Gain insight into the Fed’s interest rate decision and explore how to strategize your trades going forward.

CHARTWATCHER’S KEY POINTS

- The Fed will hike rates by 25 basis points (0.25 percentage point).

- Stock markets closed higher after hearing Chairman Powell’s comments.

- Monitoring sector performance could be the way forward in 2023.

Can the market go ahead and leave inflation in the rearview mirror? Not now. As expected, the Fed hiked rates by 25 basis points at its February 1st meeting. This matched that CME FedWatch tool Expectations showing a 99% probability of a 25 basis point rate hike. The rate hike raises the target range to 4.50%–4.75%.

Looking at the dot plot on the same website (rate forecasts), the middle target range is 5.1%. That means the Fed is likely to keep raising rates at least in the next few meetings.

The Fed remains committed to its primary goal of bringing inflation down to 2%. To achieve this goal, the Fed would have to bring monetary policy to a sufficiently restrictive level. In short, we’re not there yet. The only difference this time is that the focus appears to have shifted to the magnitude of rate hikes versus the pace of rate hikes.

If you look further into 2024 and beyond on the dot plot, you will see that interest rates are expected to fall. This suggests that the Fed is likely to pivot at some point. But at the moment there is no telling when the central bank will curb the rising cycle. The market has priced in the possibility of a 25 basis point hike in March, but it is likely that we will see some more rate hikes as inflation is still high.

While the disinflationary process has begun, the Fed needs to see the impact in non-housing services before gaining confidence that inflation is coming down.

Before the Fed’s announcement

The economy appears to be in decent shape ahead of the Fed meeting. Recent economic reports have indicated that:

- Q4 GDP grew more than expected.

- The Consumer Price Index (CPI), Producer Price Index (PPI) and Personal Consumption Expenditure (PCE) price index supported suspicions that inflation may be easing.

- 10-year yields have fallen.

In the minutes before the FOMC announcement, the Dow Jones Industrial Average ($INDU) was already down 332 points, the S&P 500 Index ($SPX) was down 0.5% and the tech-heavy Nasdaq Composite ($COMPQ) was also down 0 .3%. After the announcement, the three indices continued to fall but then bounced back. At the end of the trading day, $INDU was up 0.02%, $SPX was up 1.05% and $COMPQ was up 2%. Overall, investors reacted positively to the Fed’s decision and Powell’s comments (more on this below).

One area the Fed is watching closely is the labor market. The JOLTS report was strong, pointing to an increase in job vacancies in December. The January job report will provide further insights into the tightness of the labor market. An increase of 190,000 is expected with an unemployment rate of 3.6%. The next round of inflation reports is likely to play a large role in informing the Fed’s monetary policy stance. In the meantime, let’s see what the charts are showing.

The chart below shows various data points that paint a picture of the US economy (click on the chart to view the live chart).

The following points emerge from this diagram:

- Stock prices, represented by the S&P 500 Index ($SPX), are rising. $SPX is trading above its 200-day price moving average.

- The US Dollar ($USD) is weakening. A weakening dollar could help exports.

- The CBOE Volatility Index ($VIX) is declining. After spending some time between 20 and 35, the $VIX is now hanging below the 20 levels.

- High Yield Corporate Bonds (using HYG as a proxy) trend higher. Some of these bonds yield over 7%. When high-yield bonds are on the rise, it suggests that corporate credit conditions are easing.

- Mortgage rates ($$MORTGAGE30YR) have been falling since November, although we are yet to see any pick-up in home sales.

Powell’s words: How did the market react?

The Fed is committed to bringing inflation down to its 2% target. This means continuous interest rate hikes, achieving price stability and a significant reduction in total assets. Although economic growth has slowed due to the restrictive monetary policy, the labor market remains extremely tight. The labor market is out of whack – wage growth is high and employment gains are resilient, but labor force participation has not changed significantly from a year earlier.

While acknowledging the dangers of over-tightening, the Fed believes the risk of overly loose policy proving ineffective over time may outweigh the risk of implementing a hawkish stance, resulting in subdued economic growth.

What does this mean for your portfolio?

“Don’t bet against the Fed” is the best course of action. Some economists believe the US economy could experience a “rolling recession” in 2023. This is a type of recession that hits sectors at different times (hence “rolling”) rather than hitting all sectors at once. Some economists believe we are already in one. We’ve seen layoffs in the technology sector, weaker earnings reports and a slowdown in the real estate market. But inflation is cooling, the economy continues to grow and the labor market remains strong.

