It’s been a solid week for the markets, with the S&P 500 Index ($SPX) rising through its most important 200 days moving average This was a key area for potential upside resistance. With a positive Relative Strength Index (RSI) and Stochastic OscillatorMarkets are poised to move further as we enter an earnings season characterized by rewarding results, although not particularly strong.

Daily chart of the S&P 500 Index

The consumer discretionary sector was the top performer, helped by a double-digit rally in retailer Amazon (AMZN), which remains 43% below its 52-week high despite the strong gain. The stock was upgraded after it was revealed that any company can participate in the once-exclusive free two-day Prime delivery program.

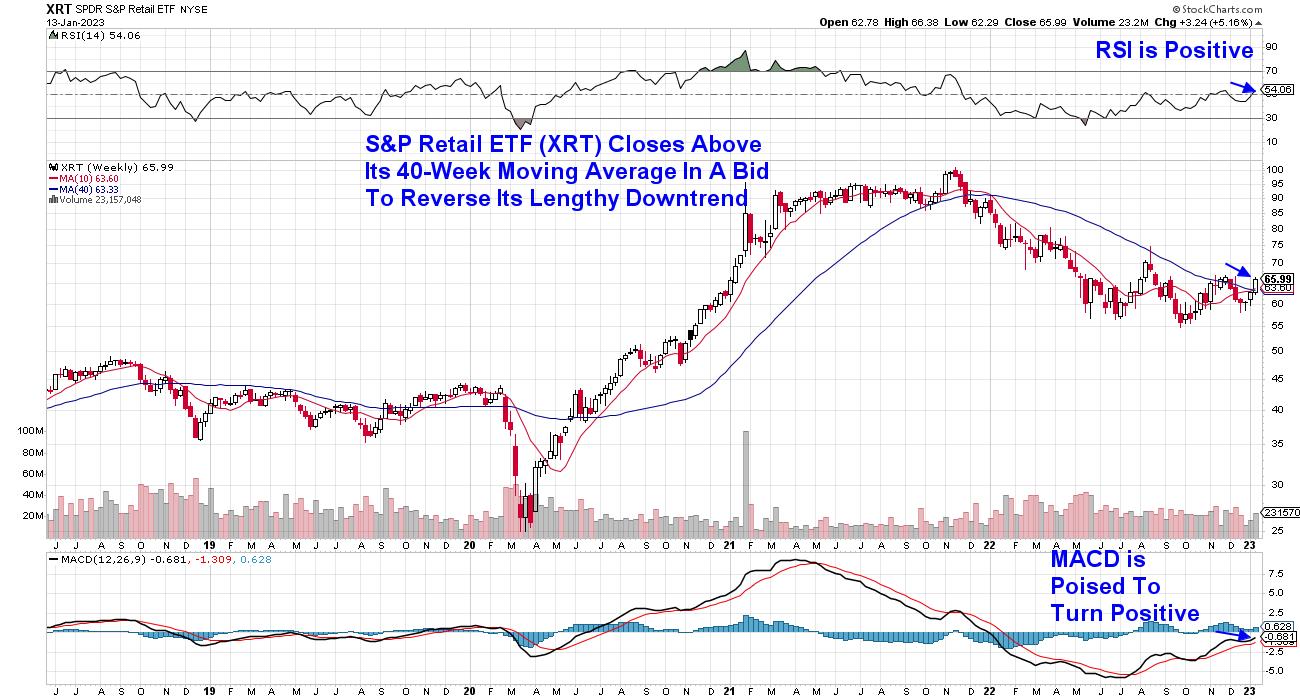

Other retail stocks also rallied as evidence of lower inflation coupled with a consumer confidence report that put the number at a 10-month high pushed the SPDR S&P Retail ETF (XRT) into positive territory. The longer-term weekly chart is showing the RSI in positive territory now, with the moving average convergence/divergence (MACD) also turning positive.

