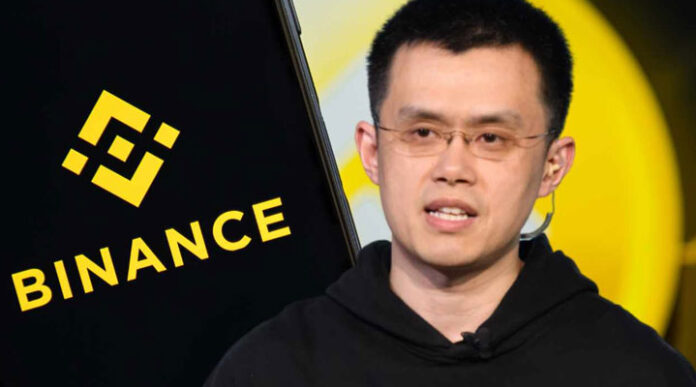

According to a late-2020 written request seen by Reuters, US federal prosecutors asked Binance, the world’s largest cryptocurrency exchange, to provide extensive internal records about its anti-money laundering checks, as well as communications involving its chief executive and founder Changpeng Zhao.

The Justice Department’s money laundering division requested that Binance hand over messages from Zhao and 12 other executives and partners on topics such as the exchange’s detection of illegal transactions and recruitment of US customers. It also demanded that any company records be “deleted, altered, or removed from Binance’s files” or “transferred from the United States.”

The December 2020 request, which had not previously been reported, was part of an ongoing Justice Department investigation into Binance’s compliance with US financial crime laws, according to four people familiar with the investigation.

According to the sources, US authorities are looking into whether Binance violated the Bank Secrecy Act. If crypto exchanges conduct “substantial” business in the United States, they must register with the Treasury Department and comply with anti-money laundering regulations. The law, intended to protect the US financial system from illicit finance, calls for prison sentences of up to ten years.

Reuters was unable to determine how Binance and Zhao, two of the most prominent figures in the crypto sector, responded to the criminal division’s request.

Binance Chief Communications Officer Patrick Hillmann responded to Reuters’ questions about the letter and investigation, saying, “Regulators from all over the world are contacting major cryptocurrency exchanges to better understand our industry. This is a standard procedure for any regulated organization, and we regularly work with agencies to answer any questions they may have.” Hillmann added that Binance has “an industry-leading global security and compliance team” with over 500 employees, including former regulators and law enforcement agents.

He did not elaborate on Binance’s response to the Justice Department’s request. A spokesman for the Department declined to comment.

The request reveals the breadth of the United States investigation into Binance. Bloomberg first reported on the probe’s existence last year, but little else is known about it. “We take our legal obligations very seriously and engage with regulators and law enforcement in a collaborative fashion,” a Binance spokeswoman said at the time.

The letter made 29 separate requests for documents produced since 2017 pertaining to the company’s management, structure, finances, anti-money laundering and sanctions compliance, and US business. “Binance is requested to produce all documents and materials in its possession, custody, or control that are responsive to this letter,” it said.

Binance, founded in 2017 in Shanghai by Zhao, also known as CZ, controlled more than half of the world’s crypto trading markets in July, processing transactions worth more than $2 trillion that month. Zhao, who was born in China and educated in Canada, where he holds citizenship, told Bloomberg in March that he will be based in Dubai for the “foreseeable future,” after Dubai granted Binance a license to conduct some operations that month.

This year, a series of Reuters articles revealed how Binance fueled its explosive growth while maintaining lax customer checks and withholding information from regulators. According to Reuters, gaps in Binance’s compliance program allowed criminals to launder at least $2.35 billion in illicit funds through the exchange, which also served Iranian traders despite US sanctions. Binance customers could trade cryptocurrency with just an email address until mid-2021.

Binance dismissed Reuters’ findings as “outdated.” According to the exchange, it is “driving higher industry standards” and aims to “further improve our ability to detect illegal crypto activity on our platform.” It stated that it did not believe Reuters’ calculations of illicit fund flows were correct.

SCRUTINY IN THE US

Crypto exchanges are coming under increased scrutiny in the United States, where top government officials, including Treasury Secretary Janet Yellen, have publicly supported increased regulation of the sector this year. The Justice Department established a national cryptocurrency enforcement team in February to “address the growth of crime involving these technologies,” with an emphasis on exchanges.

The founders of another exchange, BitMEX, pleaded guilty to violating the Bank Secrecy Act that month and were sentenced to up to two and a half years of probation. BitMEX agreed to pay a $100 million fine to settle separate Act violations. BitMEX now claims to be “fully committed to conducting its business in accordance with all applicable laws” and to have made “substantial investments” in its compliance program.

The Justice Department’s 2020 letter was sent to Binance Holdings Ltd., a Cayman Islands-based company, and Roberto Gonzalez, a Washington-based attorney at Paul, Weiss. According to regulatory filings, Zhao owns Binance Holdings and the Binance trademark. Gonzalez and Paul, Weiss did not return calls seeking comment.

Binance’s corporate structure is a mystery. It has refused to provide information about the ownership or location of its main exchange, Binance.com, which has not accepted customers from the United States since mid-2019. Clients are instead directed to a separate US-based exchange called Binance.US, which is also controlled by Zhao, according to regulatory filings. Binance.US registered with the Treasury in 2019, whereas the main exchange did not.

Over a dozen financial regulators around the world have issued warnings about Binance since last year, alleging that it was either serving users without licenses or violating anti-money laundering rules. Binance was fined over 3 million euros by the Dutch central bank in July for operating in violation of the country’s financial crime laws. A spokesperson for Binance said at the time that the fine was a “pivot in our ongoing collaboration” with the central bank.

The Justice Department sought all documents identifying Binance employees responsible for Bank Secrecy Act compliance, details of its policies to combat illegal finance, and any reports of suspicious financial activity it had filed to authorities in the 2020 request. Binance was asked to provide information on any transactions it had with users involved in ransomware, terrorism, and darknet marketplaces, as well as those sanctioned by the US.

The department also demanded documents pertaining to the “business rationale” for the establishment of Binance.US. It requested communications with the 13 executives and partners involved in the creation of Binance.US and its relationship to Binance, including Zhao, his co-founder Yi He, and his chief compliance officer, Samuel Lim. Lim and He are still employed at Binance.

According to company messages reviewed by Reuters in January, Lim and other senior employees were aware that Binance’s money-laundering checks were not rigorous. Lim and Binance have not responded to the messages.

In addition to the Justice Department’s request, the Securities and Exchange Commission issued a subpoena to BAM Trading Services, the operator of Binance.US, the same month. According to the subpoena obtained by Reuters, BAM was required to turn over documents revealing whether any of its employees also worked for the main Binance exchange and what services it provided to the US company.

Binance.US did not respond to Reuters’ inquiries. The SEC stated that it does not comment on potential investigations.