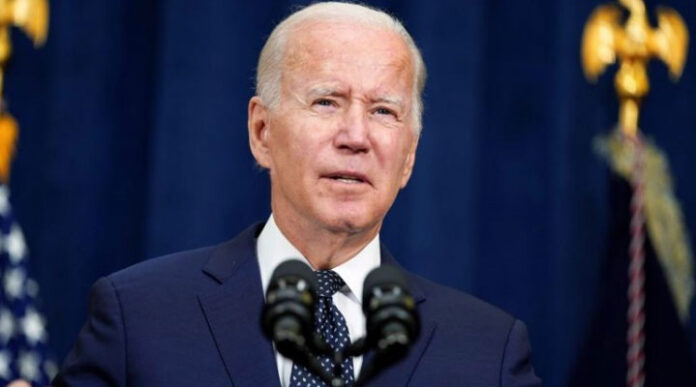

President Joe Biden announced on Wednesday that the U.S. government will forgive $10,000 in student loan debt for millions of former college students who are currently drowning in debt, keeping a promise he made during the 2020 presidential campaign.

However, some economists warned that it may fuel inflation, and some Republicans in the US Congress questioned whether the president had the legal authority to cancel the debt. The move could increase support for his fellow Democrats in the November congressional elections.

According to economists, debt forgiveness will release hundreds of billions of dollars for new consumer spending that could be used for home purchases and other big ticket items, adding a new wrinkle to the country’s fight against inflation.

The actions are “for families that need them the most – working and middle-class people who have been hit especially hard by the pandemic,” Biden said at the White House. He promised that no high-income households would benefit, addressing one of the plan’s main criticisms.

“I will never apologise for assisting working Americans and the middle class, especially to the same people who voted for a $2 trillion tax cut that primarily benefited the wealthiest Americans and the largest corporations,” Biden said, referring to a Republican tax cut signed into law by former President Donald Trump.

Borrower balances have been frozen since the start of the COVID-19 outbreak, and no payments on most federal student loans have been required since March 2020. Many Democrats urged Biden to forgive up to $50,000 per borrower.

