U2 is one of my favorite bands and I can’t help but think of their song, “With or Without You”, when I look at an S&P 500 chart. This secular bull market is waiting for no one. You’re either in it or you’re not. There’s nothing wrong with being a bit cautious from time to time, but remaining on the bearish side of the ledger or, worse yet, shorting stocks? In my opinion, it’s financial suicide. As money rotates into value-oriented stocks, there are fewer and fewer names not participating in this bull market. Trying to find stocks that will go down seems insane to me when the overwhelming majority keep trucking higher.

What Should We Expect From The Economy?

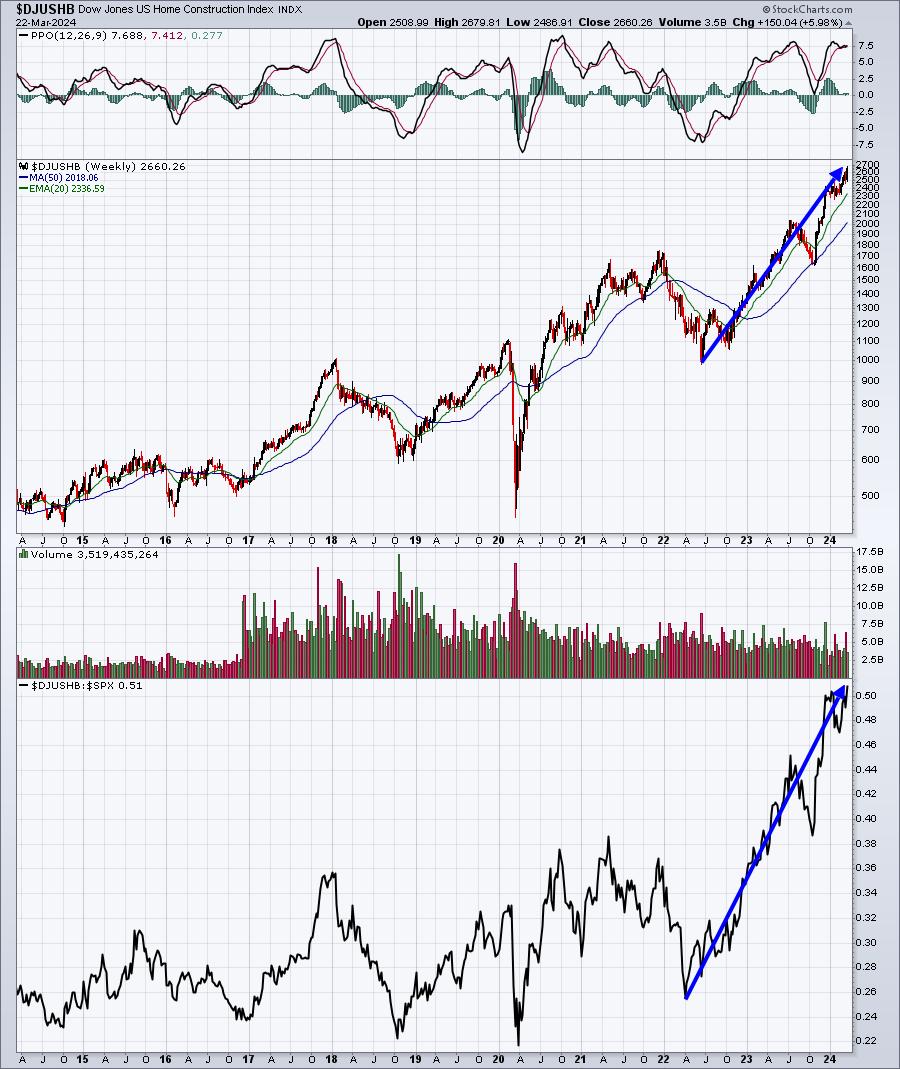

If you look at economically-sensitive areas, I find most charts very encouraging, starting with home construction ($DJUSHB). The DJUSHB was our best-performing industry group last week. Check out its performance both short-term and long-term:

DJUSHB – daily

Since breaking out in late-November, the DJUSHB has been very strong on both an absolute and relative basis (blue directional lines). But check out those blue circles in late-December. That was when the 10-year treasury yield ($TNX) hit its lowest level just beneath 3.80%. We saw the TNX climb 57 basis points after that and it’s STILL 44 basis points higher. Yet the DJUSHB has been pushing higher on an absolute and relative basis with a much higher TNX. That tells me that the big Wall Street firms believe rates will be heading lower later in 2024 and into 2025.