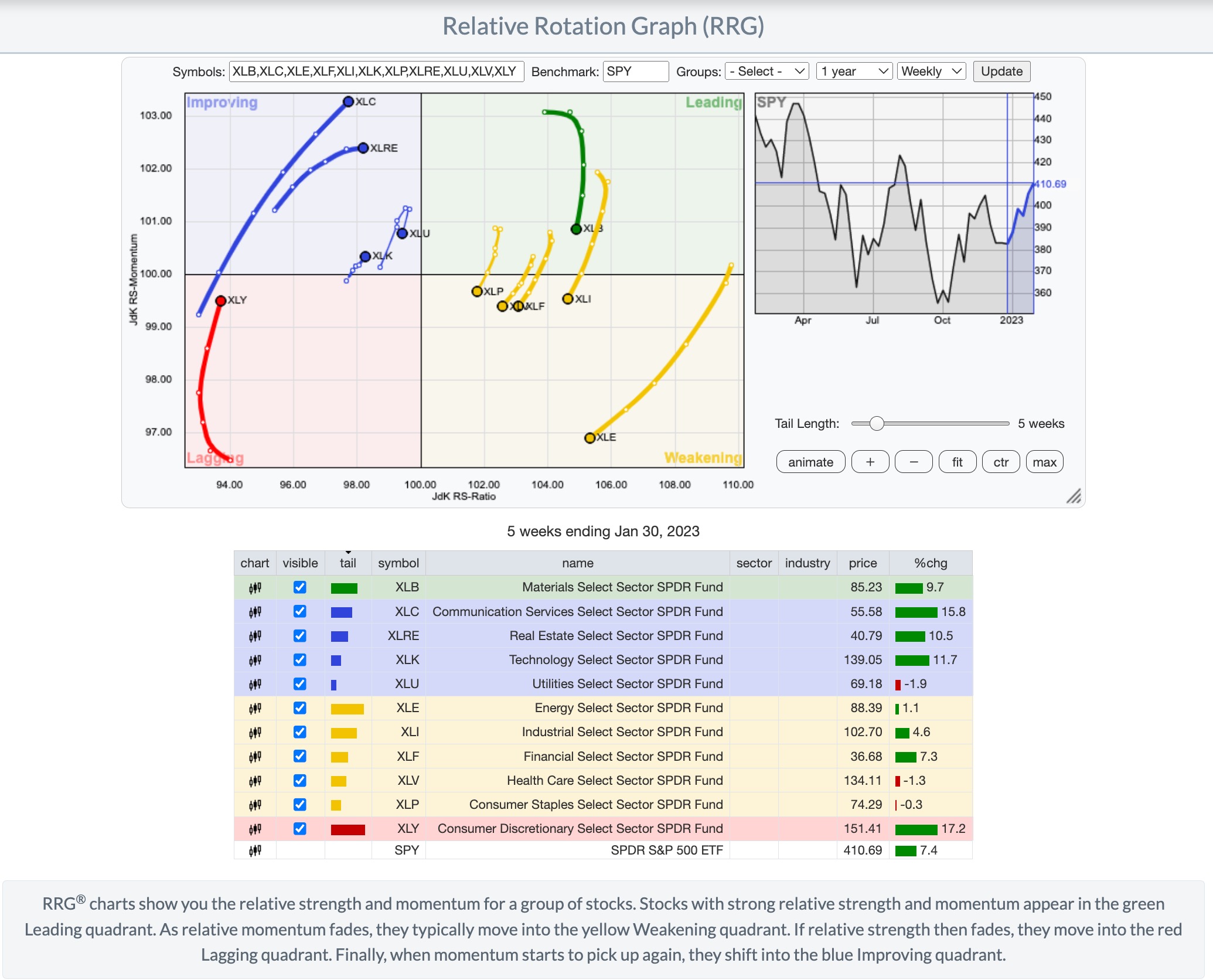

Residential construction and manufacturing can be some industries to keep an eye on. And don’t rule out global markets, especially emerging markets. Markets are dynamic and things can change at lightning speed. Fortunately, the Relative Rotation Graphs (RRG) in your StockCharts platform provide a visual overview of which sectors are leading, improving, lagging, or weakening by analyzing their relative strength and momentum. You can look at the performance of different groups of stocks in different time frames. The chart below shows the RML of the 11 S&P sectors.

Interested in exploring the RRG tool? Check out the video below.

Jayanthi Gopalakrishnan

Director, Website Content

StockCharts.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation or without consulting a financial professional.

Jayanthi Gopalakrishnan is Director of Site Content at StockCharts.com. She spends her time creating content strategies, providing content to educate traders and investors, and finding ways to make technical analysis fun. Jayanthi was Managing Editor at T3 Custom, a content marketing agency for financial brands. Prior to that, she was senior editor of Technical Analysis of Stocks & Commodities magazine for over 15 years.

Learn more