The markets continued with their unabated upmove in the week that went by and ended once again with net gains. While continuing with the advance the Nifty 50 Index extended its move higher. However, as compared to the previous week, this time, the trading range got narrower as the Index oscillated 408.30 points against 824 points. This can largely be attributed to the absence of volatility. Against an increase of 4.72% as compared to the previous week, this week, India VIX came off by 8.02% to 12.69 on a weekly basis. While staying tentative at higher levels, the headline index closed with net weekly gains of 313.25 points (+1.30%).

Despite the up moves getting extended, the markets also continue to show signs of an impending consolidation at higher levels. The 24350-24450 zone stays a strong resistance area for the markets as indicated by the options data. We may not see any major corrective moves taking place but this certainly makes some measured retracement or consolidation imminent at current or slightly higher levels. Consistent Call OI addition at 24300 and higher strikes make this point more evident. This can also mean that if 24500 is taken out with conviction, the up move may further get extended but this would make the currently over-extended markets unhealthier than what they are now.

Monday is likely to see a quiet start to the week; the levels of 24450 and 24675 may act as immediate resistance levels. The supports come in lower at 24000 and 23735.

There is also a significant deviation from the mean that is observed as Nifty’s nearest 20-week MA and 50-week MA are as far as 1615 points and 2940 points respectively. This highlights the danger that the markets have even if they make even a little event to revert to their mean or even consolidate in a ranged manner. The weekly RSI is 74.44. It stays overbought and remains neutral without showing any divergence against the price. The weekly MACD is bullish and stays above the signal line.

The pattern analysis shows that the Index has ended once again above the upper Bollinger band. This is quite bullish but it also has a possibility of the price pulling themselves back inside the band. As mentioned earlier, the 20-week MA is the nearest support which is placed 1615 points below the current levels at 22708. However, before this, a pattern support exists at 23800.

All in all, the uptrend remains intact and there are no signs of any major corrective move taking place. The markets aren’t showing any signs of major weakness but they certainly look prone and stay vulnerable to measured retracement or ranged consolidation over the coming days. They stay quite overextended and remain deviated from their mean and this keeps them vulnerable at higher levels. As we travel with the trend, it is recommended that we also focus on guarding profits at higher levels. While keeping leveraged positions at modest levels, fresh purchases should be kept limited to defensive pockets and stocks showing improving relative strength. A cautious outlook is advised for the coming week.