DJUSHB – weekly

The massive move to the upside, again both on an absolute and relative basis, screams to me that the direction of annual INFLATION had more to do with DJUSHB performance than the direction of the TNX. Once the annual Core CPI rate printed that double top and rolled over, Wall Street could not have cared less about what the Fed (or CNBC) was saying. Lower inflation meant a MUCH BETTER environment for interest-rate sensitive areas.

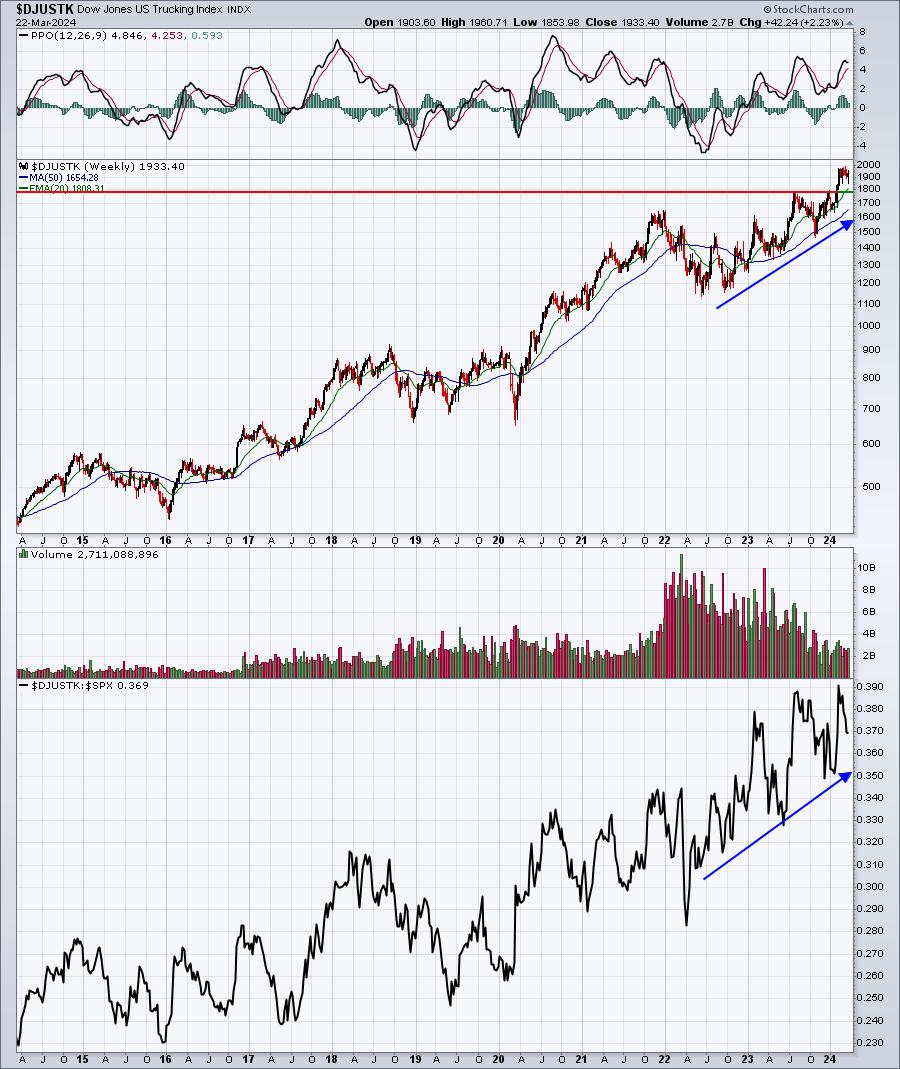

If we look at transportation stocks ($TRAN), it wasn’t quite so clear. Trucking ($DJUSTK) was very similar to home construction, mostly rising recently, but it’s been a more difficult ride on the railroads ($DJUSRR). Check out these two 10-year weekly charts:

Trucking ($DJUSTK)

Railroads ($DJUSRR)

Trucking is bullish and helping to lead stock prices higher. Railroads? Not so much. It’s worthwhile noting, however, that railroads appear to be printing the right side of a bullish cup with handle continuation pattern. What we need to see from this group is an ultimate breakout of this pattern above 3800 and a turn higher in the relative strength panel, clearing the 0.72 relative resistance level.