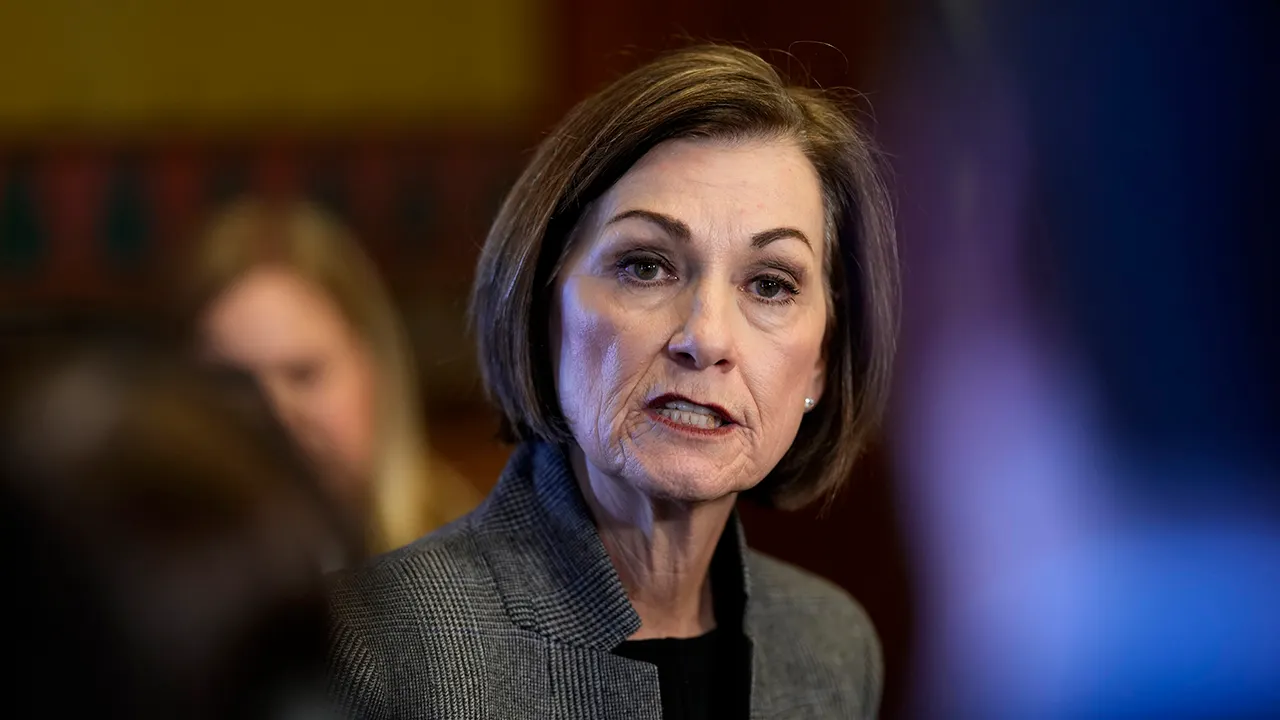

Republicans were mostly opposed to student loan forgiveness, calling it unfair because it would benefit people with higher incomes disproportionately.

“President Biden’s student loan socialism is a slap in the face to every family who sacrificed to save for college, every graduate who paid their debt, and every American who chose a specific career path or volunteered to serve in our Armed Forces to avoid debt,” Senate Minority Leader Mitch McConnell said on Wednesday.

The administration has yet to determine the cost of the package, which will be determined by the number of people who apply for it, according to White House domestic policy adviser Susan Rice. She stated that student loans obtained after June 30 of this year are ineligible.

According to White House Press Secretary Karine Jean-Pierre, the administration has the legal authority to forgive the debt due to a law that allows such action during a national emergency such as a pandemic. Republican U.S. Representative Elise Stefanik had previously described the plan as “reckless and illegal.”

Tuition at American universities is significantly higher than in most other rich countries, and Americans owe $1.75 trillion in student loan debt, the majority of which is held by the federal government. If students are not given economic relief, Biden believes other countries will bypass the United States.

PANDEMIC STOP, PELL GRANT

The administration will extend a COVID-19 pandemic-linked pause on student loan repayment until the end of the year, while also forgiving $10,000 in student debt for single borrowers earning less than $125,000 per year or married couples earning less than $250,000, according to the White House.

According to the Department of Education, approximately 8 million borrowers will be automatically affected; others must apply for forgiveness.

According to the Education Department, the government is also forgiving up to $20,000 in debt for approximately 6 million students from low-income families who received federal Pell Grants, as well as proposing a new rule that protects some income from repayment plans and forgives some loan balances after 10 years of repayment.

According to a New York Federal Reserve study, reducing federal debt by $10,000 for each student would save $321 billion and eliminate the entire balance for 11.8 million borrowers, or 31% of them.

IMPACT OF INFLATION

According to a senior Biden administration official, the plan could benefit up to 43 million student borrowers, with 20 million having their debts completely canceled.

After December 31, the government will resume collecting payments on any outstanding student loans that were put on hold during the pandemic. According to the official, this would offset any inflationary effects of the forgiveness. Payment resumption may even have a dampening effect on prices, according to the official.

Larry Summers, a former US Treasury Secretary, disagreed. On Twitter, he stated that debt relief “consumes resources that could be better used to assist those who did not have the opportunity to attend college for whatever reason. It will also have an inflationary effect by raising tuition.”

Similarly, Jason Furman, a Harvard professor who headed the Council of Economic Advisers during the Obama administration, stated that debt cancellation would negate the Inflation Reduction Act’s deflationary powers. “Pouring roughly half a trillion dollars of gasoline on an already burning inflationary fire is reckless,” he said.

Moody’s Analytics Chief Economist Mark Zandi agreed with the White House, stating that the reinstatement of billions of dollars in monthly student loan payments “will restrain growth and be disinflationary.”