SPDR S&P Retail ETF (XRT) weekly chart

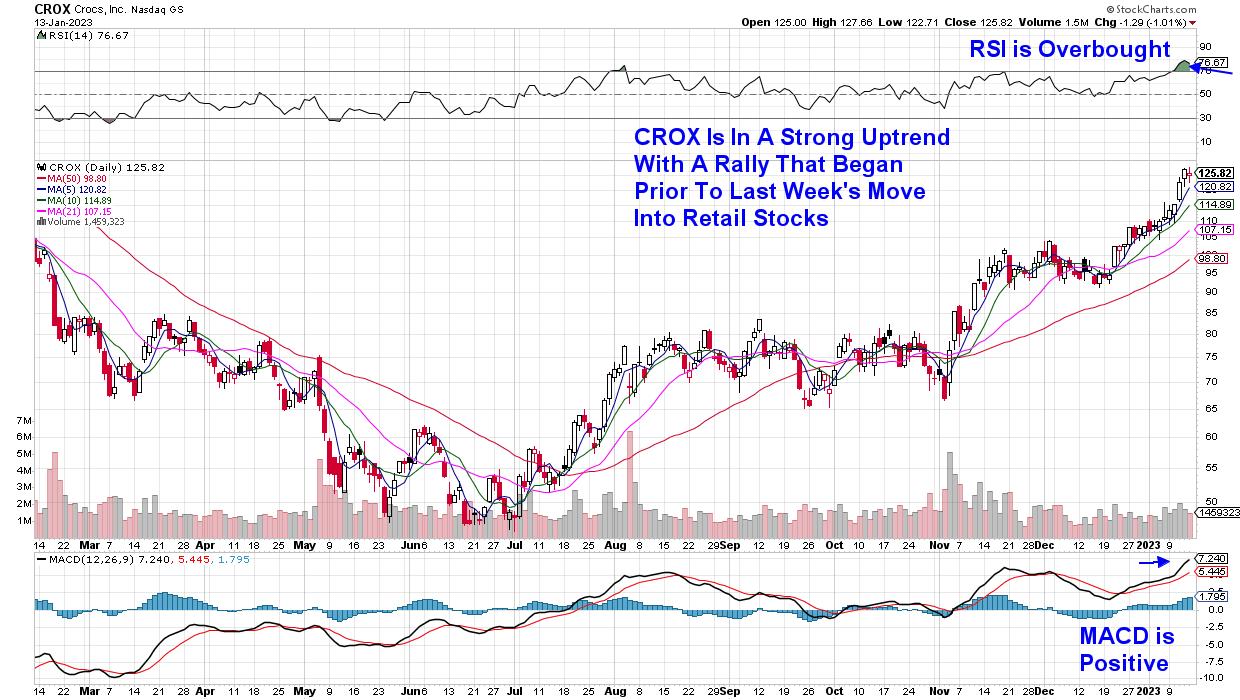

A standout area was specialty retailers that make or sell comfortable shoes. These include companies like Crocs Inc. (CROX), which makes shoes from a proprietary synthetic material and was one of the fastest growing brands of 2022.

subscribers of MEM Edge report were alerted to the stock in early December after it was added to the list of proposed holdings. Since then, CROX has gained over 20% as analysts continue to upgrade estimates. Despite healthy earnings, the stock trades at just 12 times fourth-quarter earnings, well below its peers.