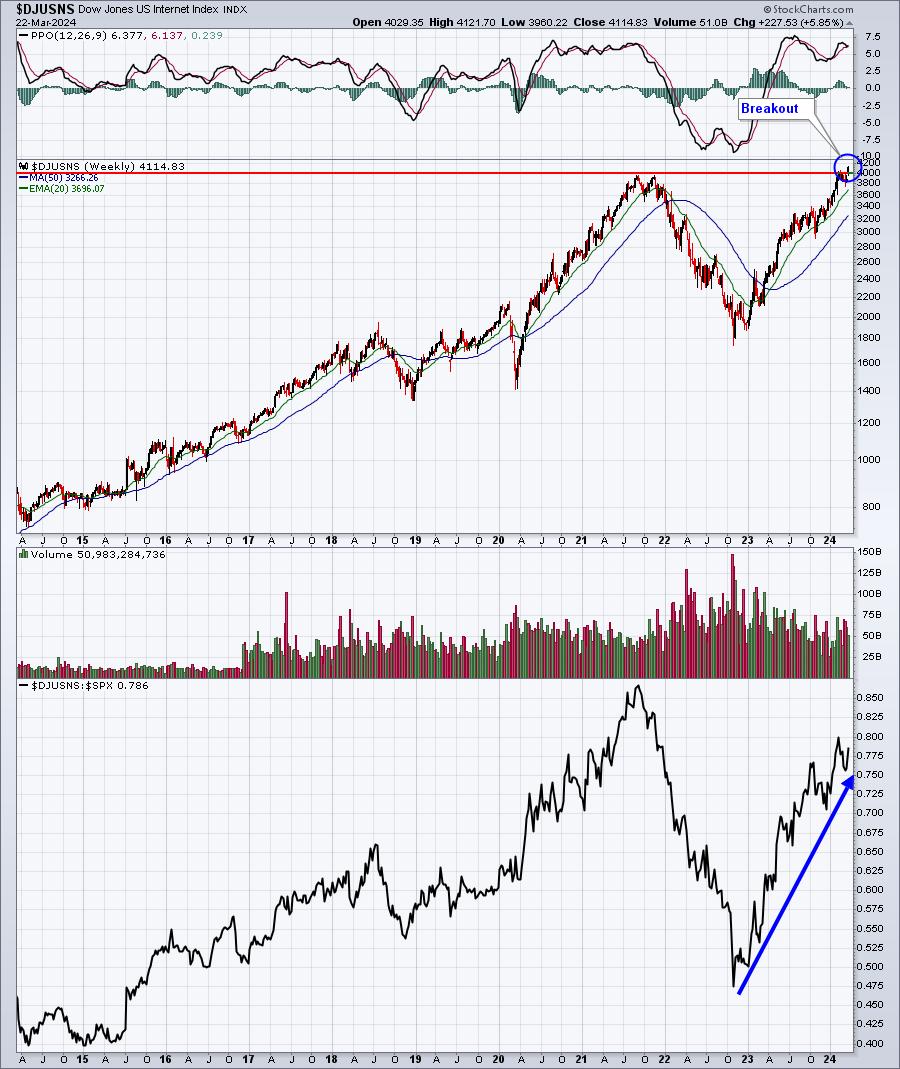

The Usual Suspects

Semiconductors ($DJUSSC), software ($DJUSSW), and internet ($DJUSNS) stocks have provided steady market leadership since early 2023, but growth had fallen out of favor the past few weeks to a couple months, depending on which chart you look at. The internet group, though, rallied to a make a breakout to an all-time high, despite the fact that its relative strength line isn’t also at an all-time high:

Weekly Market Recap

Key signals are telling me to ride this bull higher! I discuss a few of those signals and more than a dozen individual stocks showing tremendous strength in this week’s episode of EB Weekly Market Recap. CLICK HERE to watch the video and please leave me comments. It’ll also help me if you could hit that “Like” button and subscribe to our channel in order to be notified when I post a video.

Thanks so much!

Happy trading!

Tom

Tom Bowley is the Chief Market Strategist of EarningsBeats.com, a company providing a research and educational platform for both investment professionals and individual investors. Tom writes a comprehensive Daily Market Report (DMR), providing guidance to EB.com members every day that the stock market is open. Tom has contributed technical expertise here at StockCharts.com since 2006 and has a fundamental background in public accounting as well, blending a unique skill set to approach the U.S. stock market.