Apple’s celebrating ten years of Apple Pay today, and it’s clear that the Cupertino-based giant is pretty pleased with its payment offerings. I’ll be the first to admit that Apple Pay is still handy and convenient ten years down the road; most of the time, rather than reaching for a physical card, I simply double-tap the power button on my iPhone and pay.

Plenty more card partners have arrived in the years since the original launch, and more retailers have been adopting the standard. While new ways to pay, including rewards, were teased at WWDC 2024, we’re now seeing these arrive with iOS 18 and even more partners being announced. All in all, it’s freshening the ways you can pay with Apple Pay.

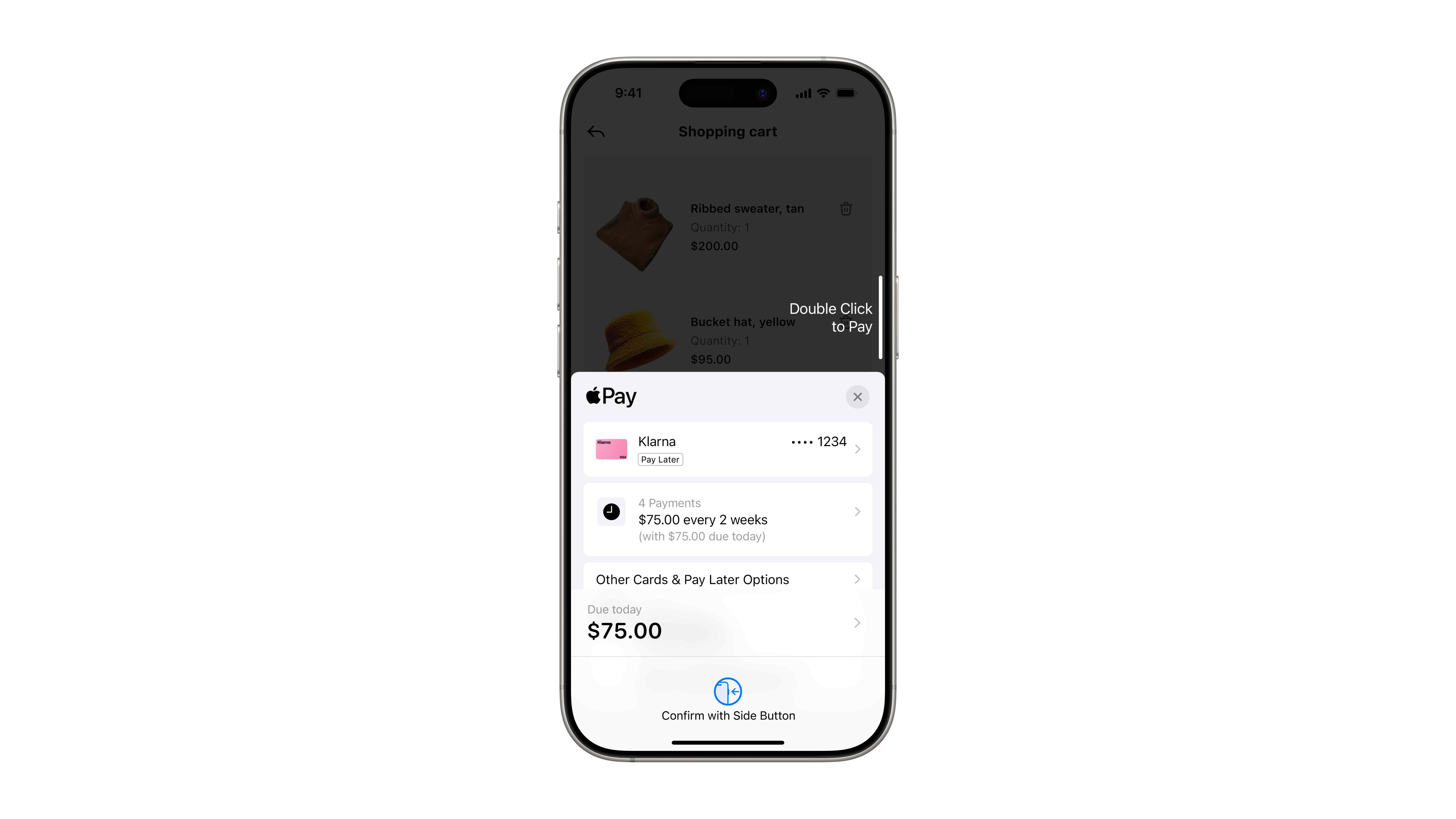

You’ll now be able to check out with Apple Pay and redeem rewards from eligible cards – like miles or points from Discover credit cards in the US – as well as access installment loans from Affirm in the US and Monzo Flex in the UK, and flexible payment options from Klarna in the US and UK.

Pay with rewards or two new payment options

Available now with iOS 18 for folks in the United States on an iPhone or iPad, you’ll now be able to select rewards like points (think cashback) or miles from eligible Discover Cards to pay for the whole amount or a portion at checkout. Apple’s integrated this option directly on the checkout screen – which takes up a portion of the bottom of your device – and it feels pretty intuitive. It will, by default, show you the maximum amount you can redeem, and by tapping on it, you can adjust the amount.

Even neater, though, and solving just a sliver of the puzzle that is airline mile worth, it will even give you the conversion of what one mile equals to dollars. That’s pretty handy. This experience of using card rewards at checkout in Apple Pay is just starting with select Discover cards now, but more partners will roll out in the future. Apple confirmed that select Synchrony, Fiserv, and FIS cards in the United States and DBS in Singapore will let you use rewards.

Beyond rewards, though, Apple is adding two new payment options and the first of which can be seen as the partner successor to Apple’s since closed down Apple Pay Later. First, Klarna’s flexible payment options are now available for folks checking out on Apple Pay — with iPhone and iPad, online and in app – in the United States and the United Kingdom. Allowing you to select the service as a payment option, get approved, and pick a plan for splitting the payment. It’s worth noting you won’t see the charges hit weekly or bi-weekly (each payment option differs), and you’ll need to visit the Klarna app for those.

Second, installment loan payment options are arriving with iOS 18 as well. In the United States, these are done through Affirm, while in the United Kingdom, these are done through Monzo. With these you’ll get approved for the loan, can pick terms – and see which have interest associated – and then complete the checkout process. This is a pretty big step and a direct replacement for Apple’s own “Apple Pay Later” installment plans. It will also be expanding at some point in the future to several other countries, including ANZ in Australia and CaixaBank in Spain.

As a whole these new ways to pay, and fresh partners, reinvigorate the Apple Pay experience a bit. It’s also key that it doesn’t change the ease of use that makes Apple Pay a stellar service and function of Apple’s myriad devices. I think the addition of rewards – for points and miles – in the Apple Pay checkout process will be very handy and will let many make better use of points, similar to how you can check out with points on Amazon. However, they might drain faster.