Crocs, Inc. (CROX) daily chart

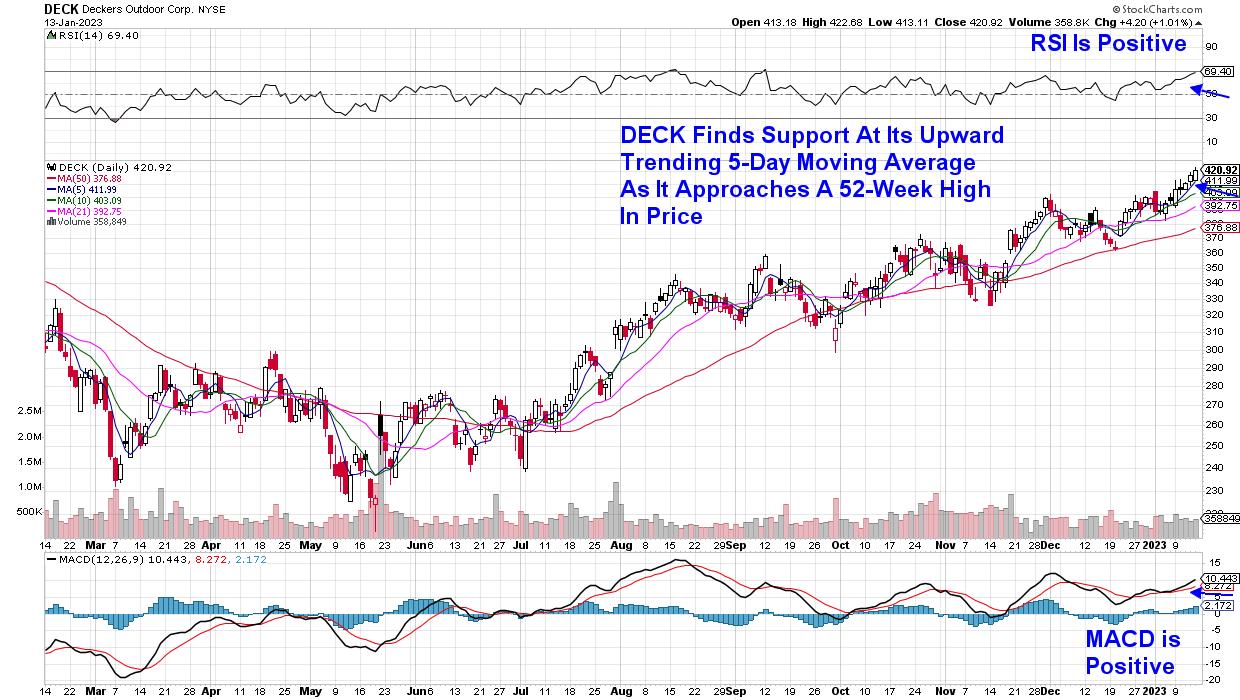

The running category was another success story in the footwear industry as a staggering number of people got outdoors as gyms closed amid the pandemic. Companies like Deckers Outdoor (DECK) have seen their sneaker brand Hoka hit the one billion mark over the past 12 months, a move that rivals sales of Decker’s already popular Uggs.

Daily chart from Decker’s Outdoor Corp. (DECK)

Well-known footwear company Nike (NKE) is also on a confirmed uptrend after surging in price on the back of shattering earnings estimates in late December. Management-led growth will continue to be valued more highly in the future given increased digital sales and inventory controls. NKE is currently approaching an overbought condition.

While each of these retailers is poised for further upside over time, newer areas within the markets have only just begun their rise as a rotation into basic materials and industrials propels select stocks into the early stages of an uptrend.

If you wish to have access to these holdings, Use this link here to access a 4 week trial my twice-weekly MEM Edge Report for a small fee. You’ll also find insightful information on why these areas are trending higher, as well as my outlook for the rest of this year

You will also be alerted to signals that the current bear market rally may reverse so you can preserve your capital ahead of the true market bottom. Be sure and take advantage of the above special offer ahead of next week’s critical economic data and other potential headwinds.

Heartfelt,

Mary Ellen McGonagle, MEM investment research

Mary Ellen McGonagle is a professional investment advisor and President of MEM Investment Research. After eight years on Wall Street, Ms. McGonagle left to become a qualified equity analyst, working with William O’Neill to identify healthy stocks with potential to take off. She has worked with clients around the world including big names such as Fidelity Asset Management, Morgan Stanley, Merrill Lynch and Oppenheimer.

learn more