Sector Analysis for the coming week

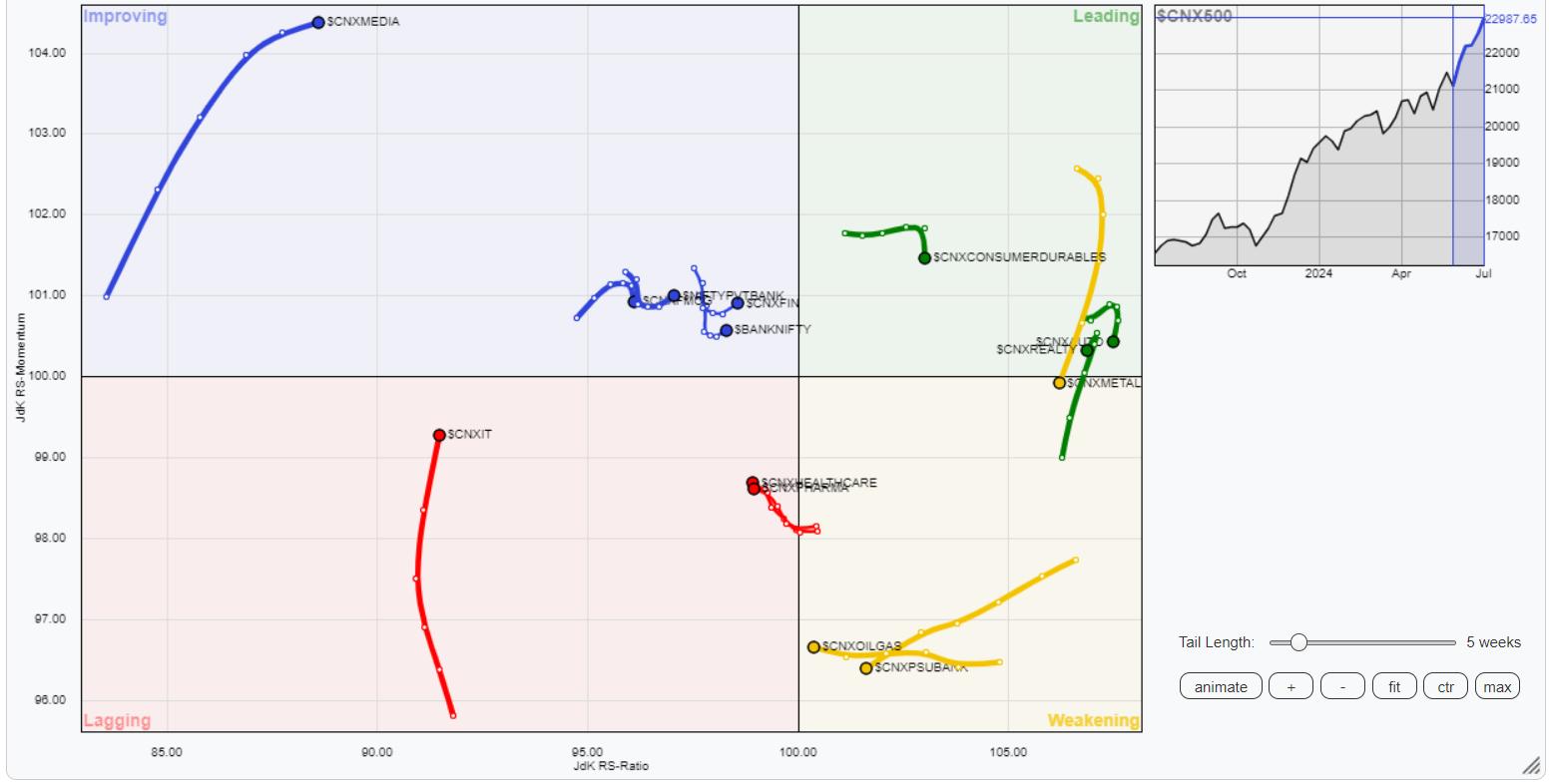

In our look at Relative Rotation Graphs®, we compared various sectors against CNX500 (NIFTY 500 Index), which represents over 95% of the free float market cap of all the stocks listed.

Relative Rotation Graphs (RRG) show that the Nifty Realty, Consumption, and Auto Indices are inside the lagging quadrant along with the Midcap 100 index; all these groups are seen taking a breather and giving up a bit on their relative momentum against the broader markets.

The Nifty Metal index has rolled inside the weakening quadrant. Nifty PSE, Infrastructure, PSU Bank, Commodities, and Energy groups are also inside the weakening quadrant.

The Nifty Services Sector Index and IT index are inside the weakening quadrant; however, both groups show improving relative momentum and may show better relative performance against the broader Nifty 500 index.

Banknifty, Nifty Media, Financial Services, and FMCG indices are placed inside the improving quadrant; the FMCG Index among these is seen giving up on its relative momentum against the broader markets.

Important Note: RRG™ charts show the relative strength and momentum of a group of stocks. In the above Chart, they show relative performance against NIFTY500 Index (Broader Markets) and should not be used directly as buy or sell signals.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

www.EquityResearch.asia | www.ChartWizard.ae

Milan Vaishnav, CMT, MSTA is a capital market professional with experience spanning close to two decades. His area of expertise includes consulting in Portfolio/Funds Management and Advisory Services. Milan is the founder of ChartWizard FZE (UAE) and Gemstone Equity Research & Advisory Services. As a Consulting Technical Research Analyst and with his experience in the Indian Capital Markets of over 15 years, he has been delivering premium India-focused Independent Technical Research to the Clients. He presently contributes on a daily basis to ET Markets and The Economic Times of India. He also authors one of the India’s most accurate “Daily / Weekly Market Outlook” — A Daily / Weekly Newsletter, currently in its 18th year of publication.