After a 50% drop, you need a 100% return to breakeven.

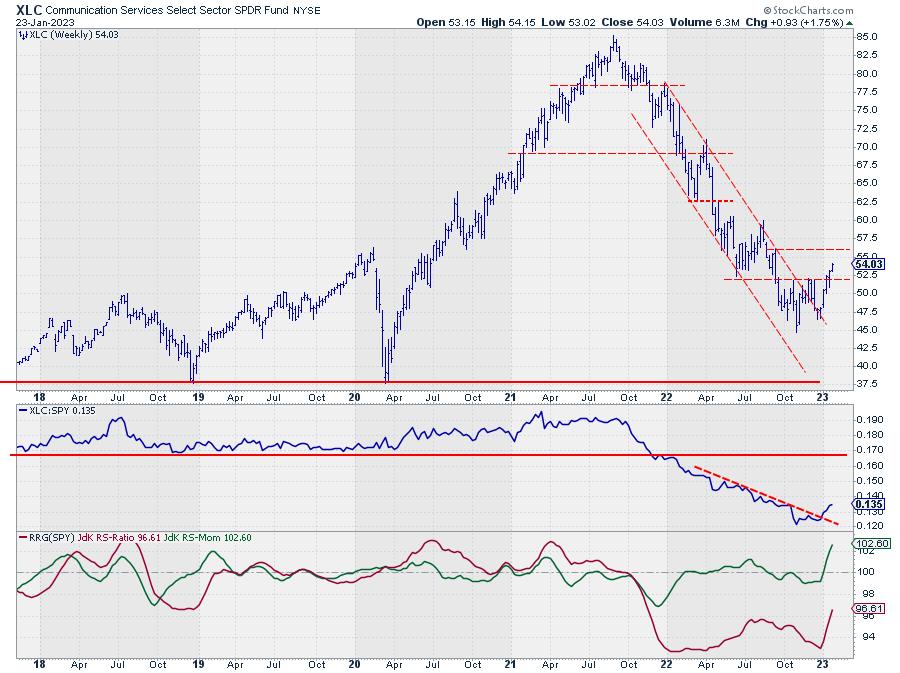

This is exactly what happened with the communications services sector. In August 2021, the Communications Services Select Sector SPDR (XLC) fund peaked at 85 and from that point began a catastrophic decline that took its price back to 45, almost 50% lower. To get back to 85, the sector needs a 100% return from its bottom.

From that perspective, the recent 20% gain is just a small start. The good news is that you are not buying at the top and there is a lot of upside potential if you look at where this sector has traded historically.

The chart above shows the very regular rhythm of lower highs and lower lows that took XLC down as low as 45 while trading in a falling parallel channel. Such “high quality” downtrends are not seen very often.

The initial rally from the recent low stalled by 52 from the level of the previous low. The old support acted as resistance. The brief correction led to the first higher low and last week XLC managed to convincingly break this barrier and start a new series of higher and lower highs.

The first higher low is in place. We have to wait for the higher high, but since we are already trading above the previous high, it guarantees that it will be higher.

Along the way there will be resistance levels that will need to be cleared, but coupled with the upside break in relative strength and rotation through the improving quadrant on a strong RRG price, communications services will become an interesting sector in the coming weeks.

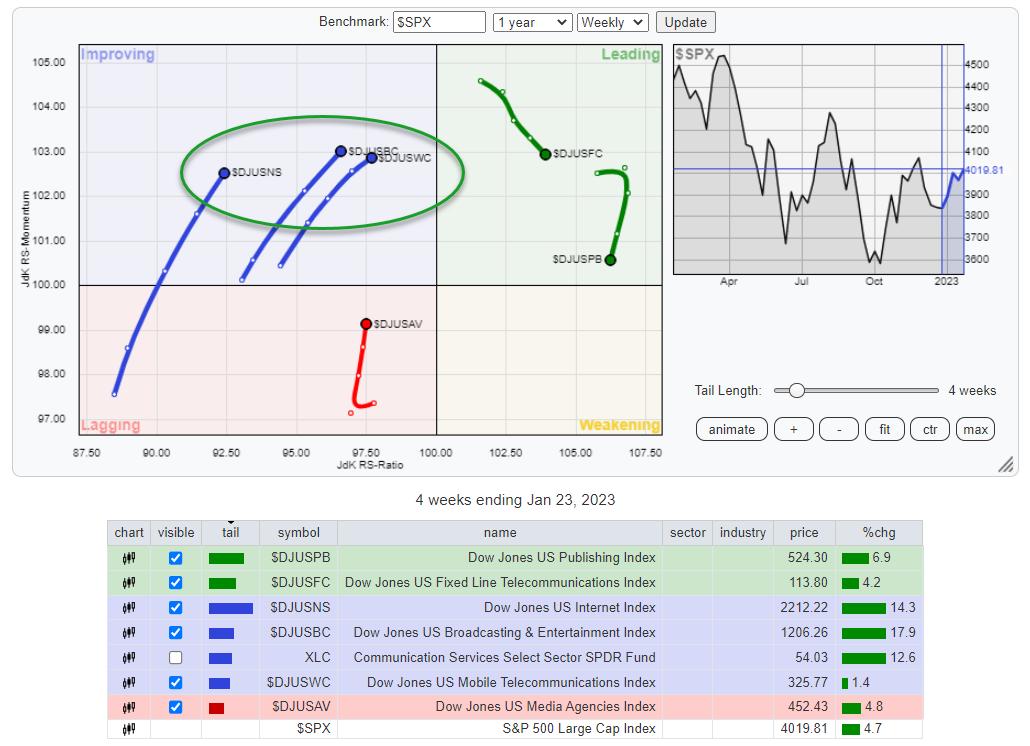

If we break down the communications services sector into its verticals, we see that publishing and fixed-line telecoms are in the leading quadrant but are losing relative momentum, causing tails to flip.

