Say what you will, but January has proven to be a very reliable indicator of US stock market movements from February to December since 1950 and with just over a week left in January 2023, market movements suggest that we We’re going to have a very strong year. It’s just another historical fact that suggests higher prices are upon us. I also recently mentioned that of the previous 13 bear markets since 1950, excluding the 2022 cyclical bear market, 6 ended in the calendar month of October. If October 2022 turns out to be the ultimate low, that’s 7 out of 14.50% of all bear markets. This is another compelling evidence that the bear market bottom is IN.

However, stepping away from historical bias and simply looking at the S&P 500 chart, the downtrend line since early 2022 is what almost every technician is observing:

The downtrendline currently intersects around 4000 depending on how you draw your trendline. In my view, this is the first critical level that needs to be broken to confirm the end of the bear market decline. However, look at the subtle difference we are seeing in January 2023. After the last 3 death crosses and bearish crosses of the PPO midline, we saw the selling accelerate and new lows were quickly made. This time we see something completely different. PPO has bounced back above midline resistance in a bullish fashion and we also saw a bullish “golden cross” just a few weeks after the death cross suggested we were headed lower. What’s wrong? Well I can tell you what I think is happening. We are preparing for a solid year. Many are waiting for price action to confirm what has been happening beneath the surface for months. I have said to our members and the wider investing public that June 2022 had the hallmarks of a major market bottom and that it was time to focus on long positions and let go of the bear mentality that was appropriate for the first six months of 2022 I don’t think I could have been much clearer:

Finally, did we go down slightly in October? Yes we have got that. However, I’m still pretty comfortable with my signals suggesting to sell the S&P 500 earlier in the year and go long in mid-June 2022. The S&P 500 closed below 3636 October 30th to 14th on 5 separate trading days from September. Since my bottom call, the S&P 500 has closed higher on 143 separate trading days. I think I’ve been on the right side of the market since June and 2023 will prove that the October 2022 low was THE ultimate bear market bottom. Waiting for more signals will result in lower returns in my humble opinion, but I suppose time will tell. I remain very optimistic and said throughout 2022 that the bear market is cyclical (short-term) in nature.

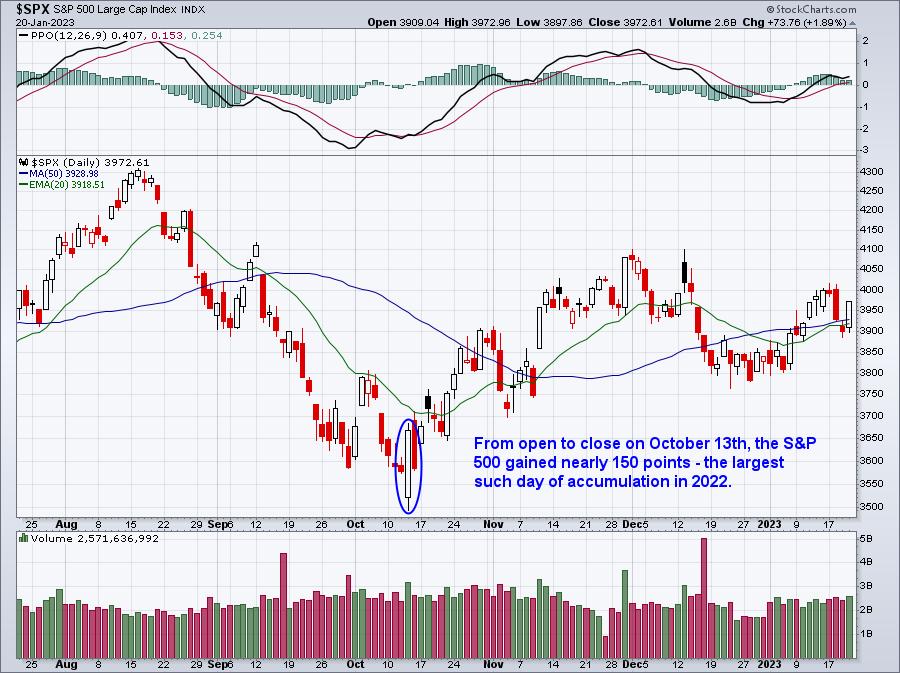

Another critical technical component that tells me the worst is behind us is that we buy on bad news. The October low saw a massive reversal candle after a much worse than expected September CPI inflation report. After a gap below, the buy was intense ALL DAY. Listen:

Another very positive development is that after a brutal fourth quarter, the sun is suddenly shining in 2023 for many growth stocks. The 10-year Treasury yield ($TNX) recently made a new low and this time growth is faring much better than value. This is a very important shift in market character because many of these growth stocks have large market caps and can move our benchmark indices like the S&P 500 much more easily. Check out the sudden improvement in growth stocks in 2023:

The November/December TNX decline did not have the same bullish impact on large cap growth (IMF) stocks as the June/July decline. However, Growth vs. Value (IMF:IWD) is moving solidly higher in 2023 and is clearly benefiting from the lower TNX. I’ve highlighted in red the months of negative relative momentum experienced by growth stocks. While things have certainly improved, we haven’t seen any significant confirmation of long-term renewed strength. The cops still have work to do.

One encouraging part, however, was the resilience of some key stocks to bad fundamental news. Take Salesforce.com (CRM) as an example. It has been trending down throughout 2022 and was the worst-performing Dow Jones stock of the year. But then, after announcing 8,000 layoffs, or 10% of its workforce, CRM rebounded strongly:

The green arrow highlights the successful 20-day EMA test on the day the layoffs were announced and you can see the subsequent rally. CRM has now broken out of its recent downtrend channel and is about to clear key relative strength resistance against its software peers ($DJUSSW).

Last week at our quarterly event, Sneak Preview: Q3 Earnings, I singled out Netflix (NFLX) as one of my favorite companies heading into earnings season. NFLX absolutely loves the month of January and January 2023 was no exception. Check out this seasonal chart:

For the past 20 years, NFLX averaged to win in January 15.7. This is incredible and is why NFLX was our favorite seasonal stock for January 2023 and was given to our EB.com members to kick off the month. Those optimistic thoughts proved correct as NFLX is currently up about 17% this month. The quarterly results were released on Thursday and were solid as expected.

Tomorrow at 4:30pm ET I’ll be hosting our “Q4 Earnings” event and I’ll be featuring my 10 favorite companies that will be reporting earnings over the next 2-3 weeks when earnings season really heats up. I will also disclose the 10 companies that I would completely avoid going into profit. I’ll be reviewing dozens of other companies that also report quarterly earnings. I use a key technical indicator to rank companies ahead of their quarterly earnings report and it has proven to be extremely effective in predicting the reported results. If you want to come tomorrow, just do it CLICK HERE and sign up for a FREE 30-day trial. You can try our entire service for a whole month for free! I hope to see you tomorrow!

Happy trading!

Tom

Tom Bowley is the Chief Market Strategist of EarningsBeats.com, a company that provides a research and education platform for investment professionals and individual investors. Tom writes a comprehensive Daily Market Report (DMR) that provides guidance to EB.com members every day the exchange is open. Tom has brought technical expertise here at StockCharts.com since 2006 and also has a fundamental public accounting background which brings him unique skills to approach the US stock market.