Google Pay is receiving three new features that collectively aim to make online shopping easier and more transparent. At first, it may seem strange how the tech giant is updating Google Pay when the app is scheduled to go offline on June 4 in the United States.

However, it turns out the patch is rolling out to the Google Pay payment system rather than to the app itself. The Google Pay app is still set to be discontinued in about two weeks from the time of this writing. You’ll see the following changes appear on desktop and mobile.

According to their announcement post, the company states “American Express and Capital One cardholders” will now see the benefits they can receive when checking out on Chrome desktop in the “autofill drop-down” menu. Google gives the example of someone buying a round-trip flight from Los Angeles to San Francisco. Your American Express Gold Card may offer three times the travel points, while a Capital One Quicksilver Card will give you “1.5 percent cash back on [your] purchase.” There are plans to add “more cards in the future” as well.

Next, the buy now, pay later (BNPL) payment option is expanding to more “merchant sites and Android apps across the US.” Google appears to be working with two BNPL services, Affirm and Zip, to make the expansion possible. Exactly which websites and apps are unknown, and Google didn’t provide any additional details in the post, although we did ask.

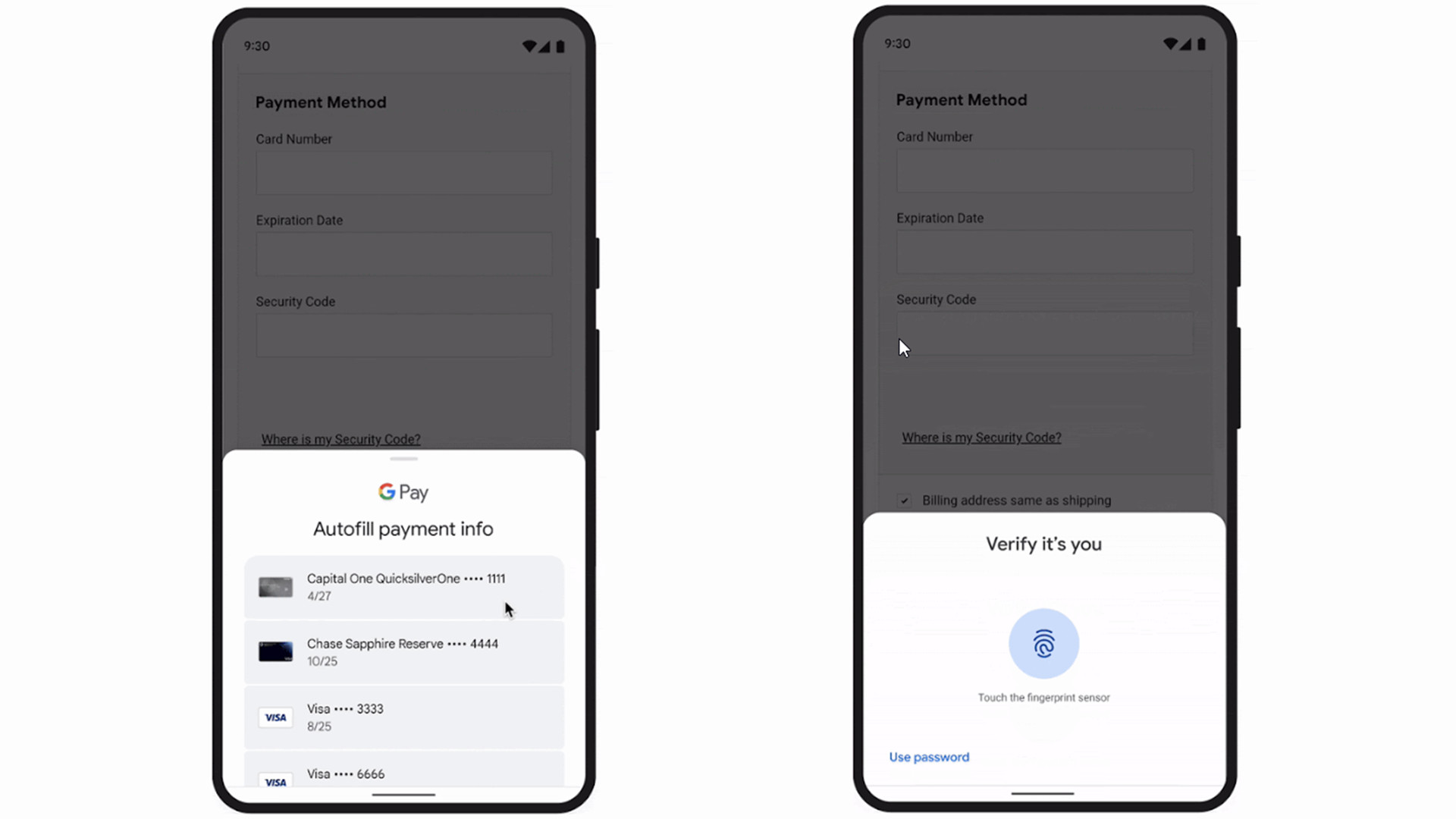

Autofill update

The first two features are exclusive to people in the United States; however, the Autofill update is seeing an international release. Moving forward, shoppers on either Chrome or Android can use biometrics or their screen lock PIN to verify card details. With this, you’ll no longer have to enter your security code manually.

Autofill will normally work without a hitch, but Google states if it detects suspicious transactions, it’ll prevent payments from going through. Also, users can “set up device unlock” to have Google Pay ask you to unlock your smartphone to reveal “full card details.” It ensures your card isn’t used by other people who might have access to your device.

Be sure to keep an eye out for the patch when it arrives. The Google Pay update is currently rolling out. While we have you, be sure to check out TechRadar’s list of the best Android phones for 2024.