The three sectors that are improving and on a positive RRG course are looking more promising. These are Internet, broadcasting and entertainment, and mobile communications.

As I went through the sector’s individual holdings by industry, I came across two interesting charts.

Walt Disney

On the RRG vs. XLC, DIS is still in the lagging quadrant, but its tail has just started to curl.

What caught my eye is the large falling wedge at the end of this long downtrend that dates back to early 2021. Additional confidence comes from the fact that the wedge came to rest in the 90 area, which also acted as support in 2017 and 2020.

So what we have here is a major reversal pattern, the falling wedge at the end of a long downtrend in a key area of support. At the same time, relative strength versus the sector is improving.

This doesn’t seem like a bad place to start looking for more upside in DIS

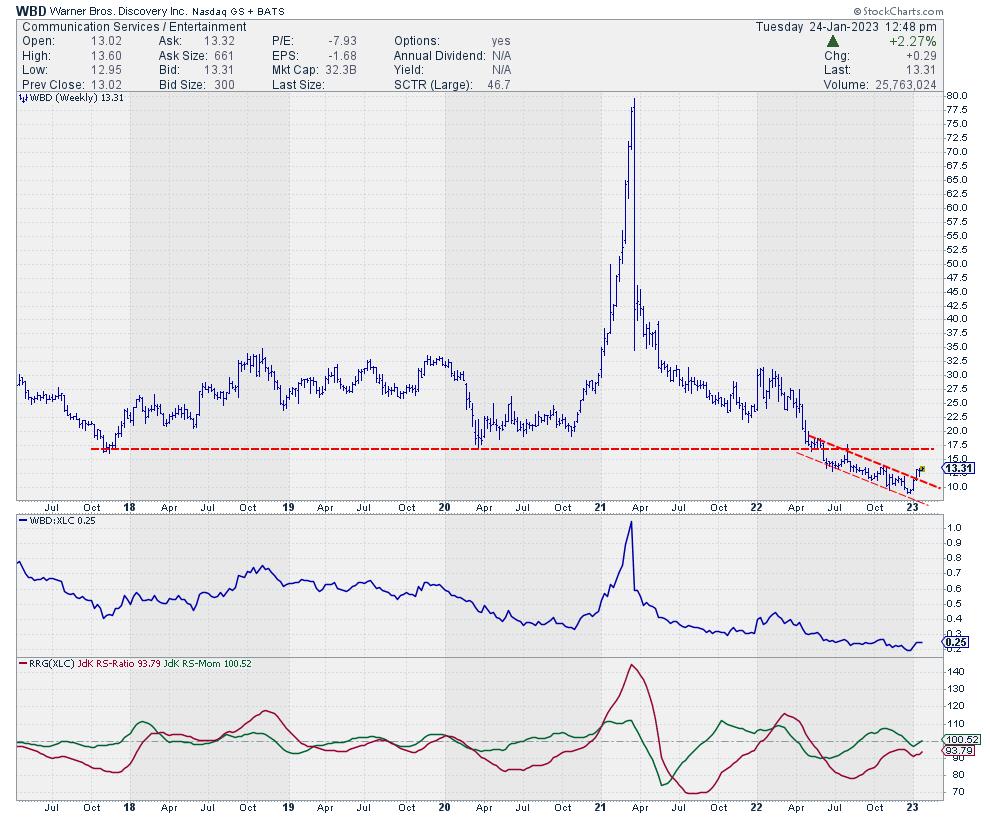

Warner Bros. Discovery

The second chart piqued my interest in WBD. Starting from a high near 80 in early 2021, its price fell below 10 in late 2022. A fresh rally emerged from its recent low that managed to break the falling resistance line that marked the upper boundary of the channel that had been in play since June.

So far, this move is performing well as relative strength improves.

The enlarged daily chart shows this in more detail. The initial pullback has held above previous highs and set the stage for new higher lows. Currently, WBD is pushing to surpass last week’s high and will soon face more serious resistance just below 14.

Once WBD can scale these levels, it will unlock a lot more upside, making it one of the more compelling stocks in the broadcast and entertainment industry.

#StayAlert – Julius

Julius de Kempenaer

Senior Technical AnalystStockCharts.com

Creator, Relative Rotation Charts

founder, RRG research

hosted by: Industry Spotlight

Please find my handles for social media channels under the bio below.

Feedback, comments or questions are welcome at Juliusdk@stockcharts.com. I can’t promise to reply to every single message, but I will certainly read them and, where reasonably possible, use the feedback and comments or answer questions.

To discuss RRG with me SCANmark me with the handle Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio and JdK RS-Momentum are registered trademarks of RRG Research.

Julius de Kempenaer is the creator of Relative Rotation Graphs™. This unique method of visualizing the relative strength within a security universe was first launched on Bloomberg Professional Services Terminals in January 2011 and published on StockCharts.com in July 2014. After graduating from the Dutch Royal Military Academy, Julius served in the Netherlands Air Force at several officer ranks. He retired from the military as a Captain in 1990 to enter the financial industry as a portfolio manager for Equity & Law (now part of AXA Investment Managers).

learn more