So there’s a chance MAGS could fall lower, although it could reverse before dipping into oversold territory.

International Markets

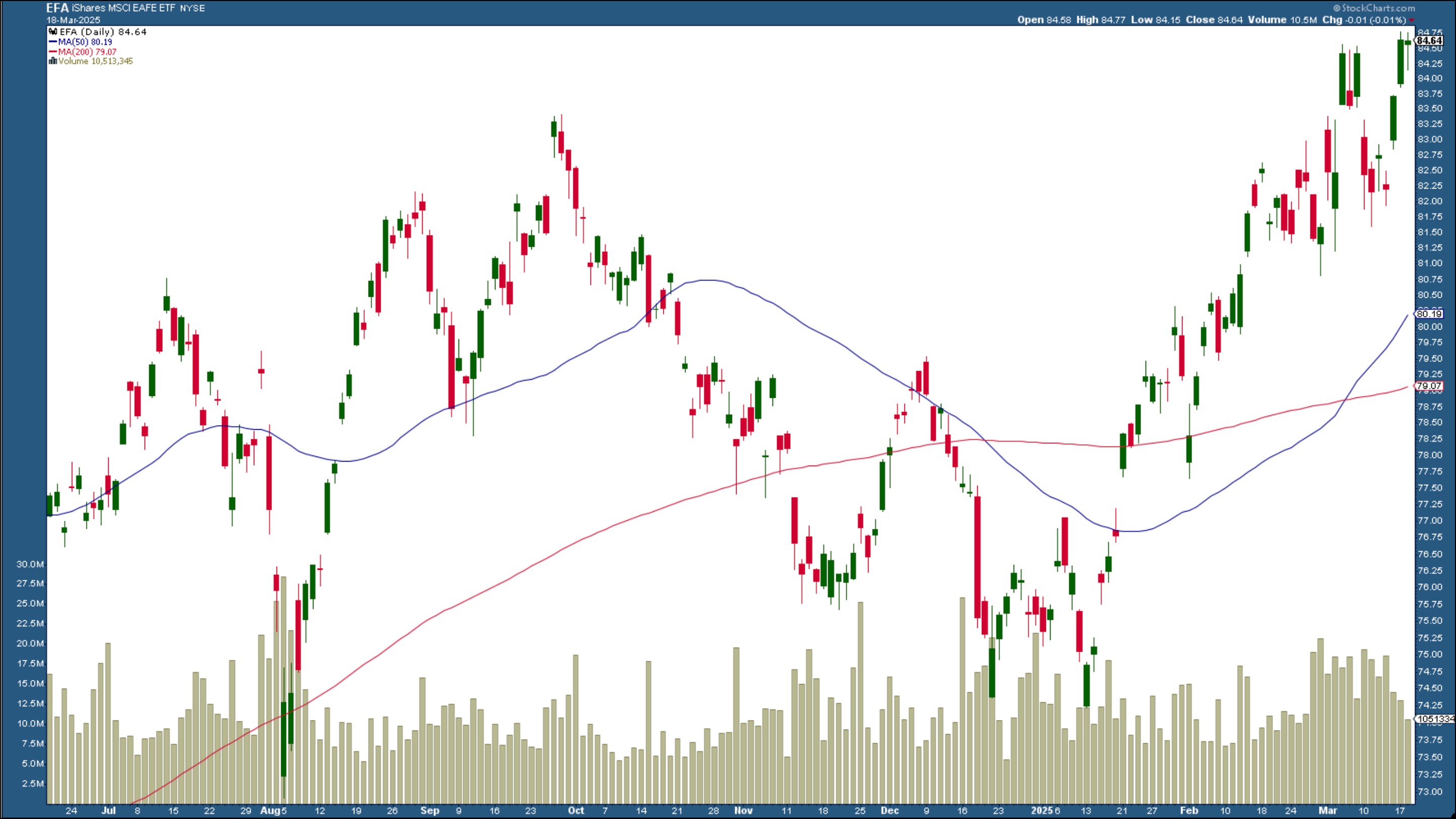

Meanwhile, the iShares China Large-Cap ETF (FXI), iShares MSCI Germany (EWG), iShares MSCI Italy ETF (EWI), and other European stock ETFs are rising. The daily chart of the iShares MSCI EAFE ETF (EFA), which has its top 10 holdings in European companies, is hitting all-time highs (see below).

FIGURE 3. DAILY CHART OF ISHARES MSCI EAFE ETF. European stocks have been rising since early 2025. The 50-day SMA has crossed above the 200-day and price is well above the 50-day SMA.Chart source: StockCharts.com. For educational purposes.

With elevated tariff uncertainty, a slowdown in the U.S. economy, and declining U.S. consumer confidence, it shouldn’t be surprising to see investors diversifying their holdings across different asset groups. This reiterates the importance of having a diversified portfolio spread across different sectors, precious metals, international stocks, and bonds.

The Closing Bell

Tuesday’s reversal after a two-day winning streak suggests investor uncertainty remains prominent. The Federal Reserve policy meeting ends on Wednesday. Chairman Powell’s press conference is the main event to listen to on Wednesday, but really, any headline could rock the markets in either direction. The best you can do is stay diversified.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.

Jayanthi Gopalakrishnan is Director of Site Content at StockCharts.com. She spends her time coming up with content strategies, delivering content to educate traders and investors, and finding ways to make technical analysis fun. Jayanthi was Managing Editor at T3 Custom, a content marketing agency for financial brands. Prior to that, she was Managing Editor of Technical Analysis of Stocks & Commodities magazine for 15+ years.

Learn More